Diving into the world of managing loan payments, this guide is here to help you navigate the complexities of loan repayment with ease. From understanding the basics to exploring different repayment plans and strategies, we’ve got you covered every step of the way. So, buckle up and let’s start this financial journey together!

Loan payments can be a daunting task, but with the right knowledge and tools, you can take control of your finances and secure a stable future.

Understanding Loan Payments

Loan payments are the regular installments made by a borrower to repay the amount borrowed, along with any interest that accrues over time.

These payments typically consist of two main components:

Components of Loan Payments

- Principal: This is the original amount borrowed from the lender.

- Interest: This is the additional cost charged by the lender for borrowing the money.

Effective management of loan payments is crucial to avoid defaulting on the loan and damaging your credit score.

Types of Loan Repayment Plans

When it comes to repaying your loans, there are several different options available to choose from. Each type of repayment plan comes with its own set of features and benefits, so it’s important to understand the differences between them in order to select the one that best fits your financial situation.

Standard Repayment Plan

The standard repayment plan is the most common type of repayment plan for federal student loans. With this plan, you make fixed monthly payments over a period of 10 years. This plan is ideal for borrowers who can afford to make higher monthly payments and want to pay off their loans as quickly as possible.

Graduated Repayment Plan

Under the graduated repayment plan, your payments start out low and increase every two years. This plan is suitable for borrowers who expect their income to increase over time or who may need some time to establish themselves in their careers before making larger payments.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. There are several types of income-driven plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans are great for borrowers with lower incomes who may not be able to afford standard repayment amounts.

Scenario Examples

- Standard Repayment Plan: Sarah, a recent graduate with a stable job, opts for the standard plan to pay off her loans quickly and save on interest.

- Graduated Repayment Plan: Mark, a new graduate pursuing a career in a competitive field, chooses the graduated plan to ease into higher payments as he advances in his career.

- Income-Driven Repayment Plans: Emily, a freelance artist with fluctuating income, enrolls in an income-driven plan to ensure she can afford her loan payments during lean months.

Strategies for Managing Loan Payments

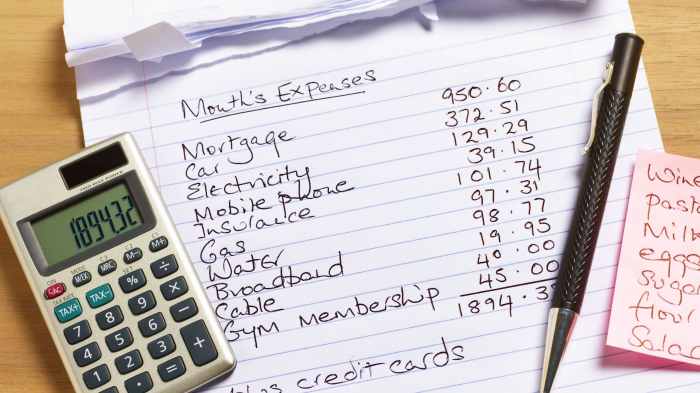

Budgeting is key to ensuring timely loan payments. By creating a detailed budget that includes your loan payments as a fixed expense, you can avoid missing deadlines and incurring late fees.

Consolidating or Refinancing Loans

If you find yourself struggling to manage multiple loan payments, consider consolidating or refinancing your loans. This process involves combining all your loans into a single payment with a potentially lower interest rate. It can help streamline your finances and make it easier to keep track of your payments.

Consequences of Missing or Defaulting on Loan Payments

Missing or defaulting on loan payments can have serious consequences. It can damage your credit score, making it harder to secure loans or credit in the future. Additionally, you may incur late fees, penalties, and even risk legal action from your lender. It’s crucial to communicate with your lender if you’re facing difficulties making payments to explore alternative options and avoid defaulting.

Tools and Resources for Loan Payment Management

When it comes to managing loan payments, there are several tools and resources available to help individuals stay on track with their payments. From apps and software to online platforms and financial advisors, there are various options to choose from based on individual preferences and needs.

Useful Apps and Software for Tracking Loan Payments

- Personal Capital: This app allows you to track your loan payments, set up reminders, and create a customized repayment plan.

- Mint: A popular budgeting app that helps you keep tabs on all your financial accounts, including loans, and provides insights on payment schedules.

- Debt Payoff Planner: Specifically designed to help users create a repayment strategy for multiple loans, this app offers personalized plans based on your financial situation.

Websites and Platforms Offering Advice on Managing Loan Payments

- Student Loan Hero: This website offers a wealth of information on student loans, repayment options, and tips for managing loan payments effectively.

- Credit Karma: In addition to providing credit score information, Credit Karma also offers resources and tools for managing and paying off loans efficiently.

- Bankrate: Known for its financial calculators and expert advice, Bankrate’s website is a valuable resource for loan payment management strategies.

Role of Financial Advisors in Managing Loan Payments

Financial advisors play a crucial role in helping individuals navigate the complexities of loan payments. They can offer personalized advice, create effective repayment plans, and provide ongoing support to ensure that borrowers stay on track with their payments. By leveraging the expertise of financial advisors, individuals can make informed decisions and manage their loan payments more efficiently.