As Importance of a financial advisor takes center stage, this opening passage beckons readers with american high school hip style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

When it comes to managing personal finances, having a financial advisor by your side can make all the difference. From navigating investments to planning for retirement, the expertise of a financial advisor is crucial for achieving financial goals. Let’s dive deep into why seeking professional financial advice is the key to financial success.

Importance of a Financial Advisor

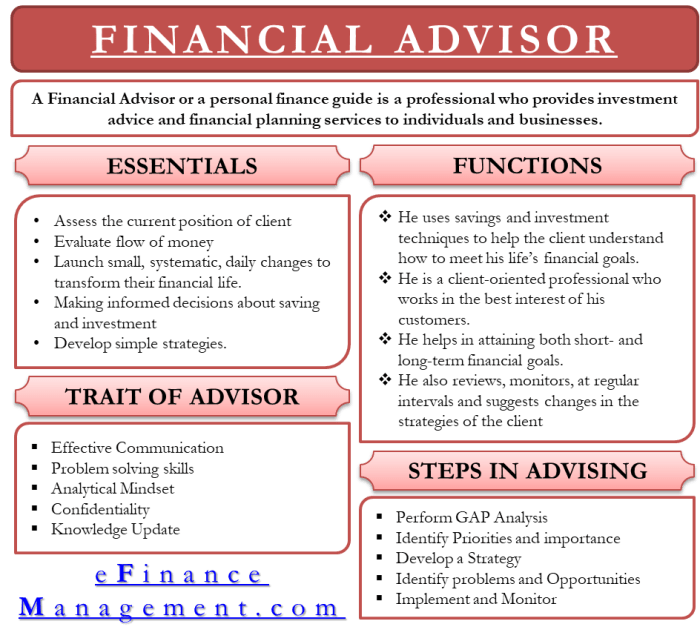

When it comes to managing your personal finances, having a financial advisor can make a world of difference. These professionals offer valuable guidance and expertise to help you make informed decisions about your money.

The Role of a Financial Advisor

A financial advisor acts as a partner in your financial journey, providing personalized advice based on your goals and circumstances. They can help you create a comprehensive financial plan, manage investments, and navigate complex financial products.

Benefits of Seeking Professional Financial Advice

- Access to Expertise: Financial advisors have specialized knowledge and experience in various areas of finance, allowing them to provide tailored advice.

- Objective Perspective: An advisor can offer an unbiased view of your financial situation and help you make decisions without emotional bias.

- Long-Term Planning: By working with a financial advisor, you can develop a long-term financial strategy that aligns with your goals and helps you build wealth over time.

Helping Reach Financial Goals

A financial advisor can assist you in setting realistic financial goals and creating a roadmap to achieve them. Whether you’re saving for retirement, buying a home, or planning for your children’s education, an advisor can guide you towards making sound financial choices.

Qualifications and Expertise

When seeking financial advice, it is crucial to ensure that the financial advisor you choose possesses the necessary qualifications and expertise to guide you effectively towards your financial goals.

Qualifications and Certifications

- A certified financial planner (CFP) designation is a key qualification to look for in a financial advisor. This certification demonstrates that the advisor has completed extensive training and testing in areas such as financial planning, taxes, insurance, estate planning, and retirement.

- Other important certifications include Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), and Chartered Financial Consultant (ChFC), each indicating expertise in specific financial areas.

Expertise Areas

- Investment Planning: A financial advisor can provide valuable insights into creating a diversified investment portfolio tailored to your risk tolerance and financial goals.

- Retirement Planning: Advisors can help you develop a comprehensive retirement plan that considers factors such as savings, social security, and healthcare costs.

- Tax Planning: Expertise in tax planning can help you minimize tax liabilities and maximize returns on investments.

- Estate Planning: Advisors can assist in creating a plan to ensure the smooth transfer of assets to heirs while minimizing estate taxes.

Importance of Experience

Experience plays a significant role in the effectiveness of a financial advisor. An advisor with years of experience has likely encountered a variety of financial situations and can provide valuable insights and guidance based on past successes and challenges. Additionally, experienced advisors have built a network of resources and contacts that can benefit their clients in various financial matters.

Customized Financial Planning

When it comes to financial planning, having a customized approach can make all the difference in achieving your financial goals. A financial advisor plays a crucial role in tailoring financial plans to meet individual needs, providing personalized guidance every step of the way.

Benefits of Personalized Financial Planning

- Creating a budget based on your income and expenses to help you save and invest wisely.

- Choosing the right investment options that align with your risk tolerance and financial objectives.

- Developing a comprehensive retirement plan that considers your lifestyle goals and future aspirations.

- Advising on tax-efficient strategies to maximize your savings and minimize tax liabilities.

Adapting Strategies to Changing Circumstances

Financial advisors are adept at adjusting financial strategies based on changing circumstances such as job changes, market fluctuations, or unexpected life events. They can help you navigate through uncertainties by revisiting and revising your financial plan to ensure it remains aligned with your goals and objectives.

Investment Guidance and Risk Management

When it comes to investing your hard-earned money, a financial advisor can provide valuable guidance to help you make informed decisions and maximize your returns while managing risks effectively.

Types of Investment Guidance

- Asset Allocation: Financial advisors can help you determine the right mix of stocks, bonds, and other investments based on your risk tolerance and financial goals.

- Portfolio Diversification: They can assist in spreading your investments across different asset classes to minimize risk and maximize returns.

- Investment Selection: Advisors can recommend specific investments that align with your objectives, whether it’s stocks, mutual funds, ETFs, or other options.

Risk Management Strategies

- Periodic Portfolio Rebalancing: Advisors can regularly review and adjust your portfolio to maintain the desired asset allocation and minimize risk.

- Stop-Loss Orders: They can help set up stop-loss orders to limit potential losses in case of market downturns.

- Diversification: By diversifying your investments, advisors can reduce the impact of volatility in any single asset on your overall portfolio.

Long-term Wealth Creation vs. Short-term Gains

Financial advisors play a crucial role in balancing the need for long-term wealth creation with the temptation of chasing short-term gains. They can help you develop a comprehensive investment strategy that aligns with your financial goals and risk tolerance, ensuring a sustainable approach to building wealth over time rather than focusing on quick wins that may come with higher risks.

Retirement Planning and Estate Management

When it comes to retirement planning and estate management, financial advisors play a crucial role in helping individuals secure their financial future and preserve wealth for generations to come.

Financial advisors assist in retirement planning by developing personalized strategies based on individuals’ financial goals, risk tolerance, and timeline for retirement. They help clients navigate complex financial decisions such as retirement account withdrawals, social security optimization, and investment allocation to ensure a comfortable retirement lifestyle.

In terms of estate management, financial advisors help individuals create comprehensive estate plans that Artikel how assets will be distributed upon their passing. They assist in minimizing estate taxes, establishing trusts, and designating beneficiaries to ensure a smooth transition of wealth to heirs.

Having a financial advisor in the estate management process is essential to avoid common pitfalls and ensure that assets are distributed according to the individual’s wishes. Advisors provide guidance on updating estate plans as life circumstances change and help mitigate potential conflicts among family members.

Furthermore, financial advisors play a key role in ensuring financial security for future generations by helping individuals establish trust funds, education funds, and other vehicles to pass on wealth to their children and grandchildren. They provide expertise in structuring inheritances to minimize tax implications and maximize the impact of the wealth transfer.

Overall, working with a financial advisor for retirement planning and estate management is crucial for individuals looking to secure their financial legacy and provide for their loved ones in the long term.