Entering the realm of real estate vs stocks, we delve into a comparison that has intrigued investors for decades. From historical performance to risk factors, this discussion uncovers the nuances of these two investment avenues, offering valuable insights for those navigating the financial landscape.

As we explore the intricacies of real estate and stocks, a compelling narrative emerges, shedding light on the diverse factors that shape the success of these investment choices.

Real Estate vs Stocks: Historical Performance

Investing in real estate versus stocks has been a long-standing debate among investors. Let’s take a look at the historical performance of these two popular investment options.

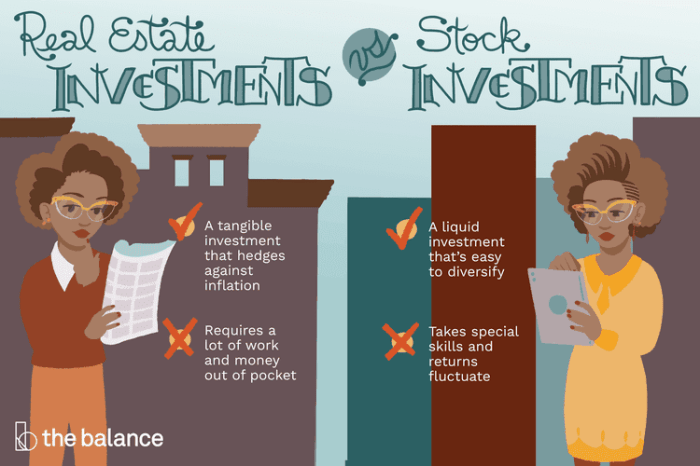

Real Estate Investments

Real estate investments have shown relatively stable and consistent growth over the years. The value of real estate properties tends to appreciate over time, providing a good hedge against inflation. However, real estate investments can be more illiquid compared to stocks, as they require time and effort to buy and sell properties. Economic factors such as interest rates, supply and demand, and overall market conditions greatly influence the performance of real estate investments.

Stock Market Investments

Stock market investments have historically shown higher volatility compared to real estate. The stock market can experience significant fluctuations in value in a short period of time, offering both high returns and high risks. Economic factors such as company performance, industry trends, and global events can have a direct impact on stock prices. Diversification is often recommended for stock market investors to mitigate risk.

Key Trends and Patterns

Historically, real estate investments have provided a more stable and predictable return compared to stocks. Real estate tends to be less volatile and can offer steady cash flow through rental income. On the other hand, stocks have the potential for higher returns but come with greater risk. Understanding the historical performance of real estate and stocks can help investors make informed decisions based on their risk tolerance and investment goals.

Real Estate vs Stocks: Risk Factors

Investing in real estate and stocks both come with their own set of risks. Let’s analyze the different risk factors associated with these two types of investments.

Market Volatility Impact

Market volatility can impact real estate and stock investments differently. For example, during economic downturns, the stock market tends to be more volatile compared to the real estate market. Stock prices can fluctuate rapidly based on market sentiment and economic indicators, while real estate prices may not experience such drastic changes in a short period of time.

- Real Estate: Real estate prices are influenced by factors such as location, supply and demand, and interest rates. While real estate values can fluctuate, they generally tend to be more stable compared to stocks during market volatility.

- Stocks: Stock prices can be highly volatile, especially during times of economic uncertainty. Factors such as company performance, market conditions, and investor sentiment can cause stock prices to fluctuate significantly in a short period of time.

Leverage and Risk

Leverage can affect risk in real estate investments differently than in stock market investments.

Leverage is the use of borrowed funds to increase the potential return on an investment.

- Real Estate: Real estate investors often use leverage by taking out mortgages to finance property purchases. While leverage can amplify returns in a rising market, it also increases the risk. If the real estate market experiences a downturn, investors may face challenges in repaying their mortgage loans, potentially leading to foreclosure.

- Stocks: In the stock market, investors can also use leverage through margin trading. However, the risks associated with leverage in stocks can be higher due to the volatile nature of stock prices. Margin calls can force investors to sell their positions at a loss, leading to significant financial losses.

Real Estate vs Stocks: Liquidity

When it comes to investing in real estate and stocks, liquidity plays a crucial role in determining how quickly an asset can be converted into cash without significantly impacting its value.

Real estate investments are considered less liquid compared to stocks. Selling a property can take time due to market conditions, finding the right buyer, and completing legal processes. This lack of liquidity can be a disadvantage for investors needing quick access to cash.

On the other hand, stocks are highly liquid assets that can be easily bought or sold on the stock market within seconds. Investors can quickly convert their stocks into cash without affecting the overall market price significantly.

Advantages of Liquid Investments:

- During times of financial emergencies, having liquid assets like stocks allows investors to access cash quickly.

- High liquidity provides flexibility for investors to adjust their portfolio based on market conditions or changing investment goals.

Disadvantages of Liquid Investments:

- In certain market conditions, selling liquid assets like stocks quickly may result in losses if the market is experiencing a downturn.

- High liquidity can sometimes lead to impulsive decision-making, impacting long-term investment strategies.

Real Estate vs Stocks: Diversification

When it comes to investing, diversification plays a crucial role in reducing overall risk in a portfolio. By spreading investments across different asset classes, investors can minimize the impact of volatility in any one sector or market.

Importance of Diversification:

- Diversification helps protect against significant losses in any single investment by spreading risk.

- It can improve overall portfolio performance by capturing gains from different sectors or asset classes.

- Reduces vulnerability to market fluctuations and economic downturns.

Comparing Diversification Benefits:

Real estate and stocks offer different diversification benefits due to their unique characteristics:

| Real Estate | Stocks |

|---|---|

| Provides a hedge against inflation. | Offers high liquidity for quick buying and selling. |

| Generates rental income and potential appreciation. | Historically higher returns over the long term. |

| Less volatile compared to stocks. | Allows for easy diversification through index funds or ETFs. |

Strategies for Effective Diversification:

- Allocate a percentage of your portfolio to both real estate and stocks based on your risk tolerance and investment goals.

- Consider investing in real estate investment trusts (REITs) for exposure to the real estate market without owning physical properties.

- Explore different sectors within stocks and real estate to diversify further, such as tech stocks versus commercial real estate.

- Regularly rebalance your portfolio to maintain desired asset allocations and adjust for changing market conditions.

Real Estate vs Stocks: Tax Implications

When it comes to investing in real estate versus stocks, understanding the tax implications is crucial. Here’s a breakdown of how capital gains, rental income, and dividends are taxed differently in real estate and stock investments, along with insights on tax-efficient strategies:

Capital Gains:

Capital gains from the sale of real estate are taxed based on how long you held the property. Short-term capital gains (properties held for less than a year) are taxed at ordinary income tax rates, while long-term capital gains (properties held for more than a year) are subject to capital gains tax rates. On the other hand, capital gains from stocks are also taxed at varying rates depending on how long you held the investment.

Rental Income:

Rental income from real estate properties is taxed as ordinary income, subject to your regular income tax rate. However, you can take advantage of deductions such as mortgage interest, property taxes, and depreciation to lower your taxable rental income. In contrast, dividends from stocks are taxed at a lower rate and can even qualify for preferential tax treatment.

Tax-Efficient Strategies:

One tax-efficient strategy for managing real estate investments is utilizing 1031 exchanges to defer capital gains taxes when selling one property and purchasing another similar property. Additionally, investing in real estate through a self-directed IRA can provide tax advantages. For stocks, tax-efficient strategies include holding investments for the long term to benefit from lower capital gains tax rates and taking advantage of tax-advantaged accounts like 401(k)s and IRAs.