When it comes to securing your financial future, understanding the difference between secured and unsecured loans is key. Get ready to dive into the world of loans with a twist of American high school hip style, where we break down the nitty-gritty details and help you make informed decisions.

Let’s explore secured loans, unsecured loans, collateral, and the approval process to navigate the complex world of borrowing money.

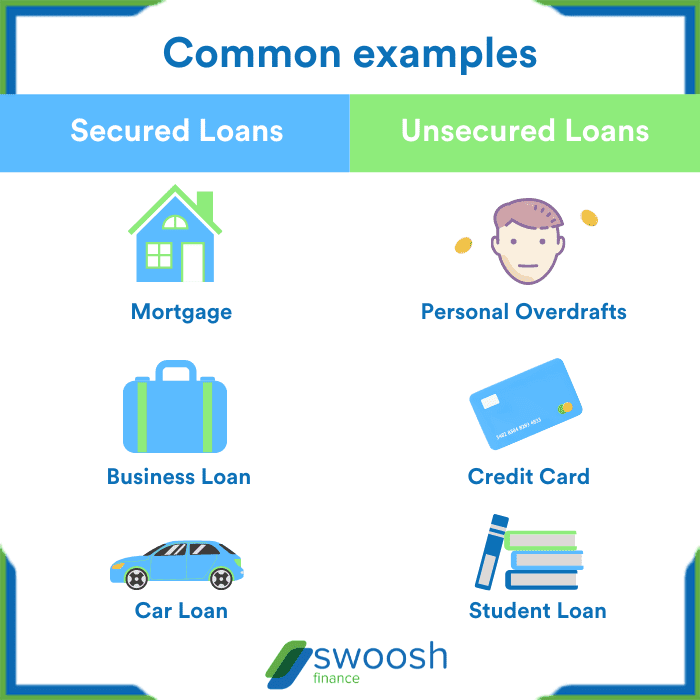

Secured Loans

Secured loans are loans that are backed by collateral, which is an asset that the borrower offers to the lender as a guarantee for the loan. If the borrower fails to repay the loan, the lender can seize the collateral to recoup their losses.

Assets as Collateral

- Real estate: such as a house or land

- Automobiles: cars, trucks, or motorcycles

- Investments: stocks, bonds, or mutual funds

Advantages and Disadvantages

- Advantages:

- Lower interest rates compared to unsecured loans

- Potential to borrow larger amounts of money

- Easier approval process due to reduced risk for the lender

- Disadvantages:

- Risk of losing the collateral if unable to repay the loan

- Longer application process due to collateral evaluation

- Limited flexibility in terms and conditions

Interest Rates Comparison

When comparing interest rates, secured loans typically have lower rates than unsecured loans. This is because the collateral reduces the risk for the lender, allowing them to offer more favorable terms to the borrower.

Unsecured Loans

When it comes to unsecured loans, borrowers don’t need to provide collateral to secure the loan. These loans are based on the borrower’s creditworthiness and promise to repay the debt.

Characteristics of Unsecured Loans

- Higher interest rates compared to secured loans.

- Shorter repayment terms.

- Lower borrowing limits.

- Approval based on credit history and income.

Eligibility Criteria for Unsecured Loans

- Good credit score: Most lenders require a credit score of 650 or higher.

- Stable income: Lenders want to ensure borrowers have the means to repay the loan.

- Low debt-to-income ratio: A lower ratio increases chances of approval.

Risks of Unsecured Loans

- Borrowers face the risk of higher interest rates due to the lack of collateral.

- Defaulting on unsecured loans can severely damage credit scores.

- Lenders face the risk of losing money if borrowers default on the loan.

Types of Unsecured Loans

- Credit cards: Revolving line of credit with no collateral required.

- Personal loans: Fixed amount borrowed with no collateral.

- Student loans: Unsecured loans for educational expenses.

Collateral

When it comes to loans, collateral plays a crucial role in determining the terms and conditions of the borrowing. Collateral refers to assets that a borrower pledges to a lender to secure a loan. In the event that the borrower is unable to repay the loan, the lender can seize the collateral to recoup their losses.

Examples of Valuable Assets

- Real estate properties (e.g., homes, land)

- Automobiles

- Investment accounts (e.g., stocks, bonds)

- Jewelry

- Artwork

Implications of Using Collateral

Using collateral can often result in lower interest rates for borrowers, as it reduces the risk for lenders. However, it also means that if the borrower defaults on the loan, they could lose the asset used as collateral.

Comparison of Collateral Requirements

| Secured Loans | Unsecured Loans |

|---|---|

| Require collateral to secure the loan | Do not require collateral |

| Typically have lower interest rates | Generally have higher interest rates |

| Can be easier to qualify for with collateral | May require a higher credit score for approval |

Approval Process

When it comes to securing a loan, the approval process is a crucial step that determines whether you will be able to access the funds you need. Understanding how the approval process works for secured loans, the documentation required, and how it differs from unsecured loans is essential for anyone looking to borrow money.

Approval Process for Secured Loans

- For secured loans, the approval process typically involves providing collateral to secure the loan. This collateral can be in the form of real estate, vehicles, or other valuable assets.

- Lenders will assess the value of the collateral provided to determine the amount of the loan that can be approved.

- Since the loan is backed by collateral, the approval process for secured loans is generally less stringent compared to unsecured loans.

Documentation Needed for a Secured Loan

- When applying for a secured loan, you will need to provide documentation such as proof of ownership of the collateral, income verification, credit history, and other financial information.

- Additionally, lenders may require a formal appraisal of the collateral to determine its value accurately.

Comparison with Unsecured Loans

- Unlike secured loans, unsecured loans do not require collateral, making them riskier for lenders.

- As a result, the approval process for unsecured loans is typically more stringent, with lenders focusing more on the borrower’s creditworthiness and financial stability.

- Due to the increased risk for lenders, unsecured loans often come with higher interest rates compared to secured loans.

Credit Scores Impact on Approval

- Credit scores play a significant role in the approval process for both secured and unsecured loans.

- A higher credit score can increase your chances of approval and help you secure better loan terms, such as lower interest rates and higher loan amounts.

- On the other hand, a lower credit score may result in higher interest rates or even rejection of your loan application, especially for unsecured loans.