Get ready to dive into the world of financial hedging strategies where we unravel the complexities and benefits of safeguarding your investments. Buckle up as we explore the ins and outs of this critical financial tool that can make or break your portfolio.

From understanding the basics to implementing advanced techniques, this guide will equip you with the knowledge needed to navigate the volatile world of finance with confidence.

Overview of Financial Hedging Strategies

Financial hedging is a risk management strategy used to protect against potential losses in financial markets. It involves taking offsetting positions to reduce the impact of adverse price movements.

The main objectives of using hedging strategies include minimizing potential losses, stabilizing cash flows, and protecting investments from volatility in the market.

Types of Financial Instruments Used in Hedging

When it comes to hedging, there are various types of financial instruments that can be used to manage risk effectively. Some of the most common ones include:

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a specific timeframe.

- Forwards: Customized contracts between two parties to buy or sell an asset at a specified price on a future date.

- Futures: Standardized contracts traded on exchanges to buy or sell an asset at a predetermined price on a future date.

- Swaps: Agreements between two parties to exchange cash flows based on a specified notional amount.

Each of these financial instruments serves a specific purpose in hedging against different types of risks, allowing investors to tailor their strategies to suit their individual needs.

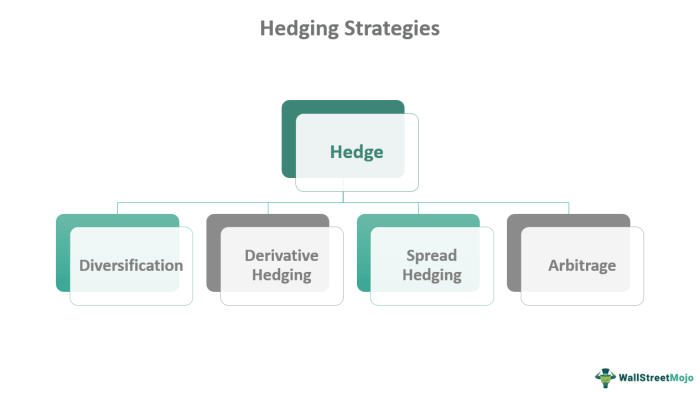

Types of Financial Hedging Strategies

In the world of financial hedging, there are various strategies that businesses and investors can utilize to manage risk and protect themselves against adverse market movements.

Forward Contracts vs. Options

When it comes to hedging, forward contracts and options are two common tools used to mitigate risk. Forward contracts involve an agreement between two parties to buy or sell an asset at a specified price on a future date. Options, on the other hand, provide the holder with the right, but not the obligation, to buy or sell an asset at a predetermined price within a set timeframe.

- Forward contracts lock in a price for the underlying asset, providing certainty but also limiting flexibility.

- Options offer more flexibility as the holder can choose whether or not to exercise the contract, depending on market conditions.

Utilization of Futures Contracts

Futures contracts are commonly used for hedging in various industries, such as commodities, currencies, and interest rates. For example, a company that relies on a certain commodity for production can use futures contracts to lock in a favorable price, protecting themselves against price fluctuations in the market.

Futures contracts are standardized agreements traded on exchanges, providing liquidity and transparency for hedging purposes.

Role of Swaps

Swaps are derivative contracts that allow parties to exchange cash flows based on different financial instruments. They are often used in managing interest rate risk, currency risk, or even commodity price risk. By entering into a swap agreement, businesses can customize their risk management strategies to suit their specific needs.

- Interest rate swaps help entities manage interest rate exposure by exchanging fixed-rate payments for floating-rate payments, or vice versa.

- Currency swaps allow parties to exchange cash flows in different currencies, mitigating exchange rate risk.

Factors Influencing the Choice of Hedging Strategies

When it comes to selecting the right hedging strategies, several factors come into play. Market volatility, interest rates, company size, and industry risk all play a crucial role in determining the most suitable approach to manage financial risk.

Market Volatility and Selection of Hedging Instruments

Market volatility refers to the degree of fluctuation in asset prices. High market volatility usually leads to a higher risk exposure for companies. In such situations, companies may opt for more complex hedging instruments such as options or futures to protect themselves against adverse price movements. These instruments provide flexibility and can be tailored to specific risk exposures, making them ideal choices during uncertain market conditions.

Impact of Interest Rates on Hedging Decisions

Interest rates play a significant role in hedging decisions as they influence the cost of borrowing and investment returns. When interest rates are low, companies may choose to hedge against potential interest rate increases by using interest rate swaps or forward rate agreements. These instruments help companies lock in favorable rates, reducing the impact of rising interest costs on their bottom line.

Company Size and Industry Risk in Hedging Strategies

The size of a company and the industry it operates in can also impact the choice of hedging strategies. Large companies with diverse operations may have different risk exposures compared to smaller firms. Similarly, industries with higher inherent risks, such as commodity or foreign exchange exposure, may require more sophisticated hedging strategies to mitigate risks effectively. Tailoring hedging strategies to specific company size and industry risk profiles is essential to ensure optimal risk management.

Implementation of Hedging Strategies

Implementing a comprehensive hedging strategy involves several key steps to effectively manage risk and protect against adverse market movements. Setting clear risk management objectives before implementing hedges is crucial to ensure alignment with the overall financial goals. Monitoring and adjusting hedging positions is essential to maintain the effectiveness of the strategy and make necessary changes as market conditions evolve.

Designing a Comprehensive Hedging Strategy

- Identify and assess the risks: Understand the specific risks facing the organization or investment portfolio.

- Establish risk tolerance levels: Determine the acceptable level of risk exposure and potential losses.

- Select appropriate hedging instruments: Choose the right financial products or strategies to mitigate identified risks.

- Set clear objectives: Define the goals of the hedging strategy in terms of risk reduction and financial performance.

- Implement and monitor: Execute the hedges and regularly evaluate their effectiveness in managing risk.

Importance of Setting Clear Risk Management Objectives

- Align with financial goals: Ensure that hedging objectives are consistent with the broader financial objectives of the organization or investment portfolio.

- Provide a framework for decision-making: Establishing clear objectives helps in making informed decisions regarding the selection and adjustment of hedging positions.

- Evaluate effectiveness: By setting measurable objectives, it becomes easier to assess the success of the hedging strategy and make necessary adjustments.

Best Practices for Monitoring and Adjusting Hedging Positions

- Regularly review market conditions: Stay informed about changes in the market that may impact the effectiveness of the hedges.

- Assess hedge performance: Monitor the performance of the hedges against the established objectives and make adjustments as needed.

- Stay flexible: Be prepared to adjust hedging positions in response to changing market dynamics or shifts in risk exposure.

- Document decisions: Maintain records of the rationale behind hedging decisions and adjustments for future reference and analysis.