Diving into the world of student loan interest rate calculation, get ready to unravel the complexities and secrets behind how these rates are determined. From fixed vs. variable rates to the impact on loan repayment, this topic is about to school you on everything you need to know.

As we journey through the different types of interest rates, formulas, and strategies involved, you’ll be equipped with the knowledge to navigate the student loan landscape like a boss.

Understanding Student Loan Interest Rates

When it comes to student loans, understanding how interest rates work is crucial. Interest rates on student loans determine how much extra you’ll pay on top of the amount you borrowed. Let’s break it down.

Types of Student Loan Interest Rates

- Fixed Interest Rates: These rates stay the same throughout the life of the loan, providing stability and predictability in monthly payments.

- Variable Interest Rates: These rates can change periodically based on market conditions, which can lead to fluctuating monthly payments.

Factors Influencing Student Loan Interest Rates

- Economic Conditions: The overall state of the economy can impact interest rates. During times of economic downturn, interest rates may be lower.

- Credit Score: A higher credit score can often lead to lower interest rates, as it indicates lower risk for lenders.

- Type of Loan: Federal student loans generally have lower interest rates compared to private student loans.

- Repayment Term: Shorter loan terms usually come with lower interest rates, but higher monthly payments.

Fixed vs. Variable Interest Rates

When it comes to student loans, borrowers often have to choose between fixed and variable interest rates. Understanding the difference between the two can help you make an informed decision that aligns with your financial goals.

Fixed Interest Rates:

– With a fixed interest rate, the rate remains the same throughout the life of the loan.

– This means your monthly payments will also remain constant, providing predictability and stability.

– Fixed rates are beneficial when interest rates are expected to rise, as you are protected from increased costs.

Variable Interest Rates:

– Variable interest rates, on the other hand, can fluctuate based on market conditions.

– While initial rates may be lower, they can increase over time, leading to higher monthly payments.

– Variable rates can be advantageous when interest rates are expected to decrease, potentially saving you money in the long run.

Scenarios:

– Fixed interest rates are more suitable for borrowers who prioritize stability and want to know exactly how much they will pay each month.

– Variable interest rates may be a better option for borrowers who are willing to take on some risk in exchange for potential savings, especially if they plan to pay off the loan quickly or if interest rates are expected to remain low.

When to Choose Fixed Interest Rates

If you prefer predictability and want to avoid the risk of rising interest rates, choosing a fixed interest rate is a wise decision. This option provides peace of mind knowing that your monthly payments will not change, regardless of market fluctuations.

When to Choose Variable Interest Rates

Opting for a variable interest rate can be advantageous if you believe that interest rates will decrease or remain low in the near future. This can result in lower initial payments and potential savings over time. However, it’s important to consider the potential for rate increases and how they could impact your budget.

Formula for Calculating Student Loan Interest

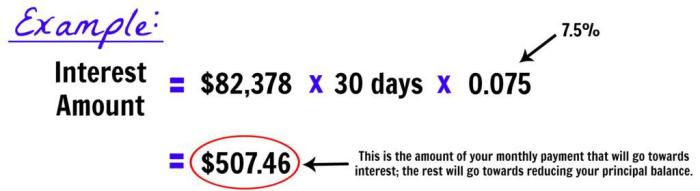

When it comes to understanding student loan interest rates, it is crucial to know how the interest is calculated. The formula used to calculate interest on student loans is essential for borrowers to comprehend, as it directly affects the total amount that needs to be repaid.

Components of the Formula

- The Principal Amount: This is the initial amount borrowed by the student.

- Interest Rate: The percentage charged by the lender for borrowing the money.

- Time Period: The length of time the borrower has to repay the loan.

Step-by-Step Guide to Calculate Student Loan Interest

- Start by determining the principal amount borrowed.

- Identify the annual interest rate provided by the lender.

- Convert the annual interest rate into a monthly rate by dividing it by 12.

- Determine the number of months the loan will be repaid over.

- Use the following formula to calculate the monthly interest amount:

Monthly Interest = (Principal Amount x Monthly Interest Rate) x Number of Months

- Finally, add the monthly interest amount to the principal to find the total amount to be repaid.

Impact of Interest Rates on Student Loan Repayment

When it comes to student loan repayment, the interest rate plays a crucial role in determining the total amount you’ll end up paying back. Understanding how interest rates affect your loans can help you make informed decisions to minimize the impact and manage your finances effectively.

Effect of Interest Rates on Total Amount Repaid

Interest rates directly impact the total amount you repay on your student loans. A higher interest rate means you’ll end up paying more over the life of the loan, increasing the overall cost of your education. On the other hand, lower interest rates can help reduce the total amount repaid, saving you money in the long run.

- High-interest rates lead to larger monthly payments and a longer repayment period, resulting in higher total repayment amounts.

- Low-interest rates can help you pay off your loans faster and with less interest, reducing the total cost of your education.

It’s essential to consider the impact of interest rates on your student loans and explore strategies to minimize the total amount repaid.

Strategies to Minimize Impact of High-Interest Rates

To mitigate the impact of high-interest rates on your student loan repayment, consider the following strategies:

- Make extra payments towards the principal amount to reduce the overall interest paid.

- Refinance your student loans to secure a lower interest rate and save on interest costs.

- Explore income-driven repayment plans that adjust your monthly payments based on your income to make repayment more manageable.

Long-Term Financial Implications of Different Interest Rate Scenarios

Analyzing the long-term financial implications of different interest rate scenarios is crucial for understanding the overall impact on your finances. Consider the following factors:

| Interest Rate Scenario | Financial Implications |

|---|---|

| High-Interest Rates | Higher total repayment amount, increased financial burden, longer repayment period. |

| Low-Interest Rates | Lower total repayment amount, reduced financial strain, quicker loan repayment. |

By assessing different interest rate scenarios and implementing effective repayment strategies, you can navigate the impact of interest rates on your student loan repayment and achieve financial stability.