Home loan refinancing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Get ready to dive into the world of home loan refinancing with a fresh perspective and a touch of American high school hip style.

Exploring the ins and outs of refinancing your home loan can open up a world of financial opportunities and savings. Let’s break down the complexities and make it easy to understand.

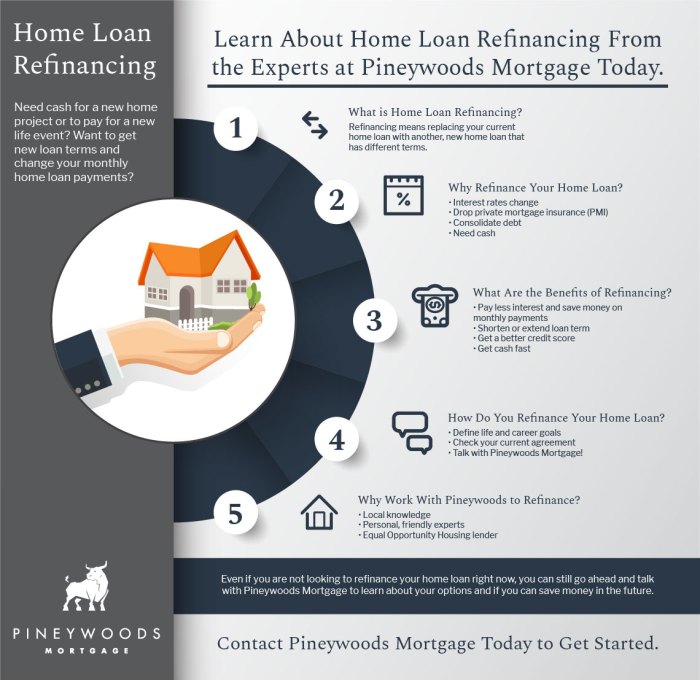

Understanding Home Loan Refinancing

When it comes to home loan refinancing, it’s all about getting a new loan to replace your existing mortgage. This can be a smart move for homeowners looking to save money, lower their monthly payments, or tap into their home equity for other financial needs.

Benefits of Home Loan Refinancing

- Lower Interest Rates: Refinancing can help you secure a lower interest rate than your current mortgage, potentially saving you thousands of dollars over the life of the loan.

- Reduced Monthly Payments: By refinancing to a lower interest rate or extending the loan term, you can lower your monthly mortgage payments, providing more breathing room in your budget.

- Access to Home Equity: Refinancing allows you to tap into your home equity for things like home improvements, debt consolidation, or other financial goals.

Reasons for Homeowners to Consider Refinancing

- Improving Credit Score: If your credit score has improved since you took out your original mortgage, you may qualify for better loan terms through refinancing.

- Changing Financial Goals: Homeowners may refinance to switch from an adjustable-rate mortgage to a fixed-rate mortgage, or vice versa, based on their financial goals and risk tolerance.

- Debt Consolidation: Refinancing can help consolidate high-interest debt into a lower interest mortgage, simplifying your financial obligations and potentially saving you money.

How Home Loan Refinancing Works

When it comes to home loan refinancing, the process involves replacing your current mortgage with a new one, typically to take advantage of better terms, lower interest rates, or to access equity in your home.

Refinancing with Current Lender vs. New Lender

- Refinancing with your current lender: This option may involve less paperwork and fees since you are already a customer. However, you might miss out on better rates or terms that other lenders could offer.

- Refinancing with a new lender: Going with a new lender gives you the opportunity to shop around for the best deal. You may find lower interest rates and better terms, but you will have to go through the application process again.

Potential Costs of Home Loan Refinancing

- Application fees: Lenders may charge fees for processing your application, which could range from a few hundred to a few thousand dollars.

- Appraisal fees: An appraisal of your home may be required to determine its current value, which can cost a few hundred dollars.

- Closing costs: Similar to when you purchased your home, refinancing also involves closing costs such as title search, title insurance, and other fees.

- Prepayment penalties: Some mortgages come with prepayment penalties if you pay off your loan early. Make sure to check if your current loan has this provision.

Benefits of Home Loan Refinancing

Refinancing a home loan comes with several advantages that can help homeowners save money and improve their financial situation. One of the main benefits is the potential to lower monthly payments, which can provide immediate relief to those struggling with high mortgage costs. Additionally, refinancing can lead to savings over the long term by securing a lower interest rate and reducing the total amount paid over the life of the loan.

Lower Monthly Payments

- By refinancing at a lower interest rate, homeowners can reduce their monthly mortgage payments.

- Lower monthly payments can free up cash flow, allowing homeowners to allocate funds to other expenses or savings goals.

- Adjusting the loan term during refinancing can also help lower monthly payments by spreading the remaining balance over a longer period.

Long-Term Savings

- Securing a lower interest rate through refinancing can result in significant savings over the life of the loan.

- Reducing the total amount paid in interest can lead to thousands of dollars in savings over the years.

- Refinancing to a shorter loan term can help homeowners build equity faster and pay off their mortgage sooner, saving even more in interest costs.

Considerations Before Refinancing

When considering refinancing your home loan, there are several important factors to keep in mind. From your credit score to the right timing, each aspect plays a crucial role in determining whether refinancing is the right choice for you.

Importance of Credit Score and Debt-to-Income Ratio

Maintaining a good credit score is essential when refinancing a home loan. Lenders use your credit score to assess your creditworthiness and determine the interest rate you qualify for. A higher credit score can result in lower interest rates, ultimately saving you money in the long run. Additionally, lenders also consider your debt-to-income ratio, which is the percentage of your monthly income that goes towards paying off debts. A lower debt-to-income ratio demonstrates financial stability and may increase your chances of getting a favorable refinancing deal.

Determining the Right Time to Refinance

Timing is key when it comes to refinancing your home loan. It’s important to consider factors such as current interest rates, your financial goals, and how long you plan to stay in your home. Refinancing when interest rates are low can help you secure a better rate and save on monthly payments. However, if you plan to move in the near future, the cost of refinancing may outweigh the potential savings. It’s essential to evaluate your individual circumstances and consult with a financial advisor to determine the optimal time to refinance.

Types of Home Loan Refinancing

Refinancing your home loan can take different forms, each serving a specific purpose depending on your financial goals and circumstances.

Rate-and-Term Refinancing

Rate-and-term refinancing involves obtaining a new loan with better terms, such as a lower interest rate or a shorter loan period. This type of refinancing is ideal for homeowners looking to reduce their monthly payments, save on interest costs, or pay off their mortgage sooner.

Cash-Out Refinancing

Cash-out refinancing allows homeowners to access the equity they have built in their homes by borrowing more than what is owed on the current mortgage. The extra funds can be used for various purposes, such as home improvements, debt consolidation, or other financial needs. This type of refinancing is suitable for those looking to tap into their home’s equity for a specific purpose.