Get ready to dive into the world of credit reports, where financial decisions and stability hang in the balance. This guide will equip you with the knowledge needed to navigate the complex maze of credit scores and reports with ease.

From unraveling the mysteries of credit score ranges to decoding the impact of credit reports on loan approvals, this comprehensive overview will leave you informed and empowered.

Importance of Understanding Credit Reports

Understanding credit reports is crucial for making informed financial decisions and maintaining a healthy financial profile. A credit report provides a snapshot of an individual’s credit history and financial behavior, which lenders and creditors use to assess creditworthiness. Here are some reasons why understanding credit reports is essential:

Impact on Financial Decisions

- Credit reports influence the approval or denial of loan applications, credit card applications, and other forms of credit.

- Interest rates on loans and credit cards are determined based on the information in a credit report. A good credit score can lead to lower interest rates, saving money in the long run.

- Employers may check credit reports as part of the hiring process, especially for positions that involve financial responsibilities.

Consequences of Not Understanding Credit Reports

- Incorrect information on a credit report can lead to a lower credit score, making it harder to qualify for loans or credit cards.

- Identity theft or fraud may go unnoticed without regular monitoring of credit reports, leading to financial losses and damage to credit reputation.

- Missed payments or defaults reflected on a credit report can have long-term negative effects on creditworthiness and financial opportunities.

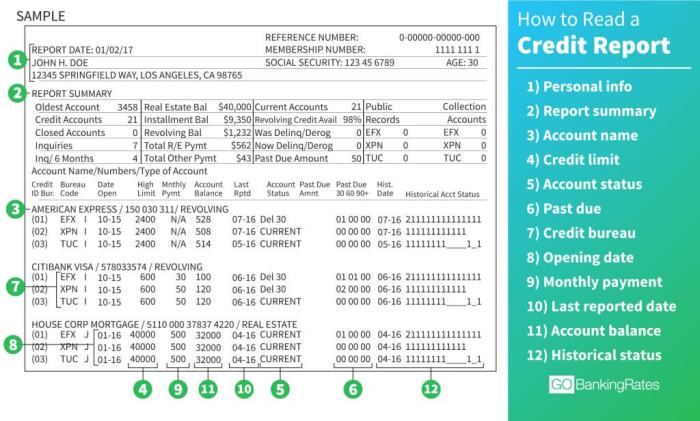

Components of a Credit Report

Understanding the key elements found in a credit report is crucial for managing your financial health and making informed decisions. Each component provides valuable insights into your creditworthiness and financial behavior.

Credit Score

Your credit score is a three-digit number that reflects your creditworthiness based on your credit history. It is calculated using a variety of factors such as payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries. A higher credit score indicates lower credit risk, making it easier to qualify for loans and credit cards with favorable terms.

Payment History

Payment history is a record of your past payments on credit accounts, including any late payments or delinquencies. Lenders use this information to assess your ability to manage credit responsibly. A positive payment history with on-time payments can boost your credit score, while late payments can have a negative impact.

Credit Inquiries

Credit inquiries are records of when lenders or creditors request your credit report. There are two types of inquiries: hard inquiries, which occur when you apply for credit and can impact your credit score, and soft inquiries, which are for informational purposes and do not affect your credit score. Monitoring your credit inquiries can help you understand who is checking your credit and why.

Credit Accounts

Credit accounts include information about your open and closed credit accounts, such as credit cards, mortgages, auto loans, and student loans. This section details your account balances, credit limits, payment history, and account status. Maintaining a mix of credit accounts and managing them responsibly can positively impact your credit score.

Public Records

Public records on a credit report may include bankruptcies, foreclosures, tax liens, and civil judgments. These negative marks can significantly lower your credit score and indicate financial distress. It’s crucial to address any public records on your credit report and work towards improving your financial situation.

Credit Utilization

Credit utilization is the ratio of your credit card balances to your credit limits. High credit utilization can signal financial strain and negatively impact your credit score. Keeping your credit utilization low, ideally below 30%, shows responsible credit management and can improve your creditworthiness.

How Credit Reports are Generated

Credit reports are generated through a systematic process that involves the collection, compilation, verification, and maintenance of an individual’s credit information. The following steps Artikel how credit reports are generated:

Role of Credit Bureaus

Credit bureaus play a crucial role in collecting and maintaining credit information. These agencies gather data from various sources, such as lenders, financial institutions, and public records, to create comprehensive credit reports for individuals. The major credit bureaus in the U.S. include Equifax, Experian, and TransUnion.

Information Verification and Updating

Once the credit bureaus receive information from different sources, they verify the accuracy of the data before updating it in an individual’s credit report. This verification process ensures that the information included in the credit report is reliable and reflects the individual’s credit history accurately. Any discrepancies or errors found during verification are rectified to maintain the integrity of the credit report.

Interpreting Credit Report Information

Understanding credit score ranges and analyzing a credit report are essential for managing your financial health. Let’s break it down further.

Interpreting Credit Score Ranges

- Credit scores typically range from 300 to 850.

- A score above 700 is considered good, while a score below 600 may indicate poor creditworthiness.

- The higher your credit score, the more likely you are to qualify for loans and credit cards with favorable terms.

Tips for Reading and Analyzing a Credit Report

- Review your personal information, account history, and credit inquiries for accuracy.

- Look for any late payments, collections, or charge-offs that may negatively impact your score.

- Check for any accounts that you don’t recognize, as they could be a sign of identity theft.

- Monitor your credit utilization ratio, which should ideally be below 30% to maintain a good score.

Common Errors on Credit Reports

- Incorrect personal information, such as misspelled names or outdated addresses.

- Duplicate accounts or accounts that have been closed but still appear as open.

- Inaccurate account statuses, like showing a paid-off debt as outstanding.

- Fraudulent accounts opened in your name without your knowledge.

Impact of Credit Reports on Financial Health

Having a good understanding of credit reports is crucial for maintaining financial health and stability. Credit reports play a significant role in determining an individual’s creditworthiness, affecting their ability to secure loans, mortgages, and other financial opportunities. Let’s explore how credit reports impact financial health and stability.

Correlation between Credit Reports and Loan Approvals

- Credit reports are a key factor that lenders consider when evaluating loan applications.

- A higher credit score, as reflected in the credit report, increases the likelihood of loan approval.

- On the other hand, a low credit score or negative items on the credit report can result in loan rejections or higher interest rates.

- Lenders use credit reports to assess the risk of lending money to individuals, based on their past credit history and repayment behavior.

Strategies to Improve Credit Scores

- Regularly review your credit report to identify any errors or discrepancies that may be affecting your credit score negatively.

- Pay bills on time and in full to demonstrate responsible financial behavior and improve your credit score.

- Keep credit card balances low and avoid maxing out credit limits to maintain a healthy credit utilization ratio.

- Avoid opening too many new credit accounts within a short period, as it can lower your average account age and impact your credit score.

- If you have past delinquencies or collections, work on settling them and improving your payment history to boost your credit score over time.

Monitoring and Managing Credit Reports

Regularly monitoring your credit report is crucial to staying on top of your financial health. By keeping an eye on your credit report, you can catch any errors or potential fraud early on and take steps to rectify them. It also allows you to track your progress in improving your credit score over time.

Tools and Services for Monitoring Credit Reports

- Free Annual Credit Report: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) once a year. Take advantage of this to monitor your credit.

- Credit Monitoring Services: There are various credit monitoring services available that provide regular updates on your credit report, alerting you to any changes or suspicious activity.

- Credit Score Apps: Many financial apps offer credit score tracking as part of their services, making it convenient to keep an eye on your credit score and report.

Best Practices for Managing a Healthy Credit Report

- Pay Bills on Time: Timely payments are one of the most important factors in maintaining a healthy credit report. Set up reminders or automatic payments to ensure you never miss a due date.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30% to show lenders that you can manage credit responsibly.

- Monitor Your Credit Regularly: Check your credit report at least once a year to catch any errors or discrepancies early on.

- Dispute Inaccuracies: If you find any errors on your credit report, take steps to dispute them with the credit bureau to have them corrected.

- Avoid Opening Too Many Accounts: Opening multiple new accounts within a short period can hurt your credit score. Be strategic about when and why you open new credit accounts.