Kickin’ it off with Financial literacy for kids, we’re diving into why it’s crucial to teach our young ones about money management early on. From basic concepts to setting financial goals, we’re breaking it down in a way that’s fun, interactive, and totally essential for their future success.

Importance of Financial Literacy for Kids

Teaching financial literacy to children is crucial as it equips them with essential skills to make informed decisions about money management from a young age. By instilling financial knowledge early on, kids are better prepared to navigate the complex world of personal finance in the future.

Long-Term Benefits of Early Financial Education

- Children learn the value of saving and budgeting, setting them up for financial success later in life.

- Early financial education can help kids develop good money habits and avoid debt traps in adulthood.

- Understanding concepts like interest rates and investments early on can lead to smarter financial choices in the long run.

Impact on Children’s Future Financial Stability

Financially literate kids are more likely to achieve financial independence and security as adults.

By teaching children about financial literacy, we empower them to take control of their financial future and build a solid foundation for long-term financial stability.

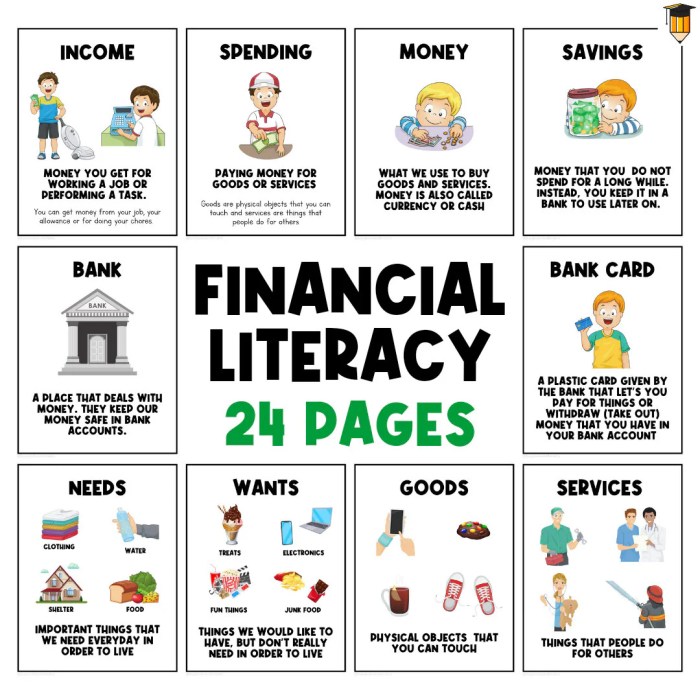

Basic Concepts to Teach Kids

Teaching kids about financial concepts at a young age can help set them up for a successful future. By starting with basic concepts and simplifying complex terms, children can develop a strong foundation in financial literacy that will benefit them throughout their lives.

1. Budgeting

Budgeting is the process of creating a plan for how to spend money. To introduce this concept to kids, you can use a simple allowance system where they allocate funds for different categories such as saving, spending, and giving. Encourage them to track their expenses and adjust their budget accordingly.

2. Saving

Saving money is an important skill to learn early on. Teach kids the importance of setting aside a portion of their income for future goals or unexpected expenses. You can create a savings jar or piggy bank where they can physically see their savings grow over time.

3. Needs vs. Wants

Help children differentiate between needs (essential items for survival) and wants (things that are nice to have but not necessary). Use real-life examples like groceries versus toys to illustrate this concept. Encourage them to prioritize spending on needs before wants.

4. Earning Money

Teach kids about different ways to earn money, such as through chores, lemonade stands, or selling handmade crafts. Help them understand the value of hard work and the satisfaction of earning their own money.

5. Investing

Introduce the concept of investing by explaining how putting money into stocks, bonds, or a savings account can help it grow over time. Use simple examples like planting seeds in a garden that will eventually bear fruit. Emphasize the importance of patience and long-term thinking in investing.

6. Credit and Debt

Explain the difference between credit (borrowed money that needs to be repaid) and debt (money owed to others). Teach kids about responsible borrowing and the consequences of accumulating too much debt. Encourage them to prioritize paying off debts and using credit wisely.

Setting Financial Goals for Kids

Teaching kids how to set financial goals is crucial for their future financial well-being. By instilling this habit early on, children can develop important skills that will help them manage their money effectively as they grow older.

When helping children set financial goals, it is essential to start by encouraging them to think about what they want to achieve. This could be saving up for a new toy, a bike, or even a college fund. It is important to guide them in setting realistic goals that are attainable based on their current financial situation.

Tips on Tracking Progress Towards Goals

- Encourage kids to keep a savings jar or piggy bank where they can physically see their money grow.

- Help them create a chart or visual representation to track their progress towards their goals.

- Set regular check-ins to review their progress and make adjustments if necessary.

Importance of Saving for Short-term and Long-term Objectives

- Teaching kids to save for short-term goals, like buying a toy, helps them understand the value of delayed gratification.

- Encourage them to save for long-term objectives, such as a college education or a future home, to instill the importance of planning for the future.

- By balancing saving for both short-term and long-term goals, children learn to prioritize their spending and make informed financial decisions.

Teaching Budgeting Skills

Budgeting is a crucial skill that kids can learn at a young age to help them manage their money effectively. By teaching kids how to budget, parents can instill good financial habits early on that will benefit them in the long run.

Age-Appropriate Budgeting Techniques

- For younger kids (ages 5-8): Introduce the concept of saving and spending by using clear jars or piggy banks labeled for different purposes. Help them set small savings goals for items they want to purchase.

- For pre-teens (ages 9-12): Encourage them to track their expenses and income using a simple notebook or budgeting app. Teach them to allocate money for different categories like saving, spending, and giving.

- For teenagers (ages 13-18): Involve them in creating a monthly budget based on their income (allowance, part-time job) and expenses. Teach them about prioritizing needs over wants and saving for larger financial goals.

The earlier kids learn how to budget, the better equipped they will be to make smart financial decisions in the future.

Significance of Instilling Budgeting Habits Early On

Teaching kids how to budget from a young age helps them develop a sense of financial responsibility and accountability. It also teaches them important skills such as setting priorities, making trade-offs, and planning for the future. By mastering budgeting skills early on, kids can avoid overspending, manage debt effectively, and work towards achieving their financial goals.

Earning, Saving, and Spending

Earning, saving, and spending are crucial aspects of financial literacy that kids should learn early on to develop healthy money habits for the future. Teaching kids about earning money, saving a portion of it, and making responsible spending decisions can set them up for financial success.

Teaching Kids About Earning Money

Teaching kids about earning money can be done through various ways, such as assigning chores or providing allowances. By assigning age-appropriate chores and linking them to a small monetary reward, kids can learn the value of hard work and responsibility. Additionally, giving kids a regular allowance can help them understand the concept of earning money through consistent effort.

Encouraging Kids to Save

To encourage kids to save a portion of their earnings, parents can introduce the concept of a piggy bank or a savings account. Setting a savings goal, such as saving for a toy or a special treat, can motivate kids to save regularly. Parents can also match a percentage of their child’s savings to reinforce the habit of saving.

Guidance on Responsible Spending

Teaching kids about responsible spending habits involves helping them differentiate between needs and wants. Encouraging kids to create a budget for their spending can also instill good money management skills. Parents can guide kids on making informed decisions when it comes to spending, emphasizing the importance of prioritizing essential purchases over impulse buys.

Differentiating Needs vs. Wants

Understanding the difference between needs and wants is crucial when it comes to managing money wisely. Needs are essentials for survival, while wants are things that are nice to have but not necessary.

Examples of Needs

- Food and water

- Shelter

- Clothing

- Education

Examples of Wants

- Video games

- Toys

- Designer clothes

- Fast food

Activities to Reinforce the Concept

- Make a list: Have your child list down items they think are needs and wants, then discuss and categorize them together.

- Role-playing: Create scenarios where your child has to decide between purchasing a need or a want, teaching them to prioritize.

- Budgeting game: Give your child a set amount of play money and have them allocate it towards their needs and wants.

Introduction to Banking

Banking is a crucial part of managing finances, and introducing kids to banking services at a young age can help them develop good money habits early on. One key aspect of banking is the use of savings accounts, which can teach children the importance of saving and how to earn interest on their money.

Purpose of Savings Accounts and How Interest Works

- Savings accounts provide a safe place to deposit money and earn interest over time.

- Interest is the money the bank pays you for keeping your money in the account.

- Compound interest is when the interest is calculated on both the initial deposit and the interest already earned.

- Teaching kids about interest can show them how their money can grow over time.

Tips for Opening a Savings Account for Kids

- Research different banks to find one with low fees and a good interest rate.

- Consider opening a joint account with your child to monitor their spending and saving habits.

- Explain to your child how to deposit and withdraw money, and involve them in the process.

- Encourage your child to set savings goals and track their progress regularly.