Diving into the world of 401(k) investment options, this intro sets the stage for an exciting journey through the ins and outs of securing your financial future. Get ready to learn all you need to know about maximizing your retirement savings in a way that’s as cool as your favorite high school hangout spot.

Get ready to uncover the secrets behind creating a diversified portfolio, choosing the right investment options, and making the most of your employer’s matching contributions. It’s time to level up your financial game!

Importance of Diversification in 401(k) Investments

Diversification is a key strategy in investment portfolios that involves spreading your investments across different asset classes to reduce risk.

Benefits of Diversifying 401(k) Investment Options

- Diversification helps protect your 401(k) savings from market volatility by not putting all your eggs in one basket.

- It can potentially increase returns by capturing gains in different sectors or industries.

- Reduces the impact of a single investment performing poorly, as losses in one asset may be offset by gains in another.

- Provides a more balanced portfolio that aligns with your risk tolerance and investment goals.

How Diversification Helps Manage Risk in Retirement Savings

- By spreading investments across various assets, such as stocks, bonds, and real estate, the overall risk is reduced.

- During market downturns, diversified portfolios tend to be more resilient as losses in one area may be offset by gains in others.

- Helps navigate unpredictable market conditions and economic cycles, ensuring your retirement savings are not overly exposed to a single risk factor.

Types of 401(k) Investment Options

401(k) plans offer a variety of investment options to help individuals save for retirement. These options vary in terms of risk and return potential, catering to different investment preferences and goals.

Stocks

Stocks are one of the common investment options in a 401(k) plan. They represent ownership in a company and tend to have higher risk but also the potential for higher returns. Investing in stocks can help grow your retirement savings over the long term, but it’s important to be prepared for market fluctuations.

Bonds

Bonds, on the other hand, are considered safer investments compared to stocks. They involve lending money to a corporation or government in exchange for periodic interest payments and the return of the principal amount at maturity. While bonds offer lower returns than stocks, they provide more stability to a portfolio.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer instant diversification and are managed by professional fund managers. Mutual funds come in various types, such as index funds, actively managed funds, and target-date funds.

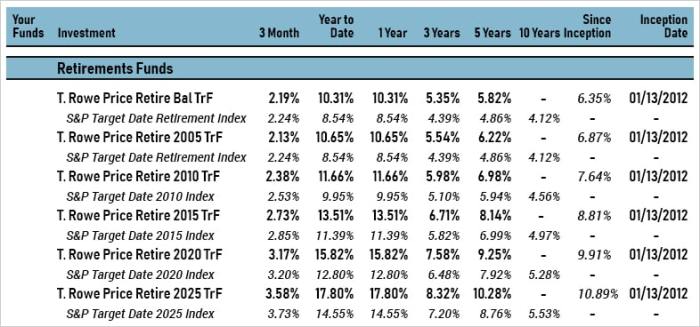

Target-Date Funds

Target-date funds are a newer type of 401(k) investment option that automatically adjusts the asset allocation based on the investor’s retirement date. These funds typically start with a higher allocation to stocks for younger investors and gradually shift towards more conservative investments as the retirement date approaches. They offer a hands-off approach to investing, suitable for those who prefer a set-it-and-forget-it strategy.

Factors to Consider When Choosing 401(k) Investments

When selecting 401(k) investment options, it’s crucial to consider various factors to ensure your choices align with your retirement goals and risk tolerance. By evaluating these key aspects, you can make informed decisions that support your financial objectives.

Investment Goals and Risk Tolerance

- Before choosing 401(k) investments, define your investment goals, whether they involve long-term growth, income generation, or capital preservation.

- Assess your risk tolerance by considering how comfortable you are with market fluctuations and potential losses.

- Align your investment choices with your goals and risk tolerance to create a diversified portfolio that balances potential returns with acceptable risk levels.

Aligning Investments with Retirement Goals

- Review your retirement timeline and desired lifestyle to determine the level of growth needed from your 401(k) investments.

- Consider factors such as inflation, healthcare costs, and other expenses to ensure your investment strategy adequately supports your retirement needs.

- Adjust your investment mix over time as your retirement goals evolve, maintaining a balance between growth and stability to meet changing financial requirements.

Role of Employer Matching in 401(k) Investment Selection

When it comes to making decisions about your 401(k) investments, the role of employer matching is crucial. Employer matching contributions can have a significant impact on your retirement savings, so it’s important to understand how to maximize this benefit through your investment choices.

Employer matching essentially means that your employer will match a portion of your contributions to your 401(k) plan. This is essentially free money that can help boost your retirement savings over time. The amount of the match can vary depending on your employer’s policy, but it’s typically based on a percentage of your contributions, up to a certain limit.

Maximizing Employer Matching Benefits

- Contribute enough to get the full match: To maximize the benefit of employer matching, make sure you are contributing enough to your 401(k) to receive the full match offered by your employer. This is essentially free money that can significantly boost your retirement savings.

- Consider your investment options: When choosing your 401(k) investments, consider the match structure offered by your employer. Some employers may have specific requirements or restrictions on how the match is allocated, so be sure to take this into account when making your investment decisions.

- Review and adjust as needed: It’s important to regularly review your 401(k) contributions and investment choices to ensure you are taking full advantage of the employer match. If your employer offers a match increase or changes their policy, be sure to adjust your contributions accordingly.

Example of Employer Matching Impact

Let’s say your employer offers a dollar-for-dollar match on the first 3% of your salary that you contribute to your 401(k) plan. If you earn $50,000 a year and contribute 3% ($1,500), your employer will also contribute $1,500, effectively doubling your contribution. Over time, these matching contributions can add up significantly and help you reach your retirement savings goals faster.