As finance management apps take center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. Get ready to dive into the realm of finance management apps where budgeting, tracking expenses, and financial planning meet innovation and convenience.

In a world where managing finances is key, these apps are the secret weapon to staying on top of your money game. Let’s explore the ins and outs of finance management apps and how they can revolutionize the way you handle your personal or business finances.

Importance of Finance Management Apps

Using finance management apps is crucial for effectively managing personal or business finances. These apps provide a convenient way to budget, track expenses, and plan for financial goals. They offer a centralized platform to monitor transactions, analyze spending patterns, and make informed decisions about money management.

Budgeting with Finance Management Apps

- Set up customized budgets for various expense categories.

- Receive alerts and notifications for overspending or reaching budget limits.

- Visualize spending habits through charts and graphs for better financial awareness.

Expense Tracking Features

- Automatically categorize transactions for easy tracking and analysis.

- Link multiple accounts to get a comprehensive view of all financial activities.

- Generate detailed reports on income, expenses, and savings to identify areas for improvement.

Financial Planning Tools

- Set financial goals and track progress towards achieving them.

- Access tools for investment planning, retirement savings, and debt management.

- Utilize calculators for loan payments, mortgage estimates, and retirement projections.

Popular Finance Management Apps

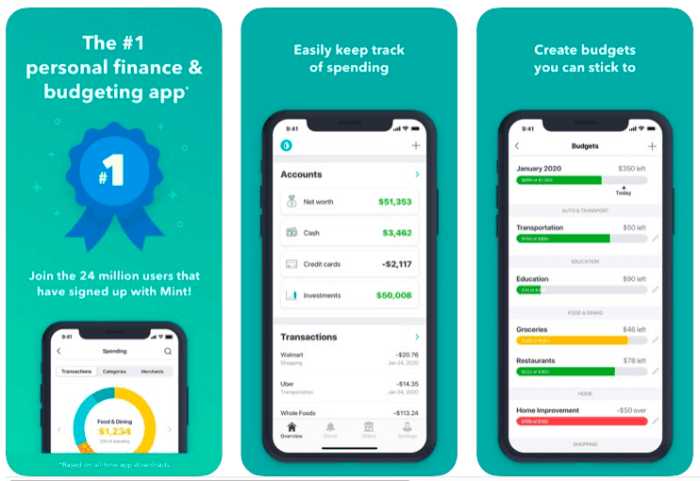

- Mint: Offers budgeting tools, bill reminders, and credit score monitoring.

- YNAB (You Need A Budget): Focuses on zero-based budgeting and financial goal setting.

- Personal Capital: Provides investment tracking, retirement planner, and net worth calculator.

Features to Look for in Finance Management Apps

When choosing a finance management app, it is important to consider the essential features that will help you effectively manage your finances. These features can vary from app to app, so it’s crucial to compare and contrast different options based on their functionalities.

Budget Tracking

- Ability to set and track budgets for different categories.

- Customizable budgeting tools to fit your financial goals.

- Real-time updates on spending to stay within budget limits.

Bill Reminders

- Automatic alerts for upcoming bills and payments.

- Option to schedule payments in advance to avoid late fees.

- Ability to link to bank accounts for seamless bill payments.

Investment Tracking

- Portfolio monitoring for stocks, mutual funds, and other investments.

- Performance analysis and insights to make informed investment decisions.

- Integration with brokerage accounts for real-time updates on investment values.

Security Features

- End-to-end encryption to protect sensitive financial data.

- Two-factor authentication for added security when accessing the app.

- Regular updates and patches to address security vulnerabilities.

Benefits of Using Finance Management Apps

Using finance management apps can offer several advantages over traditional methods of financial management. These apps provide convenience, organization, and real-time insights into your finances, making it easier to track expenses, create budgets, and achieve financial goals.

Improved Financial Health

Finance management apps have helped individuals and businesses improve their financial health by providing a clear overview of their income, expenses, and savings. By having all financial information in one place, users can make informed decisions, identify areas for improvement, and ultimately increase their savings and reduce debt.

Efficient Tracking and Analysis

These apps allow users to track their spending in real-time, categorize expenses, and analyze spending patterns. By understanding where money is being spent, individuals can make adjustments to their budget and cut unnecessary expenses. This level of tracking and analysis is nearly impossible with traditional pen-and-paper methods.

Goal Setting and Monitoring

Finance management apps enable users to set financial goals, such as saving for a vacation or paying off a loan, and monitor their progress towards these goals. The apps can send reminders, provide notifications, and offer insights on how to stay on track. This feature helps individuals stay motivated and focused on achieving their financial objectives.

Enhanced Financial Stability

By using finance management apps, individuals can achieve greater financial stability by having a clear understanding of their financial situation. These apps can help users build emergency funds, plan for retirement, and invest wisely. With improved financial stability, individuals can weather unexpected expenses and secure their financial future.

Tips for Effective Use of Finance Management Apps

When it comes to maximizing the benefits of finance management apps for efficient financial planning, there are a few key tips to keep in mind. By following these guidelines, you can set up and use these apps effectively to monitor and control your finances, ultimately integrating them into your daily financial routines for long-term success.

Set Clear Financial Goals

To make the most out of finance management apps, start by setting clear financial goals. Whether it’s saving for a big purchase, paying off debt, or building an emergency fund, having specific objectives in mind will help you stay focused and motivated.

Track Your Spending

One of the essential features of finance management apps is the ability to track your spending. Make sure to categorize your expenses accurately and regularly review your transactions to identify areas where you can cut back and save more money.

Create a Budget and Stick to It

Use your finance management app to create a realistic budget based on your income and expenses. Adjust your budget as needed and track your progress to ensure you’re staying on track towards your financial goals.

Utilize Alerts and Reminders

Take advantage of the alerts and reminders feature in your finance management app to stay on top of your bills, due dates, and financial milestones. Setting up notifications will help you avoid late payments and keep your finances in order.

Regularly Review Reports and Insights

Make it a habit to regularly review the reports and insights provided by your finance management app. Analyzing your financial trends, spending habits, and saving patterns will give you valuable insights into your financial health and help you make informed decisions.

Secure Your Data

Lastly, ensure that your sensitive financial information is secure by using strong passwords, enabling two-factor authentication, and regularly updating your app. Protecting your data is essential for maintaining the privacy and security of your financial details.