Diving into the world of asset allocation strategies sets the stage for a thrilling journey towards financial empowerment. Picture a landscape where risks are managed, returns are maximized, and portfolios are diversified to perfection. This is where the magic of asset allocation strategies comes to life.

As we delve deeper, we’ll explore different types of strategies, factors influencing decisions, best practices for implementation, and more. Get ready to revolutionize your investment game!

Importance of Asset Allocation Strategies

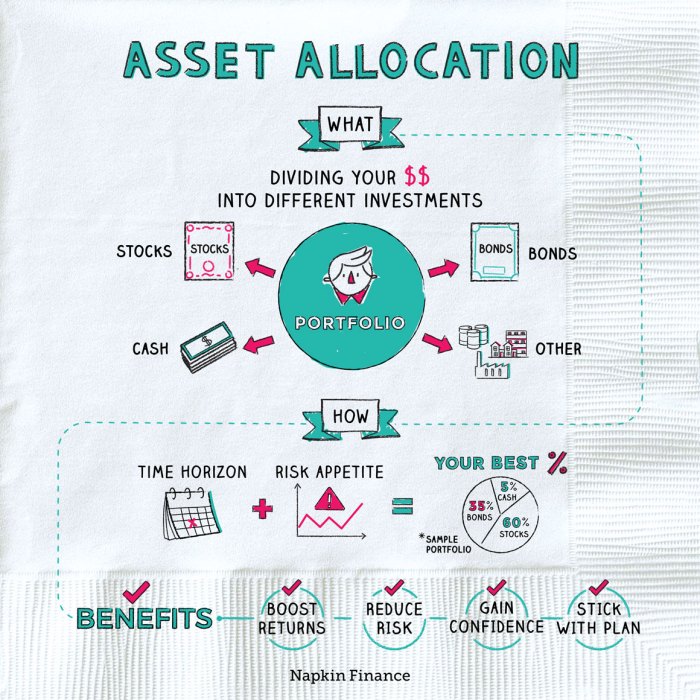

Asset allocation strategies play a crucial role in determining the success of an investment portfolio. By allocating assets across different classes, investors can effectively manage risk and maximize returns.

Risk Management

- Asset allocation helps in spreading out investments across various asset classes such as stocks, bonds, and real estate, reducing the overall risk in the portfolio.

- Diversification through asset allocation can protect investors from significant losses in case one asset class underperforms.

Maximizing Returns

- By strategically allocating assets, investors can capitalize on the growth potential of different asset classes, aiming to achieve higher returns over the long term.

- Asset allocation allows investors to take advantage of market opportunities while minimizing the impact of market downturns on the overall portfolio performance.

Portfolio Diversification

- Asset allocation plays a key role in portfolio diversification by ensuring that investments are not concentrated in one particular asset class, industry, or region.

- Diversifying through asset allocation can help in achieving a balanced portfolio that is resilient to market fluctuations and economic uncertainties.

Types of Asset Allocation Strategies

Asset allocation strategies can be classified into different types such as strategic, tactical, and dynamic. Each type has unique characteristics and objectives that cater to specific investment goals and market conditions.

Strategic Asset Allocation

Strategic asset allocation involves setting a long-term target mix of assets based on an investor’s risk tolerance, time horizon, and financial goals. The main objective is to create a diversified portfolio that remains relatively stable over time. An example of strategic asset allocation is a retirement fund that is allocated between stocks, bonds, and cash according to a predetermined ratio.

Tactical Asset Allocation

Tactical asset allocation involves adjusting the portfolio’s asset allocation based on short-term market conditions or economic forecasts. The main objective is to capitalize on short-term opportunities or mitigate potential risks. An example of tactical asset allocation is increasing exposure to a specific sector that is expected to outperform in the near term.

Dynamic Asset Allocation

Dynamic asset allocation combines elements of both strategic and tactical approaches by allowing for flexibility in adjusting the portfolio based on changing market conditions. The main objective is to actively manage the portfolio to maximize returns while controlling risks. An example of dynamic asset allocation is reducing exposure to equities during a market downturn and increasing exposure to fixed income securities.

Factors Influencing Asset Allocation

When it comes to making decisions about asset allocation, there are several key factors that can influence the process. These factors play a crucial role in determining the optimal mix of assets in an investment portfolio to achieve specific financial goals.

Risk Tolerance

Risk tolerance is one of the most important factors that influence asset allocation decisions. It refers to an investor’s willingness and ability to take on risk in exchange for potentially higher returns. Investors with a higher risk tolerance may allocate a larger portion of their portfolio to riskier assets like stocks, while those with a lower risk tolerance may prefer safer options like bonds or cash.

Investment Goals

Another crucial factor in asset allocation is investment goals. Different investors have different financial objectives, such as saving for retirement, funding a child’s education, or buying a house. The specific goals and timeline for achieving them will impact how assets are allocated to ensure the portfolio aligns with these objectives.

Time Horizon

The time horizon, or the length of time an investor plans to hold an investment, is also a significant factor in asset allocation. Investors with a longer time horizon may be able to take on more risk in their portfolio, as they have more time to ride out market fluctuations and benefit from long-term growth potential. On the other hand, investors with a shorter time horizon may need to focus on preserving capital and minimizing risk.

Market Conditions

Market conditions play a crucial role in asset allocation decisions as well. Economic factors, geopolitical events, and market trends can all impact the performance of different asset classes. Investors need to regularly assess market conditions and adjust their asset allocation accordingly to capitalize on opportunities and mitigate risks.

Best Practices for Implementing Asset Allocation Strategies

When it comes to implementing asset allocation strategies, there are some best practices to keep in mind. These practices can help individuals design a personalized plan that aligns with their financial goals, risk tolerance, and investment horizon.

Designing a Personalized Asset Allocation Plan

To design a personalized asset allocation plan, individuals should follow these steps:

- Evaluate Financial Goals: Determine short-term and long-term financial objectives, such as retirement planning, education savings, or buying a house.

- Assess Risk Tolerance: Understand how much risk you are willing to take on and how it aligns with your comfort level.

- Consider Investment Horizon: Take into account the time frame for achieving your financial goals and adjust your asset allocation accordingly.

- Diversify Asset Classes: Spread investments across various asset classes to reduce risk and optimize returns.

Selecting the Right Mix of Asset Classes

When selecting the right mix of asset classes, consider the following tips:

- Understand Asset Class Characteristics: Learn about the characteristics of different asset classes, such as stocks, bonds, real estate, and commodities.

- Match Risk Tolerance: Choose asset classes that align with your risk tolerance level to achieve a balance between risk and return.

- Align with Investment Horizon: Select asset classes that match your investment time frame to meet your financial goals effectively.

Role of Rebalancing in Maintaining Asset Allocation

Rebalancing plays a crucial role in maintaining the desired asset allocation over time. Here’s why:

- Realign Portfolio: Rebalancing helps realign your portfolio to the target asset allocation set initially, ensuring it remains in line with your goals.

- Manage Risk: By rebalancing, you can manage risk exposure and prevent your portfolio from becoming too heavily weighted in one asset class.

- Capture Opportunities: Rebalancing allows you to capture opportunities in the market by buying low and selling high, maintaining a disciplined approach to investing.