Credit union benefits are like finding a hidden treasure in the world of finances – filled with perks and advantages that can truly make a difference in your life. As we delve into the realm of credit unions, get ready to discover a whole new way of banking that prioritizes your well-being and financial success.

From exclusive services to unique membership requirements, credit unions offer a personalized approach to banking that sets them apart from traditional banks. Let’s explore the world of credit union benefits together!

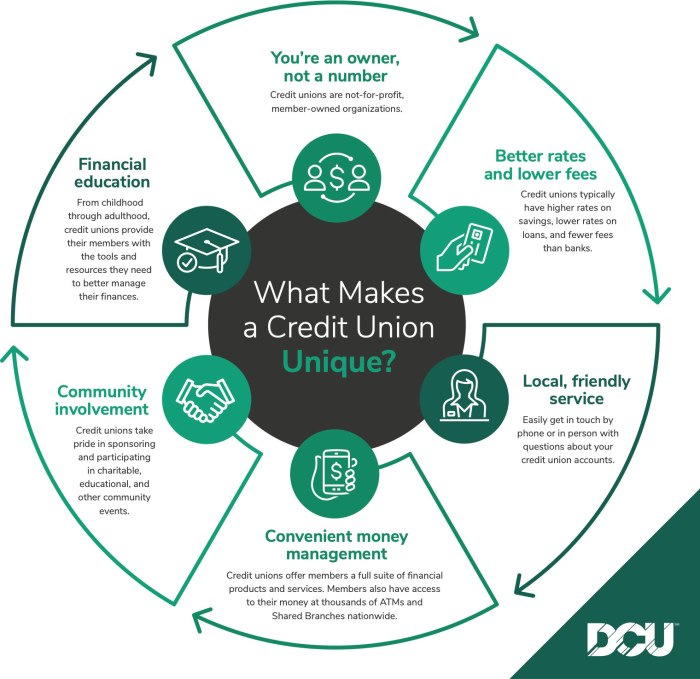

Benefits of Credit Unions

Joining a credit union comes with a bunch of perks that can help you manage your finances better than a traditional bank. Let’s break it down for ya!

Lower Fees and Better Rates

When you’re part of a credit union, you’ll usually find lower fees for things like ATM withdrawals, overdrafts, and account maintenance. Plus, credit unions often offer higher interest rates on savings accounts and lower rates on loans compared to big banks. That means more money in your pocket!

Personalized Customer Service

Credit unions are all about building relationships with their members. You’ll get more personalized service, with staff who actually know your name and are willing to work with you to find the best financial solutions. No more feeling like just another number in a corporate system.

Community Involvement

Credit unions are deeply rooted in the communities they serve. They often support local causes, events, and businesses, helping to boost the overall well-being of the community. By being a credit union member, you’re also contributing to these positive impacts.

Services Offered by Credit Unions

When it comes to services offered by credit unions, they provide a wide range of financial products and assistance to their members. These services are tailored to meet the unique needs of their members and typically offer more personalized attention compared to commercial banks.

Savings and Checking Accounts

Credit unions offer savings and checking accounts just like commercial banks, but with potentially higher interest rates and lower fees. Members can benefit from competitive rates and convenient access to their funds.

Loans and Credit Cards

Credit unions provide various loan options, including personal loans, auto loans, and mortgages. They also offer credit cards with competitive rates and rewards programs. Credit unions are known for their flexibility in lending criteria and willingness to work with members to find solutions.

Financial Education and Counseling

One of the unique services offered by credit unions is financial education and counseling. They often provide workshops, seminars, and one-on-one counseling sessions to help members improve their financial literacy and make informed decisions about their money.

Community Involvement

Credit unions are deeply rooted in the communities they serve and often engage in community outreach programs and charitable initiatives. They prioritize giving back and supporting local causes, which sets them apart from traditional banks.

Member Ownership and Voting Rights

Unlike commercial banks, credit unions are owned by their members, who have voting rights and a say in the decision-making process. This member-focused approach ensures that credit unions prioritize the needs and interests of their members above all else.

Membership Requirements and Eligibility

Joining a credit union comes with certain criteria that individuals need to meet in order to become members. Let’s dive into the typical eligibility requirements and how they differ from traditional banks.

Typical Eligibility Criteria

- Individuals must usually live, work, worship, or attend school in a specific geographic area served by the credit union.

- Some credit unions may have specific employer groups or associations that qualify for membership.

- Family members of current credit union members may also be eligible to join.

Specific Membership Requirements

- Credit unions may require a one-time membership fee or a minimum deposit to open an account.

- Members may need to maintain a minimum balance in their accounts to retain membership.

- Some credit unions may have educational or community service requirements for members.

Difference from Traditional Banks

Credit unions are member-owned financial cooperatives, meaning that members have a say in how the institution is run. This is different from traditional banks, where customers are typically just account holders without any ownership rights. Additionally, credit unions often offer lower fees and better interest rates on loans and savings accounts compared to banks.

Financial Products and Rates

When it comes to financial products and rates, credit unions offer a variety of options that can help you manage your money and reach your financial goals. Let’s take a closer look at what they have to offer.

Loans

Credit unions provide various loan options, including personal loans, auto loans, and home equity loans. These loans often come with competitive interest rates and flexible repayment terms, making them a popular choice for many borrowers.

Savings Accounts

Credit unions offer savings accounts that typically earn higher interest rates compared to traditional banks. This means that your money can grow faster over time, helping you build your savings more effectively.

Credit Cards

Credit unions also provide credit cards with competitive interest rates and fees. These cards often come with rewards programs and other benefits that can help you manage your expenses and earn valuable perks.

Interest Rates and Fees

Credit unions generally offer lower interest rates on loans and higher interest rates on savings accounts compared to traditional banks. Additionally, credit unions tend to have lower fees and charges, saving you money in the long run.

Benefits of Credit Union Financial Products

Obtaining financial products from a credit union can offer numerous benefits, including personalized customer service, lower fees, competitive rates, and a focus on member satisfaction. By choosing a credit union for your financial needs, you can enjoy a more personalized and rewarding banking experience.