Diving into the world of Credit union benefits, this introduction sets the stage for a captivating exploration of the perks and advantages that credit unions offer over traditional banks. Get ready to discover a whole new level of financial empowerment and community engagement that comes with being a credit union member.

Types of Credit Union Benefits

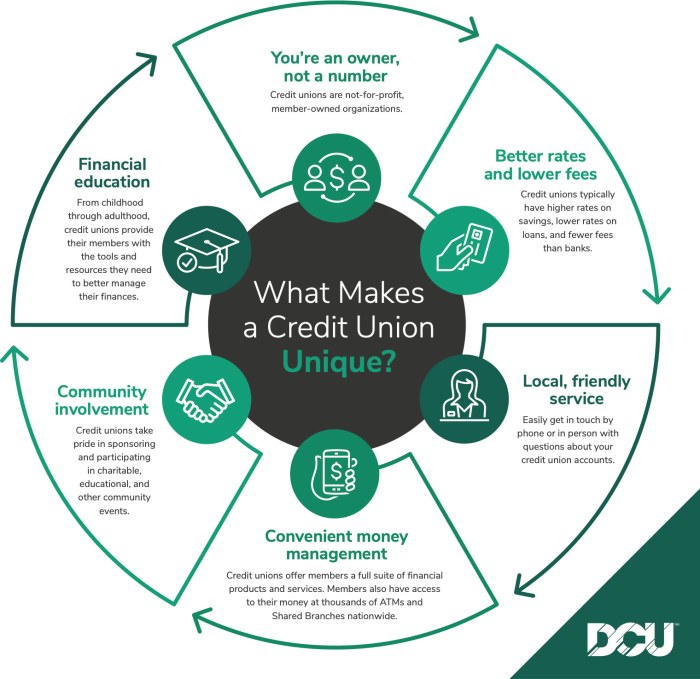

Credit unions offer a variety of benefits that set them apart from traditional banks. These benefits contribute to a more personalized and member-focused experience for individuals seeking financial services.

Lower Fees and Better Rates

Credit unions typically have lower fees and offer better interest rates on savings accounts, loans, and credit cards compared to banks. This means members can save money on fees and earn more on their deposits, leading to greater financial stability and growth.

Community Focus

Credit unions are member-owned and operated, which means they prioritize the needs of their members and the local community. This community focus allows credit unions to offer personalized services, financial education, and support that cater to the unique needs of their members.

Member Ownership

Unlike banks, where profits go to shareholders, credit union members are owners of the institution. This ownership structure fosters a sense of loyalty and accountability, as members have a direct stake in the success of the credit union. This can lead to better customer service and a more member-centric approach to banking.

Democratic Governance

Credit unions operate on a democratic governance model, where members have a say in the decision-making process. Members can vote on important issues, elect board members, and participate in shaping the direction of the credit union. This transparency and member involvement create a sense of trust and community within the institution.

Financial Education and Counseling

Credit unions often provide financial education resources, counseling services, and workshops to help members improve their financial literacy and make informed decisions about their money. This focus on education empowers members to take control of their finances and build a secure financial future.

Financial Benefits

Being a credit union member comes with various financial advantages that can help you save money and achieve your financial goals more efficiently. Credit unions typically offer cost-effective services that are exclusive to their members, providing personalized attention and competitive rates.

Lower Fees and Better Rates

Credit unions are known for charging lower fees compared to traditional banks, saving you money on things like overdraft fees, ATM fees, and monthly account maintenance fees. Additionally, credit unions often offer higher interest rates on savings accounts and lower interest rates on loans, helping you grow your savings faster and pay less in interest on borrowed money.

Personalized Service

Credit unions are member-owned and operated, so they prioritize the needs of their members above all else. This means you can expect personalized service, tailored financial advice, and a more community-oriented approach to banking. Credit unions often provide financial education resources and counseling to help you make informed decisions about your money.

Exclusive Services

Credit unions may offer exclusive services such as discounted rates on loans, special savings accounts with higher interest rates, and rewards programs that give back to members. These perks are designed to benefit the members directly and create a sense of belonging to a financial institution that truly cares about their financial well-being.

Community Involvement

Credit unions are deeply rooted in their local communities, often prioritizing community involvement as a core part of their values. This involvement goes beyond just offering financial services, as credit unions actively engage with their communities to support development and growth.

Local Initiatives

Credit unions frequently organize and participate in various community initiatives to give back and support local development. These initiatives can include financial literacy workshops, scholarship programs for students, fundraising events for local charities, and partnerships with small businesses to promote economic growth.

Importance of Community Involvement

– Building Stronger Relationships: By actively engaging in community initiatives, credit unions can build stronger relationships with local residents and businesses, fostering trust and loyalty.

– Social Responsibility: Community involvement showcases the credit union’s commitment to social responsibility, demonstrating that they care about more than just profits.

– Economic Impact: By supporting community development initiatives, credit unions can contribute to the economic growth of the local area, creating a positive impact on the overall well-being of residents.

Member Ownership and Governance

In credit unions, members not only benefit from the financial advantages but also have ownership rights that set them apart from traditional banks.

Member Ownership Rights

- Each member has a share in the credit union, giving them a say in how the institution is run.

- Members have the right to vote on important decisions, such as electing board members and approving changes in policies.

- Ownership rights also entitle members to share in the profits through dividends or lower loan rates.

Democratic Governance Structure

Credit unions operate under a democratic governance structure where decisions are made collectively by the members.

- Members elect a board of directors to oversee the credit union’s operations and ensure alignment with the members’ best interests.

- Board members are typically volunteers from within the membership, reflecting the cooperative and community-driven nature of credit unions.

- Decisions are made based on the principle of one member, one vote, promoting equality and fairness in the decision-making process.

Influence on Decision-Making Processes

Member ownership empowers individuals to have a direct impact on the direction and policies of the credit union.

- Members’ input and feedback are valued in shaping the services and products offered by the credit union.

- Ownership rights create a sense of accountability and transparency within the institution, fostering trust among members.

- The democratic governance structure ensures that decisions are made with the best interests of the members in mind, rather than for-profit motives.

Customer Service and Personalization

In the world of credit unions, customer service goes beyond just a friendly smile and a warm greeting. Credit unions are known for their personalized services that cater to the individual needs of their members. This level of personalization is a key factor in member retention and satisfaction.

Tailored Services

Credit unions take the time to understand each member’s unique financial situation and goals. They offer personalized financial solutions, such as custom loan packages, flexible payment options, and personalized investment advice. This tailored approach helps members feel valued and supported in their financial journey.

Communication Channels

Credit unions prioritize open communication with their members. They offer various channels for members to reach out, such as in-person consultations, phone support, online chat services, and mobile apps. This accessibility ensures that members can easily get the assistance they need whenever they need it.

Financial Education and Counseling

Credit unions provide financial education resources and counseling services to help members make informed decisions about their finances. They offer workshops, seminars, and one-on-one sessions to educate members on topics like budgeting, saving, and investing. This commitment to financial literacy sets credit unions apart as trusted financial partners.