Yo, listen up! Let’s dive into the world of reducing debt with some real talk. We’re about to break down how to tackle that financial burden and set yourself up for success. So grab a seat and get ready to learn some crucial tips and tricks.

Now, let’s get into the nitty-gritty details of how you can start slashing that debt and paving the way to a brighter financial future.

Understanding Debt

Debt is money borrowed by an individual or entity with the agreement to repay it in the future, often with added interest. There are different types of debt, including credit card debt, student loans, mortgages, car loans, and personal loans.

Types of Debt

- Credit Card Debt: This type of debt involves borrowing money using a credit card, with the requirement to pay it back along with interest.

- Student Loans: These are loans taken out to cover the cost of education and must be repaid after the borrower finishes school.

- Mortgages: A mortgage is a loan used to purchase a home, with the property serving as collateral for the loan.

Impact of Debt

Debt can have a significant impact on financial health and overall well-being. It can lead to stress, anxiety, and even affect relationships. High levels of debt can also limit financial opportunities and make it challenging to save for the future.

Common Reasons for Debt

- Unexpected Expenses: Medical emergencies, car repairs, or home maintenance can lead to unplanned debt.

- Living Beyond Means: Spending more than one earns can result in accumulating debt over time.

- Lack of Savings: Without an emergency fund, individuals may turn to debt to cover sudden expenses.

Assessing Your Debt Situation

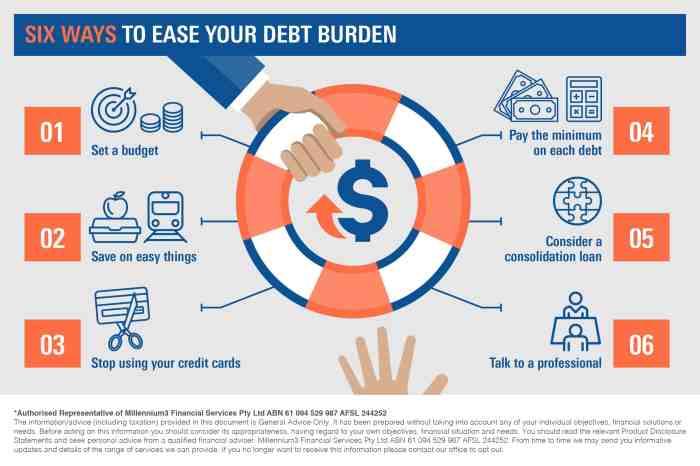

When it comes to assessing your debt situation, it’s crucial to have a clear understanding of your financial standing. By calculating your total debt, creating a budget, and analyzing your debt-to-income ratio, you can gain valuable insights into your financial health.

Calculating Total Debt

To calculate your total debt, gather all your outstanding balances from credit cards, loans, and other sources. Include the interest rates for each debt to understand the cost of borrowing. Don’t forget to note down the minimum payments required for each debt to ensure timely payments.

Creating a Budget

Creating a budget is essential to manage your finances effectively. List down all your sources of income and expenses to get a clear picture of where your money is going. This will help you prioritize debt payments and identify areas where you can cut back to allocate more funds towards debt repayment.

Analyzing Debt-to-Income Ratio

Your debt-to-income ratio is a key indicator of your financial health. To calculate it, divide your total monthly debt payments by your gross monthly income and multiply by 100. A ratio above 36% indicates that you may be overextended and need to focus on reducing debt to improve your financial stability.

Creating a Debt Repayment Plan

When it comes to getting out of debt, having a solid repayment plan is key. Here are some strategies to help you prioritize debts, negotiate with creditors, and set achievable goals to track your progress.

Prioritizing Debts

- Consider using the snowball method, where you pay off your smallest debts first while making minimum payments on larger debts. Once the smallest debts are paid off, you can snowball the payments into larger debts.

- Alternatively, you can use the avalanche method, which involves paying off debts with the highest interest rates first. This can save you money in the long run by reducing the amount of interest you pay.

Negotiating with Creditors

- Reach out to your creditors to see if they are willing to negotiate lower interest rates or create payment plans that better suit your financial situation. Many creditors are willing to work with you if you communicate openly and honestly about your circumstances.

- Consider working with a credit counseling agency to help facilitate negotiations with creditors and create a manageable repayment plan.

Setting Repayment Goals and Tracking Progress

- Set achievable repayment goals by creating a budget that Artikels how much you can realistically afford to put towards debt repayment each month. Make sure to prioritize your debt payments in your budget.

- Track your progress by monitoring your debt balances regularly and celebrating small victories along the way. Consider using debt repayment apps or spreadsheets to help you stay on track.

Managing Expenses and Increasing Income

When it comes to reducing debt, managing expenses and increasing income play a crucial role in achieving financial stability. By cutting unnecessary expenses and finding ways to boost your income, you can make significant progress towards paying off your debts and improving your overall financial situation.

Cutting Unnecessary Expenses

One of the first steps in managing your expenses is identifying and eliminating unnecessary spending. This can include dining out less frequently, canceling subscription services you don’t use, or finding more cost-effective alternatives for daily expenses.

- Avoid impulse purchases by creating a budget and sticking to it.

- Consider negotiating bills such as cable, internet, or insurance to lower monthly costs.

- Shop for groceries strategically by planning meals and using coupons or discount apps.

Increasing Income through Side Hustles

In addition to cutting expenses, finding ways to increase your income can help accelerate your debt repayment. Taking on a side hustle, freelance work, or selling items you no longer need can provide extra cash to put towards paying off debts.

- Explore opportunities for freelance work in your skillset, such as graphic design, writing, or tutoring.

- Consider starting a side business, like selling handmade crafts online or offering services in your community.

- Utilize online platforms like Fiverr, Upwork, or TaskRabbit to find freelance gigs and earn extra income.

Building an Emergency Fund

Having an emergency fund is essential in preventing the need to accumulate more debt in the future. By setting aside money for unexpected expenses, you can avoid relying on credit cards or loans during financial emergencies.

- Start small by setting a goal to save a certain amount each month until you have built up a comfortable emergency fund.

- Consider automating your savings by setting up automatic transfers from your checking account to a separate savings account.

- Use your emergency fund only for true emergencies, such as medical expenses, car repairs, or unexpected home repairs.

Seeking Professional Help

When you’re feeling overwhelmed by your debt and struggling to make a plan on your own, it might be time to seek help from a credit counselor or financial advisor. These professionals can provide you with expert advice on how to manage your debt effectively and create a plan to get back on track financially.

Debt Consolidation Options

If you have multiple debts with high-interest rates, debt consolidation might be a good option for you. Debt consolidation involves combining all of your debts into one single loan with a lower interest rate. This can make it easier for you to manage your payments and potentially save you money in the long run.

- Consider a balance transfer credit card: Transfer high-interest credit card balances to a card with a lower interest rate to save on interest payments.

- Personal loans: Take out a personal loan to pay off your debts and consolidate them into one monthly payment.

- Home equity loans or lines of credit: If you own a home, you may be able to use the equity in your home to consolidate your debts at a lower interest rate.

Debt consolidation can help simplify your payments and potentially save you money on interest charges.

Free Financial Education and Assistance Programs

There are many resources available for free financial education and assistance programs to help you manage your debt and improve your financial literacy.

- Non-profit credit counseling agencies: These organizations offer free or low-cost services to help you create a budget, manage your debt, and improve your financial situation.

- Government-sponsored programs: Look for government-sponsored programs that offer financial education and assistance, such as workshops, webinars, and resources to help you manage your debt effectively.

- Online resources: There are many online resources available, including budgeting tools, debt calculators, and articles on personal finance topics to help you learn more about managing your debt.