Managing revolving credit is like navigating the halls of high school – it requires skill, strategy, and a keen eye for detail. In this guide, we’ll dive into the world of revolving credit, exploring its nuances and uncovering the secrets to financial success. So grab your backpack and get ready to ace this important subject!

Rev up your engines as we explore the ins and outs of managing revolving credit with style and finesse.

Understanding Revolving Credit

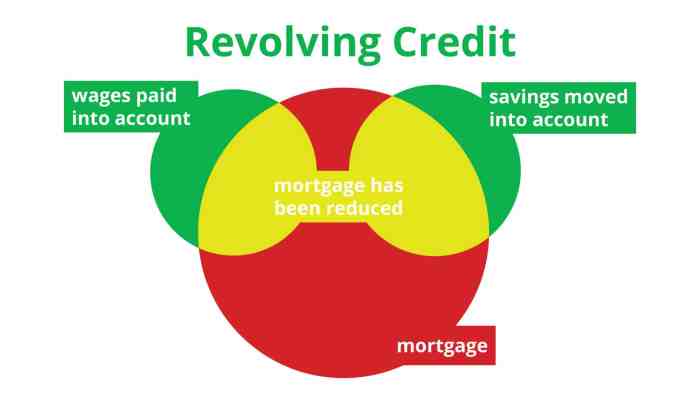

Revolving credit is a type of credit that allows you to borrow money up to a certain limit and then repay the borrowed amount over time. Unlike installment loans, which have a fixed term and regular payments, revolving credit provides flexibility in repayment and allows you to borrow again once you have repaid the amount borrowed.

How Revolving Credit Works

Revolving credit works by giving you access to a line of credit that you can borrow from up to a specified limit. You can use the funds as needed and make minimum monthly payments based on the outstanding balance. As you repay the borrowed amount, the available credit limit is replenished, allowing you to borrow again if needed.

Common Types of Revolving Credit

- Credit Cards: Credit cards are a popular form of revolving credit that allow you to make purchases up to a certain credit limit. You can choose to pay the full balance or make minimum payments each month.

- Home Equity Line of Credit (HELOC): A HELOC is a revolving credit line that uses the equity in your home as collateral. You can borrow against the equity in your home and repay the borrowed amount over time.

- Personal Line of Credit: A personal line of credit is an unsecured revolving credit line that can be used for various purposes, such as emergencies or large expenses. You can borrow up to a certain limit and repay based on the outstanding balance.

Benefits of Managing Revolving Credit

Effective management of revolving credit comes with a myriad of advantages that can positively impact your financial well-being. By staying on top of your revolving credit accounts, you can boost your credit score, secure lower interest rates, and pave the way for a healthier financial future.

Improved Credit Scores

- Timely payments on your revolving credit accounts can show lenders that you are a responsible borrower, leading to an increase in your credit score over time.

- Keeping your credit utilization ratio low by not maxing out your credit cards can also contribute to a better credit score.

- Having a mix of different types of credit, including revolving credit, can demonstrate to credit bureaus that you can manage various financial responsibilities effectively.

Lower Interest Rates

- Responsible management of revolving credit can translate into lower interest rates on future loans or credit products you may apply for.

- Lenders are more likely to offer you favorable interest rates if they see that you have a history of managing your revolving credit accounts wisely.

- By maintaining a good credit score through effective revolving credit management, you can potentially save thousands of dollars in interest payments over the years.

Strategies for Effective Revolving Credit Management

Effective management of revolving credit is crucial for maintaining financial stability and avoiding unnecessary debt. By following specific strategies and practices, individuals can successfully handle their revolving credit accounts, ensuring they remain in good standing and do not accumulate excessive interest charges.

Creating a Budget for Managing Revolving Credit

Creating a budget is essential for managing revolving credit effectively. Here are steps to help you establish a budget that works for you:

- Calculate your monthly income: Determine how much money you bring in each month from all sources.

- List your expenses: Make a detailed list of all your monthly expenses, including bills, groceries, and other necessities.

- Allocate funds for revolving credit payments: Set aside a specific amount of money each month to pay off your revolving credit balances.

- Track your spending: Monitor your spending habits to ensure you stay within your budget and avoid overspending.

Tracking and Monitoring Revolving Credit Balances

Tracking and monitoring your revolving credit balances is crucial to avoid exceeding your credit limit and accumulating unnecessary debt. Here are ways to effectively track and monitor your revolving credit balances:

- Regularly review your credit statements: Check your credit card statements each month to verify transactions and monitor your balance.

- Set up balance alerts: Many credit card issuers offer balance alerts that notify you when your balance reaches a certain threshold.

- Use budgeting apps: Utilize budgeting apps or tools to track your spending and monitor your credit card balances in real-time.

Paying Off Revolving Credit Balances in a Timely Manner

Paying off your revolving credit balances on time is essential to avoid high-interest charges and maintain a good credit score. Here are tips to help you pay off your revolving credit balances promptly:

- Make more than the minimum payment: Whenever possible, pay more than the minimum amount due to reduce your balance faster.

- Prioritize high-interest balances: Focus on paying off credit cards with the highest interest rates first to save money on interest charges.

- Automate payments: Set up automatic payments for your credit card bills to ensure you never miss a payment deadline.

Pitfalls to Avoid in Revolving Credit Management

When it comes to managing revolving credit, there are certain pitfalls that individuals should be aware of in order to avoid financial setbacks. Making mistakes in handling revolving credit can lead to serious consequences and impact one’s financial health in the long run.

Maxing out Revolving Credit Accounts

One common mistake people make is maxing out their revolving credit accounts. This means using up the entire credit limit available on their credit cards or other lines of credit. When individuals max out their revolving credit accounts, they are left with no available credit for emergencies or unexpected expenses.

Consequences of maxing out revolving credit accounts include:

- Increased credit utilization ratio, which can lower credit scores

- Accumulation of high-interest debt, leading to financial strain

- Limited access to credit for future needs

Making Only Minimum Payments

Another risky behavior in revolving credit management is only making minimum payments on credit card balances. While it may seem convenient to pay the minimum amount due each month, this approach can result in long-term negative consequences.

Risks of only making minimum payments on revolving credit balances include:

- Accumulation of interest charges, increasing the total amount owed

- Extended repayment period, leading to higher overall costs

- Negative impact on credit scores due to high credit utilization