Diving into the world of secured personal loans, this introduction will take you on a journey through the ins and outs of borrowing with style and confidence. Get ready to explore the realm of financial security and empowerment like never before.

Secured personal loans are a powerful tool for individuals looking to secure funding while leveraging their assets. From understanding the types of collateral accepted to weighing the risks involved, this guide has got you covered.

Definition of Secured Personal Loans

Secured personal loans are a type of loan that is backed by collateral, such as a car, home, or other valuable asset. This collateral provides security for the lender in case the borrower fails to repay the loan.

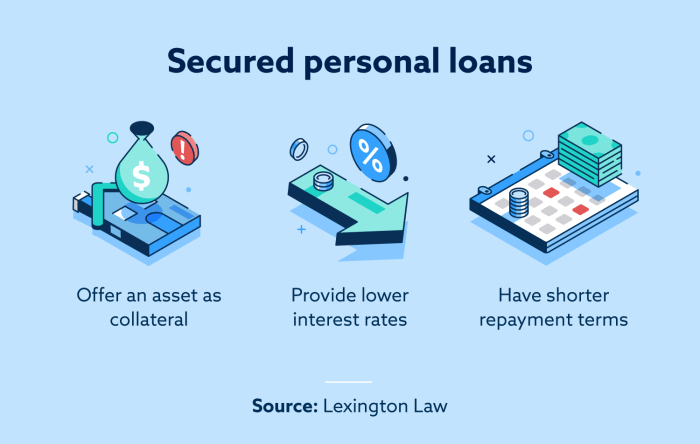

Key Features of Secured Personal Loans

- Collateral Requirement: Secured personal loans require the borrower to pledge an asset as collateral.

- Lower Interest Rates: Due to the collateral, secured personal loans typically have lower interest rates compared to unsecured loans.

- Risk for Borrower: If the borrower defaults on the loan, they risk losing the asset used as collateral.

- Higher Loan Amounts: Lenders are more willing to offer higher loan amounts for secured loans due to the reduced risk.

Comparison with Unsecured Personal Loans

- Collateral: Secured loans require collateral, while unsecured loans do not.

- Interest Rates: Secured loans generally have lower interest rates than unsecured loans.

- Risk: Borrowers face a higher risk of losing their assets with secured loans compared to unsecured loans.

- Loan Amounts: Secured loans typically allow for higher loan amounts than unsecured loans.

Types of Collateral Accepted

When applying for a secured personal loan, the lender requires collateral to secure the loan amount. Collateral serves as a form of protection for the lender in case the borrower defaults on the loan. The type of collateral accepted can vary depending on the lender and the loan amount.

Common Types of Collateral

- Real Estate: Properties such as homes, land, or commercial buildings

- Vehicle: Cars, trucks, motorcycles, and other vehicles

- Investments: Stocks, bonds, or other investment accounts

- Jewelry: High-value items like diamonds, gold, or watches

Importance of Collateral

Collateral is crucial in securing a loan because it reduces the risk for the lender. By having an asset tied to the loan, the lender has a way to recoup their losses if the borrower fails to repay the loan. This added security allows lenders to offer lower interest rates and larger loan amounts compared to unsecured loans.

Value of Collateral and Loan Amount

The value of the collateral directly influences the loan amount that a borrower can receive. Lenders typically offer loans up to a certain percentage of the collateral’s value, known as the loan-to-value ratio.

This ratio helps determine the maximum loan amount based on the appraised value of the collateral. Borrowers with high-value collateral can qualify for larger loan amounts, while those with lower-value assets may receive smaller loans.

Advantages of Secured Personal Loans

Secured personal loans offer several advantages over other types of financing, making them a popular choice for many borrowers. One of the main benefits is the lower interest rates that come with secured loans compared to unsecured loans. This is because the lender has the security of collateral, reducing the risk associated with the loan.

Lower Interest Rates

Secured personal loans typically come with lower interest rates than unsecured loans. This is because the lender has the assurance of collateral, which reduces the risk of lending money to the borrower. With lower interest rates, borrowers can save money over the life of the loan and have more manageable monthly payments.

Beneficial for Individuals with Poor Credit History

Secured personal loans can be a great option for individuals with poor credit history. Since the loan is backed by collateral, such as a car or home, lenders are more willing to approve the loan even if the borrower has a less-than-perfect credit score. This can give borrowers with poor credit access to much-needed funds and an opportunity to rebuild their credit history by making timely payments on the loan.

Risks Associated with Secured Personal Loans

Secured personal loans offer benefits, but they also come with risks that borrowers need to be aware of before committing to this type of loan. Understanding these risks can help borrowers make informed decisions and avoid potential financial pitfalls.

Defaulting on a Secured Loan

Defaulting on a secured personal loan can have serious consequences for the borrower. When a borrower fails to make timely payments or stops paying altogether, the lender has the legal right to seize the collateral that was used to secure the loan. This means that if you default on a secured loan, you could lose your valuable assets, such as your home or car.

Lenders Mitigating Risk

Lenders mitigate the risks associated with secured personal loans by thoroughly assessing the borrower’s creditworthiness and the value of the collateral. They may require a higher credit score or a lower debt-to-income ratio for approval. Additionally, lenders may limit the loan amount to a percentage of the collateral’s value to reduce the risk of loss in case of default. By taking these precautions, lenders aim to minimize their potential losses and protect their interests.