Get ready to dive deep into the world of Budgeting techniques, where managing finances is a whole new ball game. From zero-based budgeting to the 50/30/20 rule, we’ve got you covered with all the insider tips and tricks you need to know.

We’ll break down the importance of budgeting techniques, explore different methods for effectively managing your money, and show you how to make smart financial decisions that will set you up for success.

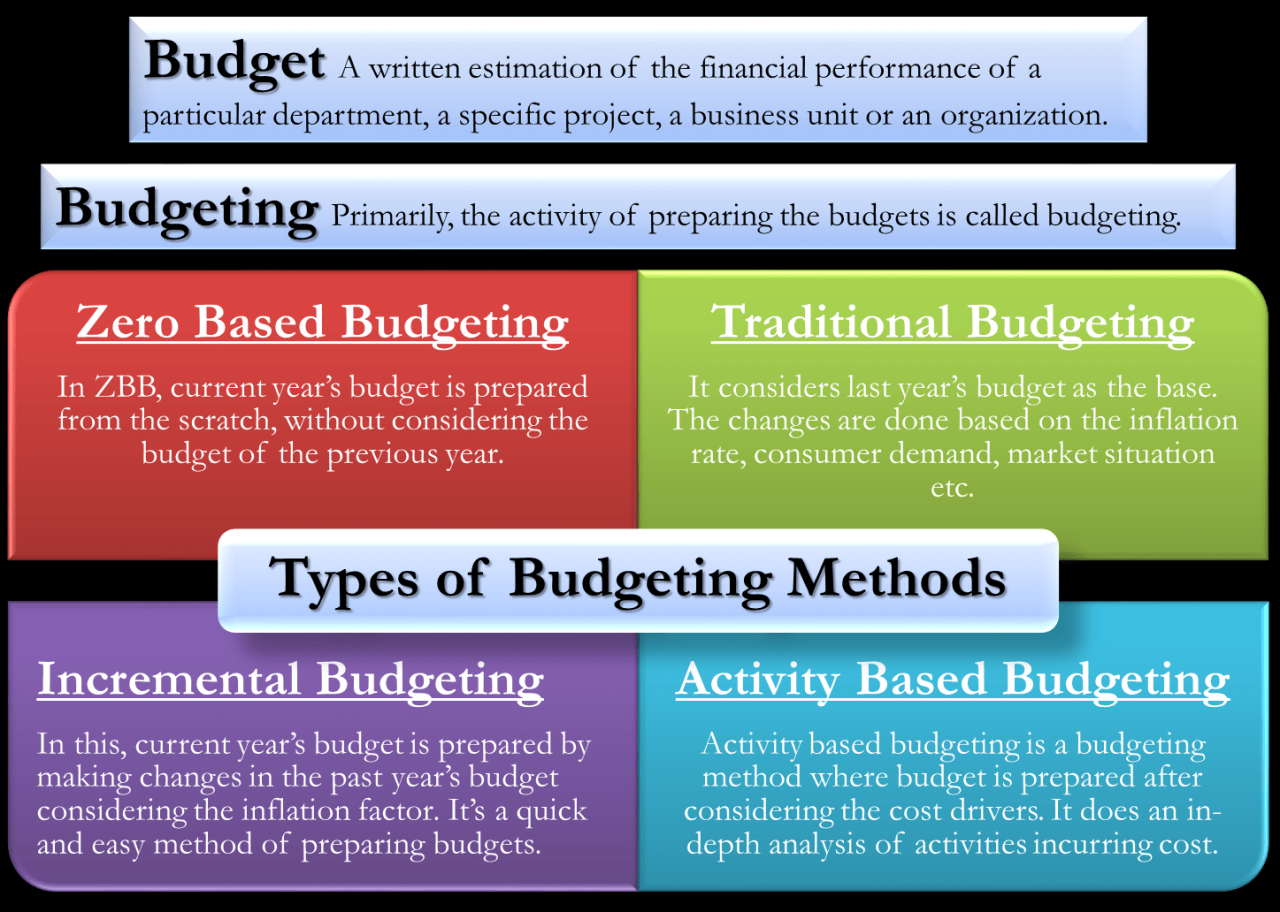

Budgeting Techniques Overview

Budgeting techniques play a crucial role in personal finance as they help individuals track their expenses, prioritize their spending, and work towards achieving financial goals. By utilizing different budgeting methods, individuals can gain better control over their finances, reduce debt, and save for the future.

Zero-Based Budgeting

Zero-based budgeting is a method where every dollar of income is allocated towards expenses, savings, or investments, ensuring that the total income minus the total expenses equals zero. This technique forces individuals to assign a purpose to every dollar they earn, promoting conscious spending and saving habits.

Envelope System

The envelope system involves dividing cash into different envelopes designated for specific categories such as groceries, entertainment, or bills. By using cash for each category, individuals are less likely to overspend and can visually see how much money is left for each expense, promoting better budget management.

50/30/20 Rule

The 50/30/20 rule suggests allocating 50% of income towards needs, 30% towards wants, and 20% towards savings or debt repayment. This method provides a simple guideline for budgeting, ensuring a balance between essential expenses, discretionary spending, and saving for the future.

Zero-Based Budgeting

Zero-Based Budgeting is a budgeting technique where all expenses must be justified for each new budget period, regardless of whether they were included in the previous budget. This differs from traditional budgeting methods where previous budget amounts are adjusted incrementally.

Prioritizing Expenses

Zero-Based Budgeting can help individuals prioritize expenses by forcing them to evaluate each expense and determine if it is necessary or if there are more cost-effective alternatives. For example, instead of automatically renewing a gym membership, individuals using zero-based budgeting would assess if they are actually utilizing the membership and if the cost justifies the usage.

Creating a Zero-Based Budget

To create a zero-based budget, individuals need to start from scratch and allocate their income to expenses, savings, and investments until the total equals zero. This process encourages individuals to be intentional with their spending and ensures that every dollar has a purpose. As a result, individuals are more likely to make informed financial decisions and prioritize expenses based on their values and goals.

Envelope System

The envelope system is a budgeting technique where you allocate a specific amount of cash to different categories of expenses and keep that money in separate envelopes. Each envelope represents a different spending category, such as groceries, entertainment, or transportation. Once the money in an envelope is gone, you cannot spend any more in that category until the next budgeting period.

Advantages of Using the Envelope System

- Helps in tracking and controlling spending: By physically separating your money into different envelopes, you can easily see how much you have left to spend in each category. This visual representation can prevent overspending.

- Encourages prioritization: The envelope system forces you to prioritize your expenses based on what is most important. You have to decide how much money to allocate to each category, which can help you make more conscious spending decisions.

- Avoids debt: Since you are limited to spending only the cash in each envelope, you are less likely to rely on credit cards or loans to cover expenses. This can help you avoid accumulating debt.

Setting Up and Maintaining an Envelope System

- Identify your spending categories: Determine the different areas where you typically spend money, such as groceries, utilities, entertainment, etc.

- Assign a budget to each category: Decide how much money you want to allocate to each spending category for the budgeting period.

- Label and fill the envelopes: Label each envelope with the corresponding spending category and put the allocated cash inside. Make sure to only spend from the designated envelope for each category.

- Track your spending: Keep a record of how much you spend from each envelope. This can be done manually or using a budgeting app to monitor your expenses.

- Review and adjust: At the end of the budgeting period, review your spending and adjust your allocations if needed. Make changes based on your actual expenses to refine your budget for the next period.

50/30/20 Rule

The 50/30/20 rule is a popular budgeting technique that suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This rule provides a simple guideline for individuals to allocate their money effectively and achieve a balanced financial plan.

Recommended Allocation Percentages

- 50% for needs: This category includes essential expenses such as rent, utilities, groceries, and transportation.

- 30% for wants: These are discretionary expenses like dining out, entertainment, shopping, and vacations.

- 20% for savings and debt repayment: This portion should go towards building an emergency fund, retirement savings, paying off debt, or investing.

Balancing Spending and Savings Goals

The 50/30/20 rule helps individuals prioritize their financial goals by ensuring that a significant portion of their income is allocated towards savings and debt repayment. By distinguishing between needs and wants, this budgeting technique encourages responsible spending habits while also setting aside funds for future financial security.

Real-Life Examples

- John earns $3,000 per month after taxes. Following the 50/30/20 rule, he allocates $1,500 (50%) for needs, $900 (30%) for wants, and $600 (20%) for savings and debt repayment.

- Sarah decides to use the 50/30/20 rule to manage her finances. With a monthly income of $4,500, she budgets $2,250 (50%) for needs, $1,350 (30%) for wants, and $900 (20%) for savings and debt repayment.