Best practices for investment research sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Get ready to dive into the world of investment research, where knowledge is power and strategy is key.

Importance of Investment Research

Investment research plays a vital role in helping individuals and organizations make well-informed decisions when it comes to investing their money. By conducting thorough research, investors can gain valuable insights into various investment options, market trends, and potential risks, ultimately enabling them to maximize returns and minimize losses.

Benefits of Conducting Thorough Research

- Identifying Opportunities: Research allows investors to identify potential investment opportunities that align with their financial goals and risk tolerance.

- Understanding Risks: By analyzing market data and trends, investors can better understand the risks associated with different investments and develop strategies to mitigate these risks.

- Optimizing Portfolio: Through research, investors can optimize their investment portfolio by diversifying across asset classes and industries to reduce overall risk.

- Improving Decision-Making: Research equips investors with the knowledge and insights needed to make informed decisions, leading to better outcomes in the long run.

How Research Can Help Mitigate Risks and Maximize Returns

- Evaluating Fundamentals: Researching the fundamentals of a company or asset can help investors assess its potential for growth and profitability.

- Monitoring Market Trends: By staying informed about market trends and economic indicators, investors can adjust their investment strategies accordingly to capitalize on opportunities and avoid potential pitfalls.

- Staying Ahead of Competition: Conducting research gives investors a competitive edge by allowing them to stay ahead of market developments and make timely decisions.

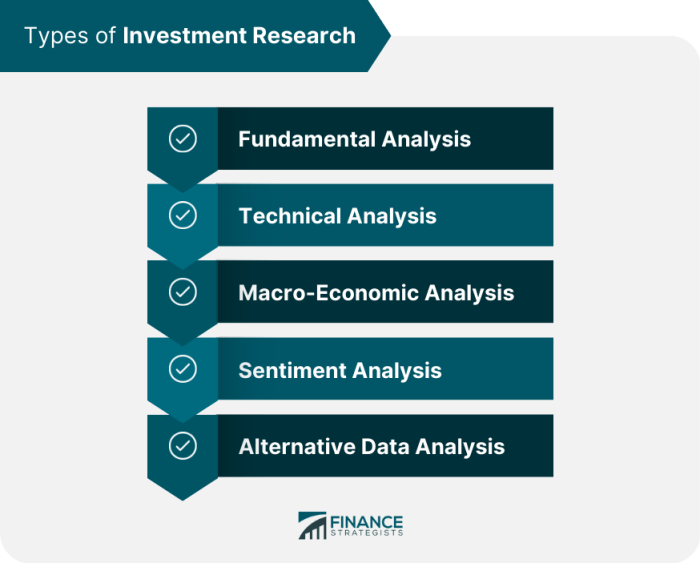

Types of Investment Research

Investment research can be categorized into different types, each serving a unique purpose in the decision-making process of investors. Understanding the various types of research methods is crucial for making informed investment decisions.

Fundamental Analysis vs. Technical Analysis

When it comes to investment research, two primary methods are fundamental analysis and technical analysis. Fundamental analysis involves evaluating the financial health and performance of a company by analyzing its financial statements, management team, competitive position, and overall industry trends. On the other hand, technical analysis focuses on studying historical price movements and trading volume to predict future stock price movements. While fundamental analysis is more long-term oriented, technical analysis is often used for short-term trading strategies.

Quantitative and Qualitative Research Methods

Quantitative research involves using mathematical and statistical models to analyze investment opportunities. This method relies on objective data such as financial ratios, earnings reports, and market trends to make investment decisions. Qualitative research, on the other hand, focuses on subjective factors like company reputation, brand value, and industry outlook. By combining both quantitative and qualitative research methods, investors can gain a comprehensive understanding of potential investment opportunities.

Role of Market Research

Market research plays a crucial role in investment decision-making by providing insights into market trends, consumer behavior, and competitor analysis. By conducting thorough market research, investors can identify emerging opportunities, assess market risks, and make informed investment decisions. Market research helps investors stay ahead of market trends and make strategic investment choices that align with their financial goals.

Best Practices for Conducting Investment Research

Investment research is a crucial step in making informed financial decisions. By following best practices, you can effectively evaluate opportunities and mitigate risks. Here is a step-by-step guide to conducting investment research:

Step 1: Define Your Investment Goals

Before diving into research, it’s essential to clearly define your investment goals. Consider your risk tolerance, time horizon, and financial objectives.

Step 2: Conduct Macro and Microeconomic Analysis

Start by analyzing macroeconomic factors such as interest rates, inflation, and GDP growth. Then, move on to microeconomic analysis focusing on specific industries and companies.

Step 3: Evaluate Financial Statements

Thoroughly review the financial statements of companies you are interested in investing in. Look at key metrics such as revenue growth, profit margins, and debt levels.

Step 4: Analyze Market Trends

Stay up to date with market trends and industry developments. Identify potential opportunities and threats that could impact your investments.

Step 5: Utilize Research Tools and Resources

Make use of research tools such as financial websites, market analysis reports, and investment newsletters. Leverage these resources to gather valuable insights.

Step 6: Diversify Your Portfolio

Diversification is key to managing risk in your investment portfolio. Spread your investments across different asset classes and industries to reduce exposure to any single risk factor.

By following these best practices for conducting investment research, you can make well-informed decisions and enhance your investment strategy.

Incorporating Risk Management in Investment Research

When conducting investment research, it is crucial to incorporate risk management strategies to protect your portfolio and maximize returns. By analyzing and mitigating risks, investors can make informed decisions and avoid potential losses.

Integration of Risk Assessment

- One way risk assessment is integrated into the research process is by identifying and evaluating potential risks associated with a particular investment. This includes analyzing market risks, industry risks, and company-specific risks.

- Investors can use quantitative models, such as Value at Risk (VaR), to quantify the level of risk in their portfolio and adjust their investment strategy accordingly.

Importance of Diversification

Diversification plays a key role in managing investment risks by spreading capital across different asset classes, industries, and geographic regions. This helps reduce the impact of a single investment’s poor performance on the overall portfolio.

Diversification is often referred to as the only free lunch in investing, as it allows investors to achieve a higher return for a given level of risk.

Risk Management Strategies

- One common risk management strategy is setting stop-loss orders to automatically sell a security when it reaches a predetermined price, limiting potential losses.

- Another strategy is using options contracts to hedge against downside risk, providing protection in case of adverse market movements.

- Investors can also use fundamental analysis to assess the financial health and stability of a company before investing, reducing the risk of investing in a financially unstable company.