Diving deep into the world of debt repayment strategies, this introduction will take you on a journey to discover the most effective ways to manage and conquer your debts. Get ready to explore the ins and outs of debt snowball, debt avalanche, and debt consolidation with a fresh and engaging twist.

In the following paragraphs, we will unravel the mysteries behind these strategies and provide you with the tools you need to take control of your financial future.

Overview of Debt Repayment Strategies

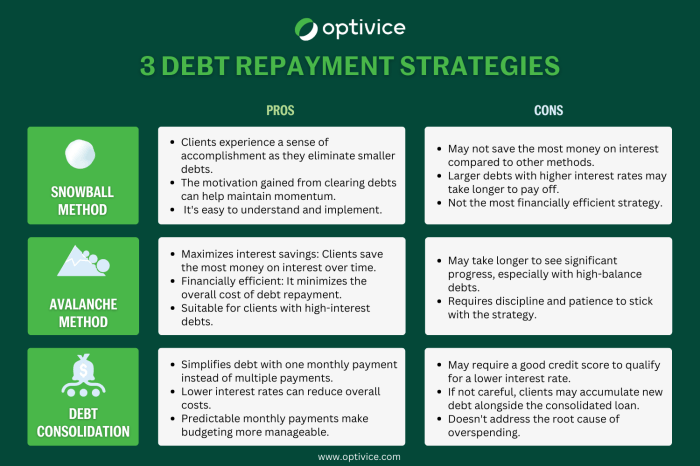

Having a structured approach to debt repayment is crucial for individuals looking to effectively manage and pay off their debts. By utilizing different strategies, individuals can tailor their approach to best suit their financial situation and goals. Common debt repayment strategies include the debt snowball, debt avalanche, and debt consolidation.

Debt Snowball

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, the amount previously allocated to that debt is then added to the minimum payment of the next smallest debt. This strategy can provide a sense of accomplishment and motivation as debts are gradually paid off.

Debt Avalanche

In contrast, the debt avalanche method focuses on paying off debts with the highest interest rates first. By tackling high-interest debts early on, individuals can save money on interest payments in the long run. This strategy may result in faster overall debt repayment compared to the debt snowball method.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan or credit account with a lower interest rate. This can simplify the repayment process by streamlining multiple payments into one, potentially reducing monthly payments and overall interest costs. However, it is important to carefully consider the terms and fees associated with debt consolidation to ensure it is the right choice for your financial situation.

Debt Snowball Method

The debt snowball method is a debt repayment strategy where you pay off your debts from smallest to largest, regardless of interest rates. This method focuses on gaining momentum by starting with the smallest debt and then rolling the payments towards the larger debts as you progress.

Steps to Implementing the Debt Snowball Method

- List all your debts from smallest to largest.

- Make minimum payments on all debts except the smallest one.

- Put extra money towards paying off the smallest debt until it is fully repaid.

- Once the smallest debt is paid off, take the amount you were paying towards it and apply it to the next smallest debt.

- Repeat this process until all debts are paid off.

Psychological Benefits of the Debt Snowball Method

The debt snowball method provides psychological benefits by giving you quick wins as you pay off smaller debts first. This sense of accomplishment and progress motivates you to continue tackling larger debts. The positive reinforcement from seeing debts being eliminated one by one boosts your confidence and keeps you focused on your goal of becoming debt-free.

Debt Avalanche Method

The debt avalanche method is a debt repayment strategy that focuses on paying off debts with the highest interest rates first. By prioritizing high-interest debts, this method aims to minimize the amount of interest paid over time, ultimately helping individuals become debt-free faster.

Prioritizing Debts Based on Interest Rates

In the debt avalanche method, individuals list out all their debts from highest to lowest interest rate. They then allocate any extra funds towards paying off the debt with the highest interest rate while making minimum payments on all other debts. Once the highest interest debt is paid off, they move on to the next highest interest debt, and so on.

- By tackling high-interest debts first, individuals can save money in the long run by reducing the total interest paid over time.

- While it may take longer to see progress on individual debts compared to other methods, the debt avalanche method is more cost-effective in terms of overall interest savings.

Comparison with Other Debt Repayment Strategies

- The debt avalanche method is often contrasted with the debt snowball method, which prioritizes paying off debts from smallest to largest balance regardless of interest rate. While the debt snowball method may provide psychological motivation by seeing debts eliminated quickly, the debt avalanche method is more financially efficient.

- Compared to the debt snowball method, the debt avalanche method can potentially save individuals more money in interest payments over time, making it a more cost-effective approach for those focused on minimizing overall debt costs.

Debt Consolidation

Debt consolidation is a strategy that combines multiple debts into a single payment, making it easier to manage and potentially reducing overall interest rates. It can help simplify debt repayment by streamlining monthly payments and potentially lowering interest rates.

Ways to Consolidate Debts

- Balance Transfers: Moving high-interest credit card debt to a card with a lower interest rate can help save money on interest payments.

- Personal Loans: Taking out a personal loan to pay off multiple debts can consolidate them into one monthly payment with a fixed interest rate.

- Debt Consolidation Programs: Working with a debt consolidation company can help negotiate lower interest rates and create a repayment plan.

When Debt Consolidation Is Suitable

- If you have multiple high-interest debts that are becoming difficult to manage, debt consolidation can simplify your payments.

- When you can qualify for a lower interest rate through debt consolidation, it can potentially save you money in the long run.

- If you are committed to changing your spending habits and avoiding accruing more debt, debt consolidation can be an effective tool to get back on track.