Yo, peeps! Ready to dive into the world of Understanding inflation rates? Get ready for a wild ride as we break down the ins and outs of this crucial economic concept. From measuring inflation to its impact on purchasing power, we’ve got all the deets you need to stay ahead of the game.

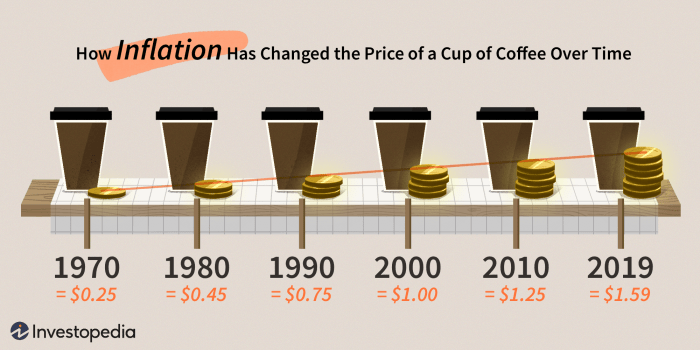

Inflation is like that sneaky trendsetter that affects everything from the price of your morning coffee to the cost of your favorite sneakers. So buckle up and let’s unravel the mysteries of inflation rates together.

What is Inflation?

Inflation is a term used in economics to describe the rate at which the general level of prices for goods and services is rising, resulting in a decrease in purchasing power.

Measuring Inflation

Inflation is measured using various indexes, with the Consumer Price Index (CPI) being one of the most common. The CPI tracks the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Goods and Services Affected by Inflation

- Food items like groceries

- Housing costs such as rent or mortgage payments

- Gasoline and energy prices

- Medical expenses

- Clothing and apparel

Impact on Purchasing Power

Inflation erodes the purchasing power of a currency, meaning that the same amount of money can buy fewer goods and services over time. This can lead to a decrease in the standard of living for individuals and impact savings and investments.

Types of Inflation

Inflation can manifest in various forms, each with its own distinct causes and characteristics. Understanding the different types of inflation is crucial in comprehending its impact on the economy.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds the available supply, leading to a rise in prices. This often happens during periods of economic growth when consumers have more disposable income to spend. As demand outstrips supply, businesses may increase prices to balance the market. A classic example of demand-pull inflation is the housing market boom, where increased demand for homes drives up prices.

Cost-Push Inflation

Cost-push inflation is driven by an increase in the production cost of goods and services. Factors such as rising wages, raw material costs, or taxes can push businesses to raise prices to maintain profit margins. One real-world example of cost-push inflation is the surge in oil prices, which can lead to higher transportation costs and impact the prices of various goods and services.

Built-In Inflation

Built-in inflation, also known as wage-price spiral, occurs when workers demand higher wages to keep up with rising prices, leading to a cycle of wage and price increases. This type of inflation is often the result of inflation expectations becoming ingrained in the economy. A common example of built-in inflation is when companies raise prices to cover increased labor costs, prompting workers to demand higher wages in response.

Factors Affecting Inflation Rates

Inflation rates are influenced by various factors that can either contribute to an increase or decrease in the overall price level of goods and services in an economy. Understanding these factors is crucial in predicting and managing inflation.

Role of Supply and Demand

Supply and demand play a significant role in influencing inflation rates. When the demand for goods and services exceeds the supply available in the market, prices tend to rise, leading to inflation. Conversely, when supply surpasses demand, prices may decrease, causing deflation. Therefore, maintaining a balance between supply and demand is essential in managing inflation.

Impact of Interest Rates

Changes in interest rates can also impact inflation rates. When central banks increase interest rates, borrowing becomes more expensive, which can reduce consumer spending and slow down economic growth. This, in turn, can help control inflation. On the other hand, lowering interest rates can stimulate borrowing and spending, potentially leading to inflationary pressures.

Government Policies on Inflation

Government policies can have a significant impact on inflation rates. For example, expansionary fiscal policies, such as increased government spending or tax cuts, can boost economic activity but may also lead to inflation if not properly managed. Similarly, monetary policies, like adjusting interest rates or money supply, can influence inflation levels.

External Factors

External factors, such as global events or natural disasters, can also affect inflation rates. For instance, geopolitical tensions, trade wars, or disruptions in the supply chain due to natural disasters can lead to fluctuations in prices of goods and services, impacting inflation. It is essential to consider these external factors when analyzing and predicting inflation trends.

Effects of Inflation

Inflation can have a significant impact on various aspects of the economy, including savings, investments, borrowing, lending, consumer behavior, and wage growth.

Impact on Savings and Investments

Inflation erodes the purchasing power of money over time, meaning that the value of savings and investments decreases. For example, if the inflation rate is higher than the interest rate earned on savings, the real value of those savings will decrease.

Effects on Borrowing and Lending Practices

Inflation can impact borrowing and lending practices by affecting interest rates. When inflation is high, lenders may increase interest rates to compensate for the decrease in the value of money over time. Borrowers, on the other hand, may find it more expensive to borrow money due to higher interest rates.

Influence on Consumer Behavior

Inflation can influence consumer behavior by affecting purchasing power. During times of high inflation, consumers may be more inclined to spend money quickly before its value diminishes further. This behavior can lead to increased demand for goods and services, further driving up prices.

Relationship with Wage Growth

Inflation can impact wage growth as well. When inflation is high, employers may increase wages to keep up with the rising cost of living. However, if wage growth does not keep pace with inflation, workers’ purchasing power may decrease.