Yo, let’s dive into the world of dollar-cost averaging. This slick investment strategy is all about consistency and playing the long game. If you’re looking to level up your financial game, buckle up and let’s roll with the dollar-cost averaging flow.

So, what’s the deal with dollar-cost averaging? It’s a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. Sound interesting? Let’s break it down further.

Definition and Basics

Dollar-cost averaging is a smart investment strategy where you regularly invest a fixed amount of money in a particular asset, regardless of market conditions. It helps reduce the impact of market volatility on your investments over time.

How Dollar-Cost Averaging Works

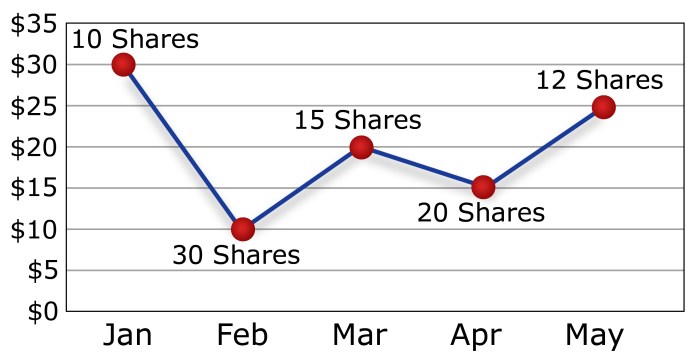

When you use dollar-cost averaging, you consistently buy a set dollar amount of an investment at regular intervals, regardless of whether the price is high or low. This means you buy more shares when prices are low and fewer shares when prices are high, which averages out your cost per share over time.

- By investing a fixed amount regularly, you automatically buy more shares when prices are low and fewer shares when prices are high.

- This strategy helps smooth out the effects of market fluctuations, potentially reducing the risk of investing a large sum at the wrong time.

Remember, the key to dollar-cost averaging is consistency. Stick to your investment plan and continue investing regularly over the long term.

Examples of How Dollar-Cost Averaging Can Benefit Investors

- Imagine you invest $100 in a stock every month. When the stock price is high, your $100 buys fewer shares. When the price is low, your $100 buys more shares. Over time, this can average out your cost per share.

- Another example is investing in a mutual fund regularly. By sticking to a fixed investment amount each month, you can benefit from the ups and downs of the market without trying to time your investments.

Implementation

To start dollar-cost averaging, follow these steps:

Step 1: Set Up an Investment Account

- Choose a brokerage firm or platform that offers investment accounts.

- Complete the account opening process by providing necessary personal information.

Step 2: Determine Your Investment Amount

- Decide how much money you are comfortable investing on a regular basis.

- Set a budget that aligns with your financial goals and risk tolerance.

Step 3: Choose Your Investment Assets

- Research and select the assets you want to invest in, such as stocks, bonds, or mutual funds.

- Diversify your portfolio to reduce risk by investing in different asset classes.

Step 4: Set Up Automatic Investments

- Establish a schedule for automatic investments to ensure consistency.

- Specify the frequency of investments based on your financial situation and goals.

Step 5: Monitor and Adjust Your Strategy

- Regularly review your investments and make adjustments as needed.

- Stay informed about market trends and performance of your assets.

Benefits and Risks

Dollar-cost averaging can be a great strategy for investing, offering various advantages but also coming with its own set of risks. Let’s dive into the benefits and potential downsides of using this investment approach.

Benefits of Dollar-Cost Averaging

- Reduces the impact of market volatility: By investing a fixed amount regularly, you buy more shares when prices are low and fewer shares when prices are high, ultimately averaging out the cost over time.

- Discipline and consistency: Dollar-cost averaging helps investors stick to a regular investment plan, promoting a disciplined approach to building wealth over the long term.

- Eliminates the need for market timing: This strategy removes the pressure of trying to time the market, as investments are made on a consistent schedule regardless of market conditions.

Risks of Dollar-Cost Averaging

- Potential for missed opportunities: Since investments are made at regular intervals, there is a risk of missing out on buying opportunities during market downturns when prices are significantly lower.

- Lower returns in bull markets: In a continuously rising market, the returns from dollar-cost averaging may be lower compared to a lump-sum investment made at the beginning of the upward trend.

- Increased transaction costs: Regularly investing small amounts can lead to higher transaction fees over time, impacting overall returns.

Comparison with Lump-Sum Investing

When comparing the performance of dollar-cost averaging with lump-sum investing, it’s essential to consider factors like market conditions, risk tolerance, and investment goals. While dollar-cost averaging offers benefits in reducing market timing risks and promoting discipline, lump-sum investing can potentially provide higher returns in certain market scenarios. Ultimately, the choice between the two approaches depends on individual preferences, financial situation, and investment objectives.

Strategies and Tips

When it comes to optimizing your dollar-cost averaging strategy, there are a few key tips and tricks to keep in mind. By following these strategies, you can maximize your returns and minimize risks along the way.

Consistent Investments

- Make sure to consistently invest the same amount of money at regular intervals. This will help you take advantage of market fluctuations without trying to time the market.

- Set up automatic investments to ensure you stay disciplined and stick to your plan, regardless of market conditions.

Diversification

- Diversify your investments across different asset classes to spread out risk. Consider investing in a mix of stocks, bonds, and other securities to achieve a balanced portfolio.

- Rebalance your portfolio periodically to adjust for any shifts in your investment mix and maintain diversification.

Long-Term Perspective

- Stay focused on your long-term goals and avoid making emotional decisions based on short-term market fluctuations.

- Remember that dollar-cost averaging is a long-term strategy, so be patient and stick to your plan even during market downturns.

Avoid Common Mistakes

- Avoid trying to time the market or making frequent changes to your investment strategy based on short-term market movements.

- Don’t stop investing during market downturns; instead, use them as opportunities to buy more shares at lower prices.