How to calculate net worth dives into the world of personal finance with a flair that’s as fresh as a new pair of kicks. From breaking down assets to deciphering liabilities, this guide is your ticket to understanding the true value of your financial status.

Get ready to level up your financial game with this comprehensive breakdown that’s as cool as rocking your favorite band tee.

Understand the Concept

Net worth is the value that represents the difference between an individual’s assets and liabilities. It is a crucial financial indicator that helps determine an individual’s overall financial health and stability. Calculating net worth provides a clear picture of one’s financial standing and can be used to track financial progress over time.

Components of Net Worth

- Assets: Assets are items of value that an individual owns and can include cash, investments, real estate, vehicles, and personal belongings. These assets contribute positively to one’s net worth as they represent wealth and value.

- Liabilities: Liabilities refer to debts and financial obligations that an individual owes, such as mortgages, student loans, credit card debt, and other loans. Liabilities have a negative impact on net worth as they represent money owed by the individual.

Examples of Assets and Liabilities

Assets:

- Cash in savings account

- Investment portfolio

- Real estate properties

- Retirement accounts

- Jewelry and valuable collectibles

Liabilities:

- Mortgage on primary residence

- Car loan

- Student loans

- Credit card debt

- Personal loans

Calculate Assets

Determining the value of assets is crucial in accurately calculating your net worth. Assets can include real estate, investments, personal property, retirement accounts, and collectibles. Here’s how you can calculate the value of your assets:

Real Estate

When calculating the value of real estate, consider the current market value of your properties. You can use online real estate websites, recent sales in your area, or hire a professional appraiser to get an accurate estimate.

Investments

To determine the worth of your investments, such as stocks, bonds, or mutual funds, check their current market value. You can find this information on investment platforms, financial news websites, or by contacting your financial advisor.

Personal Property

When evaluating personal property like vehicles, jewelry, or electronics, consider their resale value. You can use online marketplaces, appraisal services, or consult with experts in specific areas to get an idea of their worth.

Retirement Accounts

For retirement accounts like 401(k)s or IRAs, check your latest statements to determine their current balance. Consider any penalties or taxes associated with early withdrawal if you plan to include these assets in your net worth calculation.

Collectibles

When assessing the value of collectibles like art, antiques, or rare items, it’s essential to get them appraised by professionals. Their uniqueness and condition play a significant role in determining their market value.

Remember, including all assets, no matter how big or small, is crucial for an accurate net worth calculation. By valuing each asset correctly, you can have a clearer picture of your overall financial health.

Determine Liabilities

To calculate your net worth accurately, it’s essential to understand and quantify your liabilities. Liabilities refer to debts or financial obligations that you owe to others, which can impact your overall financial health.

Identifying and quantifying various types of liabilities, such as mortgages, loans, and credit card debt, is crucial for a comprehensive assessment of your net worth. Here’s how you can categorize and evaluate your liabilities effectively:

Types of Liabilities

- Short-Term Liabilities: These are debts that are due within one year, such as credit card balances, utility bills, and short-term loans.

- Long-Term Liabilities: These are debts with a repayment period longer than one year, like mortgages, student loans, and car loans.

Reducing Liabilities

- Develop a Repayment Plan: Prioritize paying off high-interest debts first to reduce the overall interest payments and accelerate debt repayment.

- Consolidate Debt: Consider consolidating multiple debts into a single loan with a lower interest rate to simplify payments and potentially reduce overall costs.

- Adjust Your Spending Habits: Cut back on unnecessary expenses and allocate more funds towards debt repayment to accelerate the process of becoming debt-free.

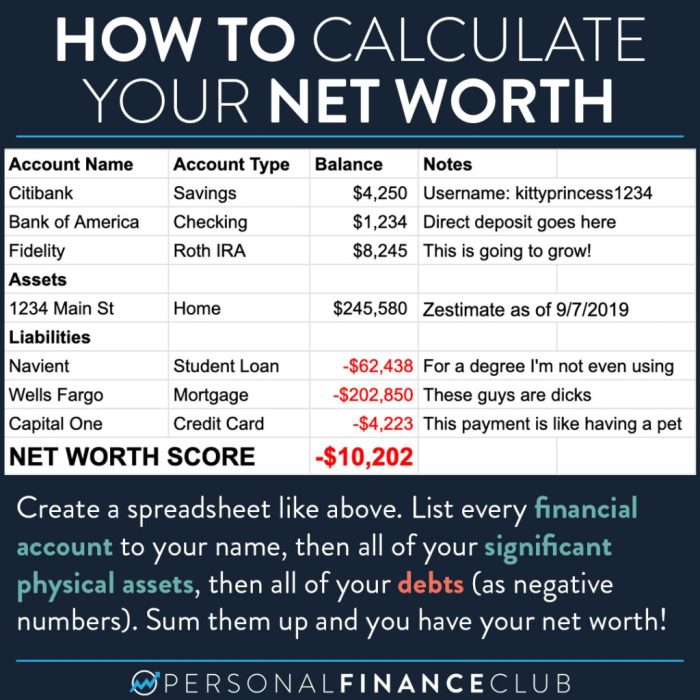

Calculate Net Worth

When it comes to calculating your net worth, it’s all about determining the difference between your assets and liabilities. This simple formula can give you a clear picture of your overall financial health. Let’s break it down step by step.

Formula for Calculating Net Worth

To calculate your net worth, you need to subtract your total liabilities from your total assets. This formula can be represented as:

Net Worth = Assets – Liabilities

Step-by-Step Guide

- List out all your assets, including cash, investments, real estate, and personal property.

- Calculate the total value of your assets.

- Next, make a list of all your liabilities, such as mortgages, loans, and credit card debt.

- Calculate the total value of your liabilities.

- Finally, subtract your total liabilities from your total assets to find your net worth.

Tracking Net Worth and Setting Financial Goals

Tracking your net worth over time can help you monitor your financial progress. Set financial goals based on your net worth calculations to improve your overall financial situation. Consider creating a budget, paying off debt, and investing wisely to increase your net worth over time.