Step into the world of venture capital funds where innovation meets opportunity, paving the way for groundbreaking investments and revolutionary startups. Get ready to dive deep into the realm of finance and entrepreneurship with a touch of flair.

Venture capital funds are a vital component of the startup ecosystem, fueling the dreams of ambitious entrepreneurs and driving economic growth. In this guide, we’ll explore the ins and outs of venture capital funding, from its core objectives to its impact on the business world.

What are Venture Capital Funds?

Venture capital funds are investment funds that provide capital to startups and small businesses with high growth potential. Their primary objectives include generating high returns for their investors by investing in companies that have the potential to grow rapidly and become successful in the market.

Role of Venture Capital Funds in the Startup Ecosystem

Venture capital funds play a crucial role in the startup ecosystem by providing not only financial support but also mentorship, guidance, and access to valuable networks. This support is essential for startups to scale their operations, develop innovative products, and ultimately succeed in the competitive market.

Examples of Successful Companies Funded by Venture Capital

– Google: Received early-stage funding from venture capital investors and went on to become one of the most valuable technology companies in the world.

– Facebook: Started as a small social networking platform with funding from venture capital firms and grew into a global social media giant.

– Uber: Raised significant capital from venture capital funds to revolutionize the transportation industry with its ride-sharing service.

Characteristics of Companies Targeted by Venture Capital Investors

- High Growth Potential: Venture capital investors look for companies that have the potential to grow rapidly and generate significant returns.

- Disruptive Innovation: Companies with innovative products or services that can disrupt existing markets are attractive to venture capital funds.

- Scalability: Startups that have the ability to scale their operations and reach a large market are preferred by venture capital investors.

- Strong Management Team: Venture capital funds invest in companies led by experienced and capable management teams who can execute on their vision.

Types of Venture Capital Funds

When it comes to venture capital funds, there are various types that cater to different stages of a company’s growth and focus on specific industries. Understanding the nuances of each type is crucial for both investors and entrepreneurs seeking funding.

Early-Stage Venture Capital Funds

Early-stage venture capital funds, as the name suggests, invest in startups at the initial stages of their development. These funds take on higher risks in exchange for potential high returns if the startup succeeds. They often provide seed funding to help companies get off the ground.

Growth-Stage Venture Capital Funds

Growth-stage venture capital funds, on the other hand, invest in companies that have already proven their concept and are looking to scale. These funds focus on helping companies expand their operations, enter new markets, and achieve sustainable growth. They involve less risk compared to early-stage funds but still offer substantial returns.

Industry-Specific Venture Capital Funds

Industry-specific venture capital funds concentrate their investments on a particular sector or niche, such as healthcare, technology, or real estate. By specializing in a specific industry, these funds can provide valuable expertise, resources, and connections to the companies they invest in, leading to higher chances of success.

Comparing Investment Strategies

- Early-stage funds focus on identifying and nurturing promising ideas, while growth-stage funds prioritize scaling existing businesses.

- Industry-specific funds leverage their domain knowledge to make informed investment decisions within a specific sector.

- All types of venture capital funds aim to provide value-added support to the companies they invest in, beyond just financial backing.

Risk-Return Profile

Venture capital funds, especially early-stage ones, carry significant risks due to the uncertainty associated with startups. However, they also offer the potential for high returns if the companies they invest in become successful. Growth-stage funds have a more balanced risk-return profile, while industry-specific funds may vary based on the sector’s stability and growth potential.

Successful Investments Examples

Sequoia Capital’s early investment in Google and Airbnb showcases the success of early-stage venture capital funds in backing groundbreaking startups.

Andreessen Horowitz’s growth-stage investment in Facebook demonstrates the value of scaling companies with the support of venture capital funds.

Healthcare-focused venture capital firm NEA’s investment in Moderna highlights the importance of industry-specific funds in driving innovation and breakthroughs in specialized sectors.

How do Venture Capital Funds Operate?

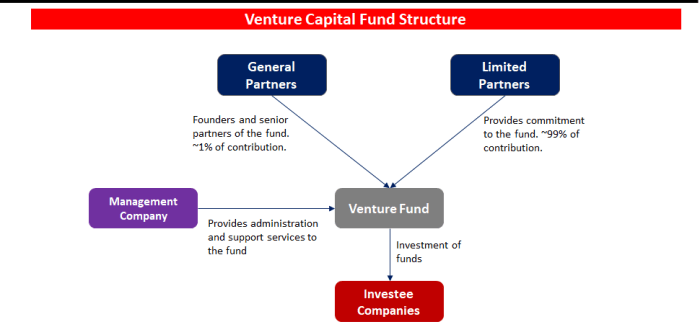

Venture capital funds operate by raising capital from institutional and individual investors to invest in early-stage companies with high growth potential. These funds play a crucial role in providing financial support to startups and emerging businesses.

Raising Capital for a Venture Capital Fund

When raising capital for a venture capital fund, fund managers typically reach out to potential investors such as pension funds, endowments, wealthy individuals, and other financial institutions. These investors commit a certain amount of capital to the fund, which is then used to make investments in startup companies.

- Investors commit capital to the fund.

- Fund managers leverage their networks to attract potential investors.

- Capital raised is used to make investments in promising startups.

Due Diligence Process in Selecting Investments

Before investing in a startup, venture capital funds conduct thorough due diligence to assess the viability and potential of the opportunity. This process involves analyzing the market, the team, the product, and the financials of the company.

Due diligence is crucial to minimize risks and maximize returns on investments.

Investment Structure and Timeline

Venture capital funds typically invest in startups in exchange for equity ownership. The investment structure may involve multiple rounds of funding as the company grows, with each round diluting the ownership stake of existing shareholders. The timeline for these investments can vary, but funds are generally patient investors looking for long-term growth.

- Invest in startups in exchange for equity.

- Multiple rounds of funding as the company grows.

- Long-term investment horizon for potential growth.

Exit Strategies for Realizing Returns

To realize returns on their investments, venture capital funds employ various exit strategies. These may include IPOs (Initial Public Offerings), acquisitions, or secondary sales of their equity stake in the company. The choice of exit strategy depends on market conditions and the overall strategy of the fund.

Exit strategies are crucial for funds to generate returns and distribute profits to investors.

Impact of Venture Capital Funds

Venture capital funds have a significant impact on startups, both positive and negative. These funds play a crucial role in fostering innovation and entrepreneurship by providing early-stage funding and mentorship to promising new businesses. However, there are also drawbacks to consider, such as the pressure to grow quickly and the potential loss of control for founders.

Positive Impacts

- Venture capital funds provide startups with the financial resources needed to develop new products and bring them to market.

- These funds often come with valuable expertise and connections that can help startups navigate challenges and accelerate their growth.

- Venture capital funding can lead to job creation as startups expand their operations and hire more employees.

Negative Impacts

- Startups that receive venture capital funding may face high expectations for rapid growth and profitability, which can create undue pressure and stress.

- Founders may need to give up a significant portion of ownership and decision-making power in their companies in exchange for funding.

- There is a risk of failure associated with venture capital funding, as not all startups are able to achieve the desired returns for investors.

Role in Fostering Innovation and Entrepreneurship

Venture capital funds play a crucial role in fostering innovation and entrepreneurship by providing the necessary resources and support for startups to thrive. These funds often invest in cutting-edge technologies and disruptive business models that have the potential to transform industries and drive economic growth.

Influence on Job Creation and Economic Growth

Venture capital funding has a direct impact on job creation and economic growth, as successful startups that receive funding are able to expand their operations, hire more employees, and contribute to the overall economy. By providing capital to innovative companies, venture capital funds stimulate economic activity and drive progress in various sectors.

Case Studies

One notable example of the transformative effects of venture capital funding is the success story of companies like Uber and Airbnb, which received early-stage funding from venture capitalists and went on to become industry giants, creating thousands of jobs and reshaping the way we think about transportation and accommodation.