Looking to boost your credit score? Building credit is a crucial step towards financial stability and achieving your goals. From understanding credit scores to responsible credit card usage, this guide covers all you need to know to start on the path to a healthier credit profile.

Starting with establishing credit history, we’ll dive into the factors influencing your credit score and explore the various credit-building options available for beginners. Stay tuned for expert tips on managing credit cards and the importance of monitoring your credit reports.

Understanding Credit Scores

A credit score is a three-digit number that represents a person’s creditworthiness. It is calculated based on the information in your credit report and helps lenders determine how likely you are to repay a loan on time.

Factors Influencing Credit Scores

Several factors influence your credit score, including:

- Your payment history: This accounts for the largest portion of your credit score and shows how reliably you pay your bills on time.

- Amounts owed: The total amount you owe on credit accounts compared to your credit limits can impact your score.

- Length of credit history: The longer you have had credit accounts open, the better it is for your score.

- Credit mix: Having a mix of different types of credit, such as credit cards and loans, can positively impact your score.

- New credit: Opening multiple new credit accounts in a short period can lower your score.

Importance of Good Credit Score

Having a good credit score is crucial for several reasons:

- Access to better loan terms: A good credit score can help you qualify for lower interest rates on loans, saving you money in the long run.

- Rental approvals: Landlords often check credit scores before approving rental applications, so a good score can help you secure a lease.

- Lower insurance premiums: Some insurance companies use credit scores to determine premiums, so a good score can lead to lower insurance costs.

Establishing Credit History

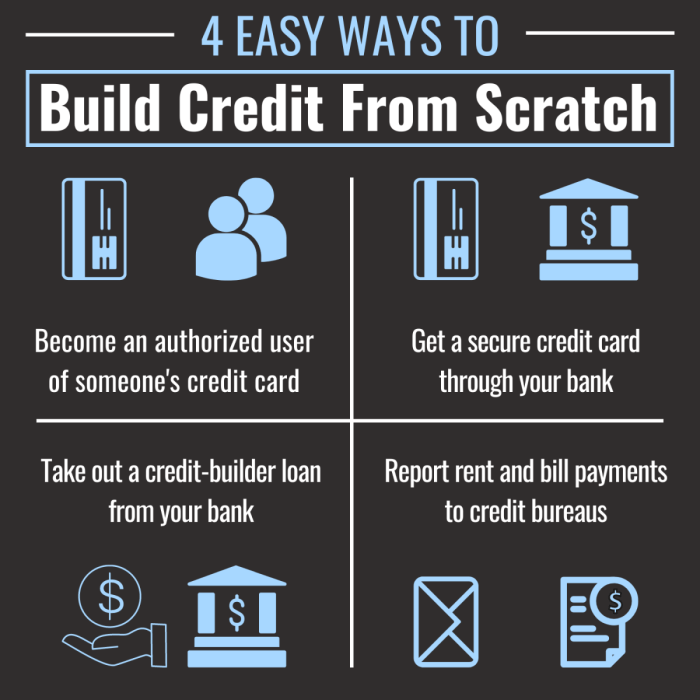

Building a solid credit history is crucial for your financial future. If you’re just starting out and have no credit history, there are a few ways to begin establishing credit and building a positive track record.

Secured Credit Cards

Secured credit cards are a great option for beginners. These cards require a security deposit that acts as your credit limit. By using a secured credit card responsibly and making timely payments, you can start building a positive credit history.

Credit Builder Loans

Credit builder loans are another option for those looking to establish credit. These loans are specifically designed to help individuals build credit. You borrow a small amount of money, which is held in a savings account until the loan is paid off. Making regular, on-time payments can help boost your credit score.

Authorized User on a Credit Card

Becoming an authorized user on someone else’s credit card can also help you establish credit. If you have a family member or close friend with a good credit history, ask if you can be added to their account. Just make sure the primary cardholder has a positive payment history.

Significance of a Positive Credit History

Having a positive credit history is essential for many aspects of your financial life. A good credit score can make it easier to qualify for loans, credit cards, and even secure lower interest rates. It can also impact your ability to rent an apartment, get a job, or buy a car. By establishing and maintaining a positive credit history, you set yourself up for financial success in the long run.

Responsible Credit Card Usage

Using a credit card responsibly is a key factor in building and maintaining a good credit score. By managing your credit card balances effectively and making timely payments, you can demonstrate to creditors that you are a reliable borrower.

Managing Credit Card Balances

- Keep your credit card balances low: Aim to keep your credit card balance below 30% of your credit limit. This shows lenders that you are not relying too heavily on credit.

- Avoid maxing out your credit card: Maxing out your credit card can negatively impact your credit score, even if you pay off the balance in full each month.

- Pay off your balance in full each month: By paying off your balance in full and on time, you can avoid interest charges and demonstrate responsible credit card usage.

Impact of Timely Payments

- Timely payments are crucial: Paying your credit card bill on time each month can have a significant positive impact on your credit score.

- Late payments can hurt your credit: Missing a credit card payment or paying late can lower your credit score and stay on your credit report for up to seven years.

- Avoiding late payments is key: Set up automatic payments or reminders to ensure you never miss a payment deadline.

Diversifying Credit Types

When it comes to building credit, having a diverse mix of credit types can be highly beneficial. It shows lenders that you can manage different types of credit responsibly, which can positively impact your credit score.

Types of Credit Accounts

- Credit Cards: Using a credit card responsibly by making on-time payments and keeping balances low can boost your credit score.

- Loans: Installment loans, like car loans or personal loans, show that you can manage long-term debt effectively.

- Mortgages: Having a mortgage can demonstrate your ability to handle a significant amount of debt responsibly.

Having a mix of these credit types can help diversify your credit profile and showcase your ability to manage various financial obligations. This diversity can lead to a better credit score over time.

Monitoring Credit Reports

Regularly checking your credit report is crucial to maintaining a healthy financial profile. It allows you to track your credit history, detect any errors, and identify potential fraudulent activities.

Obtaining and Reviewing Credit Reports

To obtain your credit report, you can request a free copy from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com. Once you have your report, review it carefully to ensure all the information is accurate and up to date. Look for any discrepancies or unfamiliar accounts that may indicate identity theft or errors.

Detecting Errors and Fraudulent Activities

Monitoring your credit report regularly can help you detect errors, such as incorrect personal information, inaccurate account details, or unauthorized inquiries. It can also alert you to potential fraudulent activities, such as unauthorized account openings or suspicious transactions. By identifying these issues early on, you can take steps to rectify them and protect your credit score.