Looking to secure some cash with a personal loan? Dive into the world of personal finance as we uncover the ins and outs of getting that much-needed loan. From researching options to understanding interest rates, we’ve got you covered every step of the way.

Ready to take your financial game to the next level? Let’s roll up our sleeves and break down the essentials of acquiring a personal loan.

Researching Personal Loans

When looking for a personal loan, it’s important to do your homework and research the different options available to you. This will help you find the best deal that suits your financial needs.

Types of Personal Loans

- Secured Loans: These require collateral, such as a car or home, which can lower interest rates.

- Unsecured Loans: These do not require collateral but may have higher interest rates.

- Fixed-Rate Loans: Interest rates remain the same throughout the loan term.

- Variable-Rate Loans: Interest rates can fluctuate based on market conditions.

Comparing Interest Rates and Terms

- Check the APR (Annual Percentage Rate) to compare the total cost of borrowing.

- Consider the loan term and monthly payments to ensure they fit your budget.

- Look for any additional fees or charges that may apply.

Understanding Terms and Conditions

Before applying for a personal loan, make sure you understand the terms and conditions set by the lender. This includes the repayment schedule, penalties for late payments, and any other important details that could impact your borrowing experience.

Eligibility Criteria

To qualify for a personal loan, you need to meet certain criteria set by lenders. These criteria typically include factors such as credit score, income, and debt-to-income ratio.

Credit Score and Income

- Your credit score plays a crucial role in determining your eligibility for a personal loan. Lenders use this score to assess your creditworthiness and the likelihood of you repaying the loan on time.

- A higher credit score indicates to lenders that you are a responsible borrower, making you more likely to be approved for a loan. On the other hand, a low credit score may result in rejection or higher interest rates.

- Your income is another important factor that lenders consider when evaluating your eligibility. A steady income demonstrates your ability to repay the loan, making you a less risky borrower.

- Lenders often have minimum income requirements to ensure that you can afford the monthly loan payments. They may also calculate your debt-to-income ratio to determine if you have enough disposable income to repay the loan.

Tips for Improving Credit Score

- Pay your bills on time: Late payments can negatively impact your credit score, so make sure to pay all your bills by the due date.

- Reduce credit card balances: High credit card balances relative to your credit limit can hurt your credit score. Try to pay down your balances to improve your score.

- Avoid opening new credit accounts: Opening multiple new credit accounts in a short period can lower your average account age and negatively affect your credit score.

- Check your credit report regularly: Monitor your credit report for errors or fraudulent activity that could be dragging down your score. Dispute any inaccuracies to have them corrected.

Choosing the Right Loan Amount

When deciding on the loan amount you need, it’s essential to consider various factors to ensure you borrow responsibly. Calculating the right loan amount based on your income and expenses can help you avoid financial strain in the future. Here are some tips to help you choose the right loan amount:

Factors to Consider

- Assess your current financial situation, including your income, expenses, and any existing debts.

- Determine the purpose of the loan and how much you realistically need to achieve that goal.

- Evaluate your ability to repay the loan within a reasonable timeframe, considering your monthly budget.

Calculating the Right Loan Amount

One common approach is the debt-to-income ratio, where you aim to keep your total monthly debt payments below 36% of your gross monthly income.

- Calculate your total monthly income, including wages, bonuses, and any other sources of income.

- List all your monthly expenses, such as rent, utilities, groceries, and other necessities.

- Subtract your total monthly expenses from your monthly income to determine how much you can afford to allocate towards loan repayments.

Avoiding Borrowing More Than Necessary

- Resist the temptation to borrow more than you need, as it can lead to unnecessary debt and financial stress.

- Create a detailed budget outlining your expenses and income to identify the exact amount you require.

- Consider alternative sources of funding, such as savings or cutting back on expenses, before turning to a loan.

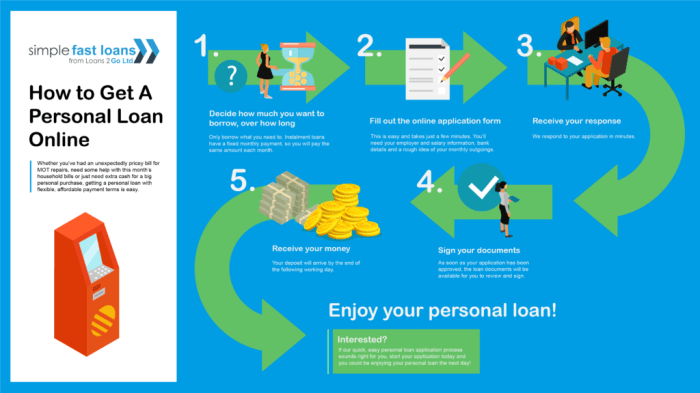

Application Process

When it comes to applying for a personal loan, there are several steps you need to follow to ensure a smooth process. From gathering the necessary documents to submitting your application, here’s what you need to know.

Documentation Required

- Gather your proof of identity, such as a driver’s license or passport.

- Provide proof of income, including pay stubs or tax returns.

- Prepare a list of your assets, such as property or investments.

- Have your employment details ready, including your employer’s contact information.

- Include information about any existing debts or loans you may have.

Speeding Up Approval

- Ensure all your documents are organized and up to date before starting the application.

- Fill out the application accurately and completely to avoid delays in processing.

- Consider applying online for faster processing and approval times.

- Provide any additional information or documentation promptly if requested by the lender.

- Check your credit score beforehand and work on improving it if needed to increase your chances of approval.

Understanding Interest Rates

Interest rates play a crucial role in determining the cost of borrowing money. They represent the percentage of the principal loan amount that lenders charge borrowers for the privilege of using their funds.

Fixed vs. Variable Interest Rates

- Fixed Interest Rates: These rates remain constant throughout the term of the loan, providing predictability in monthly payments. Borrowers can budget effectively knowing that their interest rate won’t change.

- Variable Interest Rates: These rates can fluctuate based on market conditions, meaning monthly payments may vary. While initial rates may be lower, there is a risk of rates increasing over time.

Negotiating Lower Interest Rates

- Improve Credit Score: Lenders often offer lower rates to borrowers with higher credit scores. By maintaining a good credit history, you can negotiate for better terms.

- Compare Offers: Shop around and compare interest rates from different lenders. Use competing offers as leverage to negotiate a lower rate.

- Consider Collateral: Offering collateral, such as a car or property, can sometimes help secure a lower interest rate on a personal loan.

- Build a Relationship: Existing customers may have the opportunity to negotiate lower rates with their current lenders. Loyalty can sometimes pay off in the form of reduced interest costs.

Repayment Strategies

When it comes to repaying a personal loan, there are various strategies you can consider to ensure you stay on track and avoid defaulting on your payments. Having a solid repayment plan in place is essential to managing your finances responsibly and maintaining a good credit score.

Different Repayment Options

- Standard Repayment Plan: This is the most common option where you make fixed monthly payments over the loan term until the balance is paid off.

- Graduated Repayment Plan: Payments start low and increase over time. This is ideal for those expecting salary increases in the future.

- Income-Driven Repayment Plan: Payments are based on your income, making it more manageable during financial difficulties.

Creating a Repayment Plan

- Calculate your monthly budget to determine how much you can comfortably afford to pay towards the loan.

- Set up automatic payments to avoid missing due dates and incurring late fees.

- Consider making extra payments whenever possible to reduce the total interest paid over the loan term.

Consequences of Missing Loan Payments

Missing loan payments can result in late fees, a negative impact on your credit score, and even potential legal action from the lender.

Handling Financial Difficulties

- Contact your lender immediately if you are facing financial difficulties to discuss possible options such as loan modification or deferment.

- Explore debt consolidation or credit counseling services to help manage multiple debts more effectively.

- Avoid taking on additional debt while repaying your personal loan to prevent further financial strain.