Get ready to dive into the world of investment diversification where risks are tamed, and opportunities are endless. Brace yourself for a rollercoaster ride of financial wisdom and strategic insights that will change the way you view your investment portfolio.

Let’s explore the various aspects of investment diversification, from its importance to different strategies for implementation, in order to equip you with the knowledge needed to make informed financial decisions.

Importance of Investment Diversification

Diversification is like having different flavors in your ice cream sundae – it makes your investment portfolio more robust and less risky. Let’s dive into why diversification is so crucial.

Mitigating Risk with Diversification

Diversification helps spread your investment across various assets, industries, and regions, reducing the impact of a single asset’s poor performance on your overall portfolio. For example, if you only invest in one tech company and it tanks, your whole investment is at risk. But if you spread your investments across tech, healthcare, and energy sectors, a loss in one won’t sink your entire ship.

Impact on Long-term Performance

Over the long haul, diversification can help smooth out the bumps in the road. While it might not give you the highest returns in a booming market, it also protects you from catastrophic losses during downturns. By balancing risk and reward, diversification can help your portfolio weather the storms and grow steadily over time.

Types of Investment Diversification

When it comes to diversifying your investment portfolio, there are various types of diversification strategies you can employ to minimize risk and maximize returns.

Asset Classes for Diversification

Diversifying across different asset classes is essential to reduce the risk of your investments. Some common asset classes suitable for diversification include:

- Stocks: Investing in shares of different companies across various industries.

- Bonds: Allocating funds to government or corporate bonds with different maturity dates.

- Real Estate: Including real estate properties or Real Estate Investment Trusts (REITs) in your portfolio.

- Commodities: Investing in physical goods like gold, silver, oil, or agricultural products.

Geographical Diversification

Geographical diversification involves spreading your investments across different countries or regions to reduce the impact of economic or political events in a single location. Benefits of geographical diversification include:

- Reducing exposure to country-specific risks.

- Gaining access to a wider range of investment opportunities.

- Protecting against currency fluctuations.

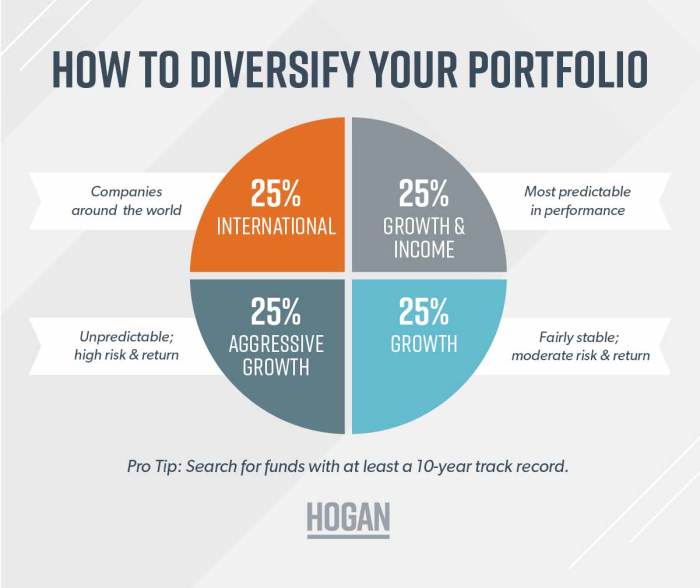

Diversifying Between Low-Risk and High-Risk Investments

Balancing low-risk and high-risk investments in your portfolio is crucial to achieve a healthy risk-return tradeoff. Benefits of diversifying between low-risk and high-risk investments include:

- Low-risk investments provide stability and steady returns, acting as a hedge against market volatility.

- High-risk investments offer the potential for higher returns, although they come with increased volatility and risk.

- Diversifying between the two allows you to achieve a mix of stability and growth potential in your portfolio.

Strategies for Implementing Diversification

Diversification is a key strategy for reducing risk and increasing the potential for returns in your investment portfolio. Let’s explore some effective strategies for implementing diversification.

The Role of Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) play a crucial role in diversifying investments. These investment vehicles pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. By investing in mutual funds or ETFs, you can instantly achieve diversification without having to select individual securities yourself.

Creating a Diversified Investment Portfolio

To create a diversified investment portfolio, you should consider spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities. Additionally, diversify within each asset class by investing in various industries or sectors. This helps reduce the impact of volatility in any one area of the market.

Comparing Dollar-Cost Averaging and Rebalancing

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of market fluctuations and can potentially lower the average cost of your investments over time. On the other hand, rebalancing involves periodically adjusting your portfolio back to its target asset allocation. While rebalancing can help maintain your desired risk level, it may involve transaction costs and tax implications.

Risks and Challenges of Investment Diversification

Diversifying your investment portfolio can help manage risks, but it also comes with its own set of challenges and pitfalls. Let’s explore some of the risks and challenges associated with investment diversification.

Common Pitfalls Investors May Face

- Overlooking Correlation: Investors may mistakenly assume they are diversified when in fact their investments are highly correlated, leading to increased risk during market downturns.

- Ignoring Asset Allocation: Failing to allocate assets properly across different classes can result in imbalanced portfolios and potential losses.

- Chasing Returns: Investors may fall into the trap of chasing high returns without considering the underlying risks, leading to poor decision-making.

Challenges of Over-Diversification

- Diluted Returns: Over-diversification can dilute the potential returns of a portfolio, as gains from strong investments may be offset by losses in weaker ones.

- Increased Complexity: Managing a large number of investments can be overwhelming and time-consuming, making it difficult to monitor and adjust the portfolio effectively.

- Higher Costs: Maintaining a highly diversified portfolio can result in higher transaction costs and fees, which can eat into overall returns.

Strategies to Overcome Complexity

- Focus on Core Holdings: Identify key investments that align with your long-term goals and allocate a larger portion of your portfolio to these core holdings.

- Regular Portfolio Review: Conduct periodic reviews to assess the performance of each investment and make necessary adjustments to rebalance the portfolio.

- Seek Professional Advice: Consider consulting a financial advisor to help streamline your investment strategy and ensure proper diversification without overcomplicating your portfolio.