Get ready to dive into the world of Financial tools for budgeting, where managing your money becomes a breeze. From tracking expenses to setting financial goals, these tools are your go-to for financial success.

Ready to take charge of your finances? Let’s explore the ins and outs of budgeting tools to help you stay on top of your game.

Types of Financial Tools

When it comes to budgeting, there are various types of financial tools that can help you manage your money more effectively. Each type of tool comes with its own set of features and benefits, so let’s take a look at some of the most popular options:

Budgeting Apps

- Popular examples include Mint, YNAB, and EveryDollar.

- Features include expense tracking, goal setting, and bill reminders.

- Benefits include real-time updates, customizable categories, and easy-to-read reports.

Spreadsheets

- Excel and Google Sheets are commonly used for creating personal budgets.

- Features include customizable templates, formulas for calculations, and easy data entry.

- Benefits include flexibility, control over design, and ability to analyze data.

Envelope System

- Requires physically dividing cash into envelopes for different spending categories.

- Features include visual representation of budget, limited spending based on cash on hand.

- Benefits include avoiding overspending, increased awareness of where money goes.

Financial Tracking Tools

- Tools like Personal Capital and Quicken help track income, expenses, and investments.

- Features include net worth calculations, investment analysis, and retirement planning.

- Benefits include holistic financial view, goal setting, and investment optimization.

Popular Budgeting Apps

Budgeting apps are a great tool for managing personal or business finances efficiently. They offer features like expense tracking, budget planning, goal setting, and financial insights to help users stay on top of their money matters.

1. Mint

Mint is a popular budgeting app that allows users to link their bank accounts, credit cards, and bills in one place. It provides a comprehensive overview of your financial situation, categorizes expenses, and sends alerts for bill payments. Mint also offers personalized budgeting tips based on spending patterns.

2. You Need a Budget (YNAB)

YNAB focuses on zero-based budgeting, where every dollar has a designated purpose. It helps users prioritize saving, avoid debt, and reach financial goals. YNAB offers live workshops and educational resources to help users build healthy financial habits.

3. Personal Capital

Personal Capital is more than just a budgeting app; it also offers investment tracking and retirement planning tools. Users can link all their financial accounts to get a holistic view of their finances. Personal Capital provides detailed investment analysis and fee tracking to optimize portfolios.

4. PocketGuard

PocketGuard simplifies budgeting by categorizing expenses and tracking income in real-time. It helps users set spending limits, track bills, and save for goals. PocketGuard also offers insights into where money is going and suggests ways to cut back on unnecessary expenses.

5. EveryDollar

EveryDollar follows a zero-based budgeting approach similar to YNAB. It enables users to create a monthly budget, track expenses, and monitor progress towards financial goals. EveryDollar provides a visual representation of spending habits and offers support for debt payoff strategies.

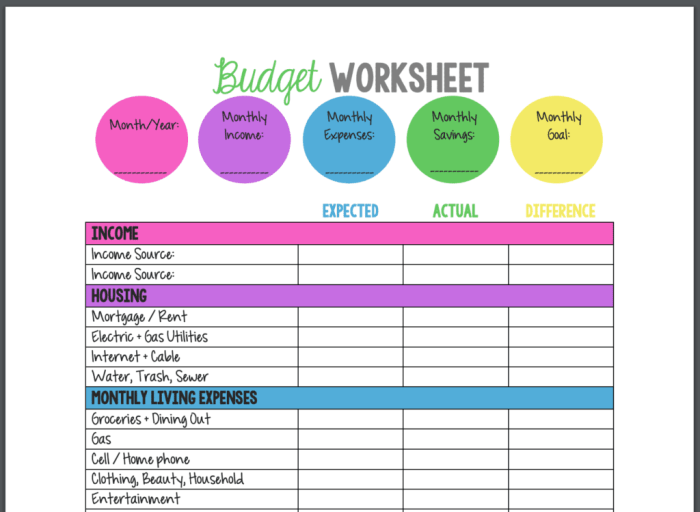

Creating a Budget Plan

Creating a budget plan is essential for managing your finances effectively. By using financial tools, you can streamline the process and stay on track with your financial goals.

Steps to Create a Budget Plan

- List your income sources: Start by calculating your monthly income from all sources, including salary, side hustles, and investments.

- Track your expenses: Use budgeting apps to categorize and monitor your expenses, such as rent, groceries, and entertainment.

- Set financial goals: Determine what you want to achieve with your budget, whether it’s saving for a vacation or paying off debt.

- Create a budget: Allocate your income to different expense categories based on your priorities and financial goals.

- Monitor and adjust: Regularly review your budget plan to see if you’re staying within your limits and make adjustments as needed.

Tips for Setting Financial Goals and Tracking Expenses

- Set specific and measurable goals: Instead of saying “save money,” specify how much you want to save each month for a specific purpose.

- Use budgeting apps: Take advantage of features like expense tracking and goal setting in budgeting apps to stay organized.

- Automate savings: Set up automatic transfers to your savings account to ensure you’re consistently saving towards your goals.

- Review your progress: Regularly check in on your financial goals and adjust your budget plan accordingly to stay on track.

Importance of Regular Reviews and Adjustments in Budget Planning

Regularly reviewing and adjusting your budget plan is crucial for financial success. It allows you to identify any overspending or areas where you can save more money. By making changes as needed, you can ensure that your budget plan remains effective in helping you reach your financial goals.

Integrating Budgeting Tools with Financial Accounts

Integrating budgeting tools with your financial accounts can streamline the budgeting process and provide real-time insights into your spending habits. By linking your bank accounts, credit cards, or other financial accounts to budgeting tools, you can automate the tracking of your income and expenses.

Security Measures in Place

When linking your financial accounts to budgeting tools, it is essential to ensure the security measures in place to protect your sensitive information. Most budgeting apps use bank-level encryption to safeguard your data and require multi-factor authentication for added security. Additionally, reputable budgeting tools have strict privacy policies to protect your financial information from unauthorized access.

Benefits of Automatic Transaction Tracking

Automatic transaction tracking through integrated financial tools offers several benefits. It allows you to categorize your expenses automatically, providing a clear overview of where your money is going. By syncing your accounts, you can easily track your progress towards financial goals, identify areas where you can cut back on spending, and receive alerts for unusual transactions. This real-time visibility into your finances can help you make informed decisions and stay on top of your budget.