Diving into the world of credit utilization ratio, this is here to grab your attention and keep you hooked. Get ready to learn all about how this ratio impacts your credit standing.

Exploring the factors that influence it and the tips for managing it, this topic is essential for anyone looking to improve their financial health.

What is Credit Utilization Ratio?

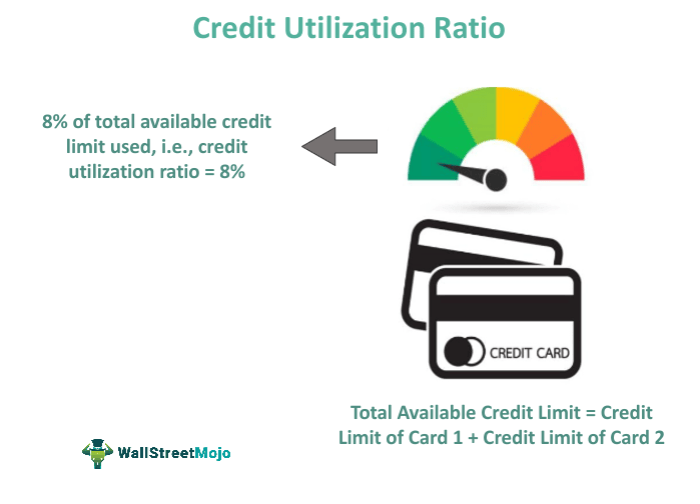

The credit utilization ratio is the percentage of your available credit that you are currently using. It is an important factor that affects your credit score.

Calculating Credit Utilization Ratio

To calculate your credit utilization ratio, you need to divide the total amount of credit you are currently using by the total amount of credit available to you. For example, if you have a total credit limit of $10,000 and you have used $2,000, your credit utilization ratio would be 20% ($2,000/$10,000).

Impact on Credit Scores

Having a high credit utilization ratio can negatively impact your credit score. Lenders may see you as a higher risk borrower if you are using a large percentage of your available credit. It is recommended to keep your credit utilization ratio below 30% to maintain a good credit score.

Importance of Low Credit Utilization Ratio

Maintaining a low credit utilization ratio shows that you are responsible with your credit and are not relying too heavily on borrowed funds. This can positively impact your credit score and make you more attractive to lenders when applying for loans or credit cards.

Factors Influencing Credit Utilization Ratio

When it comes to your credit utilization ratio, there are several key factors that can impact this important financial metric.

Credit Limits and Outstanding Balances:

Having a high credit utilization ratio can be influenced by how close you are to maxing out your credit cards. The higher your outstanding balance is in relation to your credit limit, the higher your credit utilization ratio will be. For example, if you have a credit card with a $5,000 limit and you have a balance of $4,000, your credit utilization ratio would be 80%.

Role of Multiple Credit Accounts:

Multiple credit accounts can also impact your credit utilization ratio. If you have several credit cards with high balances across all of them, your overall credit utilization ratio could be high even if each individual card is not maxed out. This is because the total balances across all your credit accounts are considered when calculating your credit utilization ratio.

Credit Card Usage Habits

- Regularly monitor your credit card balances to ensure they stay well below the credit limit.

- Avoid opening multiple credit accounts at the same time, as this can increase your overall credit utilization ratio.

- Make timely payments to reduce outstanding balances and improve your credit utilization ratio over time.

Impact of Credit Utilization Ratio on Credit Score

Maintaining a low credit utilization ratio is crucial for a healthy credit score. This ratio represents the amount of credit you are using compared to the total credit available to you. A high credit utilization ratio can negatively impact your credit score, while a low ratio can help improve it.

Credit Score Implications

- A high credit utilization ratio signals to lenders that you may be over-reliant on credit and potentially struggling financially. This can lead to a decrease in your credit score.

- On the other hand, a low credit utilization ratio indicates responsible credit management and can positively impact your credit score.

Creditworthiness Relationship

- Your credit utilization ratio is a key factor in determining your creditworthiness. Lenders often view a lower ratio favorably, as it demonstrates that you are not maxing out your available credit.

- By keeping your credit utilization ratio low, you are showing lenders that you are capable of managing credit responsibly, which can increase your creditworthiness.

Improving Credit Scores

- Lowering your credit utilization ratio can lead to an improvement in your credit score. For example, if you have a high ratio, paying down your balances or increasing your credit limits can help reduce the ratio and boost your score.

- Regularly monitoring your credit utilization ratio and making adjustments to keep it low can have a positive impact on your credit score over time.

Tips for Managing Credit Utilization Ratio

Maintaining a healthy credit utilization ratio is crucial for a good credit score. Here are some tips to help you manage your credit utilization effectively.

Strategies for Lowering Credit Utilization Ratio

- Avoid maxing out your credit cards. Try to keep your credit card balances below 30% of your total credit limit.

- Consider requesting a credit limit increase to reduce your utilization ratio.

- Pay off high balances first to lower your overall credit utilization.

Benefits of Regularly Monitoring Credit Utilization Ratio

Regularly monitoring your credit utilization ratio can help you catch any potential issues early on and take steps to address them. It also allows you to track your progress in improving your ratio over time. By staying on top of your credit utilization, you can ensure that your credit score remains healthy.

How to Effectively Use Credit to Maintain a Healthy Credit Utilization Ratio

- Use your credit cards responsibly and make timely payments to avoid high balances.

- Avoid opening multiple new credit accounts at once, as this can negatively impact your credit utilization ratio.

- Consider using a mix of credit types, such as credit cards and installment loans, to diversify your credit profile.