Get ready to dive into the world of Retirement account contributions where financial planning meets tax-advantaged accounts in a mix that’s as cool as your favorite playlist.

Let’s break down the essentials of why contributing to a retirement account is a must and how it can impact your financial future.

Importance of Retirement Account Contributions

Contributing to a retirement account is crucial for financial planning as it allows individuals to save and invest for their future. By regularly putting money into a retirement account, individuals can build a nest egg that will provide financial security during their retirement years.

Benefits of Tax-Advantaged Retirement Accounts

Tax-advantaged retirement accounts offer significant benefits to individuals looking to save for retirement. These accounts allow contributions to grow tax-deferred or tax-free, depending on the type of account, which can significantly increase the growth of savings over time.

- Traditional retirement accounts, such as 401(k)s or traditional IRAs, allow individuals to contribute pre-tax dollars, reducing their taxable income for the year. This can lead to immediate tax savings and allow investments to grow tax-deferred until withdrawals are made in retirement.

- Roth retirement accounts, on the other hand, require contributions with after-tax dollars, but offer tax-free withdrawals in retirement. This can be advantageous for individuals expecting to be in a higher tax bracket in retirement or wanting to diversify their tax situation.

Types of Retirement Accounts

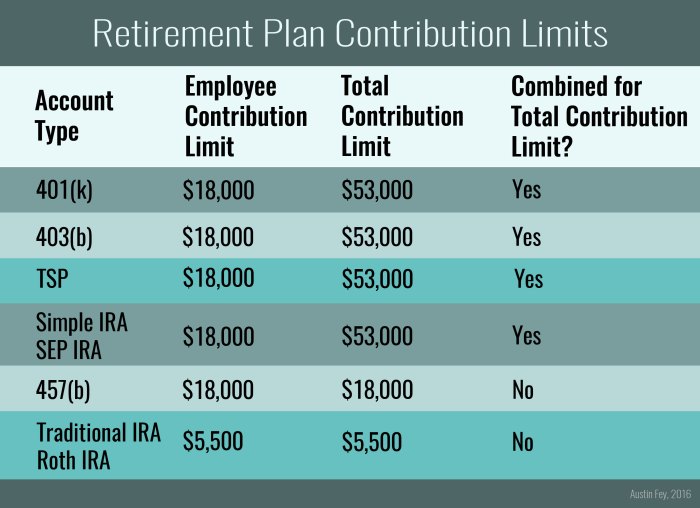

When it comes to saving for retirement, there are several types of retirement accounts to choose from. Each type has its own eligibility criteria and contribution limits, so it’s important to understand the differences.

401(k)

A 401(k) is a retirement account offered by employers that allows employees to contribute a portion of their salary on a pre-tax basis. Eligibility for a 401(k) typically depends on factors like length of employment and age. The contribution limit for a 401(k) in 2021 is $19,500, with an additional catch-up contribution of $6,500 for those aged 50 and older.

IRA (Individual Retirement Account)

An IRA is a retirement account that individuals can open on their own. There are two main types of IRAs: traditional and Roth. Eligibility for an IRA is based on income and tax-filing status. The contribution limit for an IRA in 2021 is $6,000, with an additional catch-up contribution of $1,000 for those aged 50 and older.

Roth IRA

A Roth IRA is similar to a traditional IRA, but contributions are made after-tax, meaning withdrawals in retirement are tax-free. Eligibility for a Roth IRA is also based on income and tax-filing status. The contribution limit for a Roth IRA in 2021 is $6,000, with an additional catch-up contribution of $1,000 for those aged 50 and older.

Strategies for Maximizing Retirement Account Contributions

To ensure a comfortable retirement, it is crucial to maximize your contributions to retirement accounts. Here are some strategies to help you boost your savings:

Increase Contributions Regularly

One effective strategy is to gradually increase your contributions to your retirement account. Even small increments can make a significant difference over time. Set reminders to review and adjust your contributions annually.

Take Advantage of Catch-Up Contributions

For individuals aged 50 and above, catch-up contributions allow you to contribute extra funds to your retirement account. This can help you make up for any lost time and accelerate your savings as you approach retirement age.

Optimize Contributions Based on Income Levels

Depending on your income level, you may be eligible for different types of retirement accounts, such as traditional IRA, Roth IRA, or 401(k). Design a plan that aligns with your income and financial goals to maximize tax advantages and savings potential.

Impact of Retirement Account Contributions on Taxes

When it comes to taxes, retirement account contributions can play a significant role in reducing your taxable income, ultimately affecting how much you owe the IRS.

Reducing Taxable Income

By contributing to a retirement account, such as a 401(k) or IRA, you can lower your taxable income for the year in which the contributions are made. This means that the amount you contribute is deducted from your total income before taxes are calculated, resulting in a lower tax bill.

Tax Implications of Withdrawals

While contributing to a retirement account can provide immediate tax benefits, it’s important to understand the tax implications of withdrawing funds in the future. Withdrawals from traditional retirement accounts like 401(k)s and traditional IRAs are typically taxed as ordinary income in the year they are withdrawn.

Differences in Tax Treatment

It’s crucial to note that different types of retirement accounts have varying tax treatments. For example, contributions to a Roth IRA are made with after-tax dollars, meaning withdrawals in retirement are typically tax-free. On the other hand, contributions to a traditional IRA are tax-deductible, but withdrawals are subject to income tax.