Yo, so you’re about to dive into the world of portfolio risk analysis, where we break down what it is and why it’s crucial for investors. Get ready for a ride filled with examples that showcase how this analysis can level up your investment game, straight up!

In the next paragraph, we’ll lay down some solid info about the topic that’ll have you nodding in agreement.

Introduction to Portfolio Risk Analysis

Portfolio risk analysis is the process of evaluating the potential risks associated with investing in a collection of assets, known as a portfolio. This analysis helps investors understand the level of risk they are exposed to and make informed decisions to manage and mitigate those risks.

Conducting portfolio risk analysis is crucial for investors to protect their investments and achieve their financial goals. By identifying and assessing various risks such as market risk, credit risk, liquidity risk, and concentration risk, investors can make adjustments to their portfolios to achieve a balance between risk and return.

Examples of how portfolio risk analysis can benefit investors include the ability to diversify their holdings to reduce overall risk, monitor the performance of their investments against benchmarks, and adjust their asset allocation based on changing market conditions. This analysis also helps investors understand the impact of different risk factors on their portfolios and make strategic decisions to optimize their returns.

Types of Risks in Portfolio Risk Analysis

Investors consider various types of risks when analyzing their portfolios to make informed decisions. These risks can have a significant impact on investment outcomes and the overall performance of a portfolio. It is crucial for investors to understand these risks and implement strategies to manage them effectively.

Market Risk

Market risk, also known as systematic risk, refers to the risk of investments losing value due to factors affecting the overall market. Examples include economic downturns, political events, and interest rate changes. Market risk can impact entire portfolios, leading to losses across different asset classes. Investors can manage market risk by diversifying their portfolios across various sectors and asset classes.

Credit Risk

Credit risk is the risk of investment losses due to the failure of an issuer to make timely payments of interest or principal. This risk is prevalent in fixed-income securities and bonds. For example, if a bond issuer defaults on payments, investors may incur losses. Investors can mitigate credit risk by conducting thorough credit analysis and investing in high-quality bonds with strong credit ratings.

Liquidity Risk

Liquidity risk refers to the risk of not being able to sell an investment quickly without significantly impacting its price. Illiquid investments, such as real estate or private equity, may pose liquidity risk as they cannot be easily converted to cash. Investors can manage liquidity risk by maintaining a balanced portfolio with a mix of liquid and illiquid assets.

Inflation Risk

Inflation risk is the risk that the purchasing power of investments will decrease over time due to inflation. Inflation erodes the real value of returns, especially for fixed-income investments. Investors can hedge against inflation risk by investing in assets that have historically outperformed inflation, such as real estate, commodities, and inflation-protected securities.

Currency Risk

Currency risk, or exchange rate risk, refers to the risk of losses due to fluctuations in foreign exchange rates. For international investments, changes in currency values can impact returns when converting back to the investor’s home currency. Investors can manage currency risk by using hedging strategies, such as currency forwards or options, to mitigate the impact of exchange rate fluctuations.

Tools and Methods for Portfolio Risk Analysis

When it comes to portfolio risk analysis, there are several common tools and methods that analysts use to assess and manage risks effectively. These tools help investors make informed decisions and protect their investments from potential losses.

Common Tools and Methods

- Historical Data Analysis: Examining past performance data to identify trends and patterns that can help predict future risks.

- Scenario Analysis: Creating hypothetical scenarios to evaluate how different events or market conditions could impact the portfolio.

- Sensitivity Analysis: Testing the sensitivity of the portfolio to changes in key variables like interest rates, inflation, or market volatility.

- Value-at-Risk (VaR): A statistical measure used to estimate the maximum potential loss of a portfolio over a specific time horizon at a given confidence level.

Quantitative vs. Qualitative Methods

Quantitative methods involve using mathematical models and statistical techniques to measure and analyze portfolio risk. These methods provide numerical data and calculations to assess risk levels accurately. On the other hand, qualitative methods rely on expert judgment, subjective assessments, and qualitative data to evaluate risks. While quantitative methods offer precision and objectivity, qualitative methods provide context and insights that quantitative analysis alone may not capture.

AI and Machine Learning in Portfolio Risk Analysis

Modern technologies like artificial intelligence (AI) and machine learning have revolutionized portfolio risk analysis by enhancing the speed, accuracy, and efficiency of risk assessment. These technologies can process vast amounts of data in real-time, identify complex patterns, and predict potential risks more effectively than traditional methods. By leveraging AI and machine learning algorithms, investors can make more informed decisions, optimize their portfolios, and mitigate risks proactively.

Diversification in Portfolio Risk Analysis

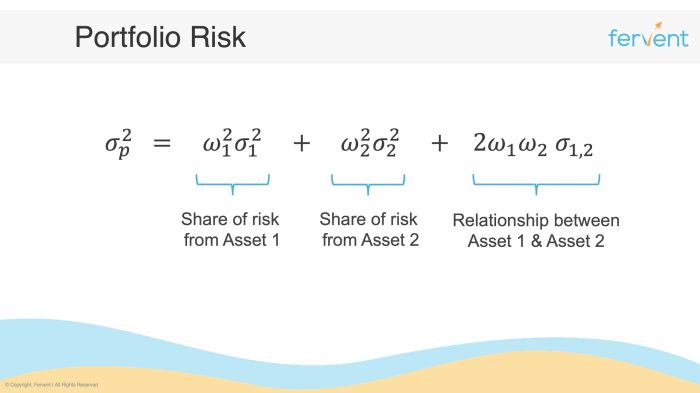

Diversification is a crucial strategy in managing portfolio risk by spreading investments across different asset classes, industries, and geographical regions. This approach aims to reduce the overall risk of the portfolio by minimizing the impact of negative events on any single investment.

Effective diversification can help investors achieve a more stable and balanced portfolio, as losses in one asset or sector can be offset by gains in others. By diversifying, investors can potentially lower the overall volatility of their portfolio and improve risk-adjusted returns over the long term.

Role of Diversification

- Diversification helps to lower the correlation between assets, reducing the risk of significant losses from a single event.

- It allows investors to capitalize on different market trends and economic conditions, enhancing the overall performance of the portfolio.

- By spreading investments across various sectors and asset classes, diversification can provide a cushion against market downturns or sector-specific risks.

Examples of Diversification

- Investing in a mix of stocks, bonds, real estate, and commodities can help reduce risk exposure to any single asset class.

- Allocating funds across different industries like technology, healthcare, and consumer goods can mitigate sector-specific risks.

- Geographic diversification, such as investing in both domestic and international markets, can protect against country-specific economic downturns.

Best Practices for Effective Diversification

- Set clear investment goals and risk tolerance before diversifying your portfolio to ensure alignment with your financial objectives.

- Regularly review and rebalance your portfolio to maintain the desired asset allocation and risk exposure levels.

- Avoid over-diversification, as it can dilute the potential returns of the portfolio without significantly reducing risk.