Auto loan refinancing options lay the foundation for this epic journey, offering readers a sneak peek into a tale filled with twists and turns, all in a high school hip American style.

As we delve deeper into the realm of auto loan refinancing, we uncover the ins and outs of this financial strategy, providing you with the knowledge needed to make informed decisions.

Overview of Auto Loan Refinancing Options

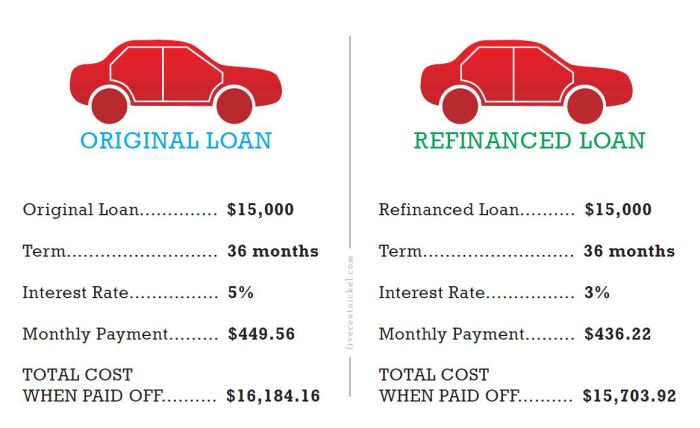

When it comes to auto loan refinancing, it’s all about swapping your current car loan for a new one with better terms. This process allows you to potentially lower your monthly payments, reduce your interest rate, or adjust the loan term. Essentially, you’re taking out a new loan to pay off the existing one.

Benefits of Auto Loan Refinancing

- Lower Interest Rates: Refinancing can help you secure a lower interest rate, which can save you money over the life of the loan.

- Lower Monthly Payments: By extending the loan term or securing a lower interest rate, you can reduce your monthly payments and free up some cash flow.

- Improved Credit Score: Making timely payments on your refinanced loan can positively impact your credit score over time.

Advantages and Disadvantages of Auto Loan Refinancing

- Advantages:

- Opportunity to Save Money: Lower interest rates or monthly payments can lead to significant savings.

- Flexible Loan Terms: Refinancing allows you to adjust the loan term to better suit your financial situation.

- Improved Financial Health: Refinancing can help you better manage your finances and improve your credit score.

- Disadvantages:

- Additional Costs: Refinancing may come with fees and charges that can offset any potential savings.

- Extended Loan Term: While lowering monthly payments can be beneficial, extending the loan term may result in paying more interest over time.

- Impact on Credit Score: Multiple credit inquiries during the refinancing process can temporarily lower your credit score.

Types of Auto Loan Refinancing Options

When it comes to refinancing your auto loan, there are several options available to help you save money and lower your monthly payments.

Traditional Refinancing Options

- Traditional refinancing involves replacing your current auto loan with a new loan from a different lender. This new loan ideally comes with a lower interest rate, allowing you to save money over the life of the loan.

- With traditional refinancing, you can also extend the loan term to reduce your monthly payments, although this may result in paying more in interest over time.

- It’s important to shop around and compare offers from different lenders to ensure you’re getting the best deal possible.

Cash-Out Refinancing

- Cash-out refinancing allows you to borrow more than what you owe on your current auto loan and receive the difference in cash. This extra cash can be used for other expenses or to pay off high-interest debt.

- However, keep in mind that cash-out refinancing may result in a higher loan amount and potentially a higher interest rate, so it’s important to weigh the pros and cons before proceeding.

Refinancing with a New Lender or Current Lender

- When refinancing your auto loan, you have the option to work with a new lender or your current lender. Working with a new lender can help you secure a better interest rate and terms, while sticking with your current lender may offer convenience and loyalty benefits.

- Before deciding on a lender, be sure to research and compare offers from multiple sources to find the best option for your financial situation.

Factors to Consider Before Refinancing

When thinking about refinancing your auto loan, there are several key factors to take into consideration to ensure it’s the right decision for your financial situation.

Credit Score Impact

Your credit score plays a significant role in determining the auto loan refinancing options available to you. A higher credit score typically leads to better interest rates and terms, making refinancing a more attractive option. On the other hand, if your credit score has improved since you first took out the auto loan, refinancing could help you secure a lower interest rate and save money over the life of the loan.

Interest Rates Consideration

The current interest rates in the market also play a crucial role in the decision to refinance your auto loan. If interest rates have dropped significantly since you initially took out the loan, refinancing could potentially save you money on interest payments. However, it’s essential to calculate the potential savings versus the cost of refinancing to determine if it’s a financially sound decision.

Process of Refinancing an Auto Loan

When it comes to refinancing an auto loan, there are specific steps you need to follow to ensure a smooth process. Additionally, understanding the documentation required and potential fees involved is crucial to make informed decisions.

Step-by-step Guide to Refinance an Auto Loan

- Evaluate Your Current Loan: Review your current auto loan terms, including interest rate, monthly payments, and remaining balance.

- Check Your Credit Score: A higher credit score can help you qualify for better refinancing rates.

- Research Lenders: Compare offers from various lenders to find the best refinancing option for your situation.

- Apply for Refinancing: Submit an application with the chosen lender, providing necessary documentation.

- Review and Accept Offer: Once approved, carefully review the new loan terms and accept the offer.

- Pay off Existing Loan: The new lender will pay off your existing auto loan, and you will start making payments to them.

Documentation Required for Refinancing

When refinancing an auto loan, you may need to provide the following documents:

- Proof of Income: Pay stubs, tax returns, or bank statements.

- Vehicle Information: Registration, insurance, and VIN.

- Current Loan Details: Statement showing the remaining balance and terms.

- Identification: Driver’s license or other government-issued ID.

Potential Fees and Costs

While refinancing can help save money in the long run, there are potential fees and costs to consider:

- Application Fee: Some lenders charge a fee to process your refinancing application.

- Origination Fee: This fee covers the cost of setting up the new loan.

- Prepayment Penalty: Check if your current loan has a penalty for paying it off early.

- Title Transfer Fee: If the lender requires a new title, this fee may apply.

Alternatives to Auto Loan Refinancing

If you’re looking to manage your auto loan payments without going through the process of refinancing, there are a few alternatives you can consider. These alternatives include exploring loan modification programs offered by lenders and negotiating better terms with your current lender without the need for refinancing.

Loan Modification Programs

Loan modification programs are offered by some lenders as a way to help borrowers who are struggling to make their payments. These programs may involve adjusting the interest rate, extending the loan term, or even temporarily reducing the monthly payment amount. It’s important to contact your lender directly to inquire about any available modification programs and see if you qualify.

Negotiating Better Terms

If you’re looking to improve your auto loan terms without refinancing, consider reaching out to your current lender to discuss possible options. You can try negotiating for a lower interest rate, a longer loan term, or even a payment plan that better suits your financial situation. Building a good relationship with your lender and explaining your circumstances may help you secure more favorable terms without the need for refinancing.