When it comes to investing in index funds, you’re entering a world where financial wisdom meets modern flair. With the allure of diversified portfolios and steady growth, index funds have become the go-to choice for savvy investors looking to build wealth over time.

In this guide, we’ll delve into the intricacies of index funds, exploring their benefits, types, considerations before investing, and the potential risks involved. Get ready to level up your investment game!

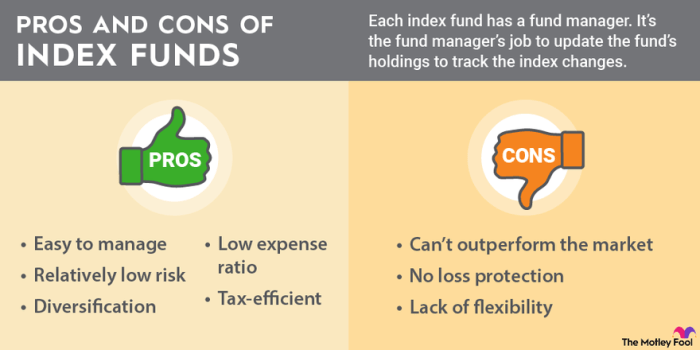

Benefits of Investing in Index Funds

Investing in index funds can be a smart move for individuals looking to build wealth over the long term. Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500. By investing in an index fund, investors gain exposure to a diversified portfolio of stocks or bonds that mirror the performance of the overall market.

Advantages of Index Funds over Individual Stock Picking

Index funds offer several advantages over individual stock picking. One key benefit is diversification. When you invest in an index fund, you are essentially investing in a basket of securities, spreading out your risk across multiple companies. This diversification helps reduce the impact of any single stock underperforming, thus lowering the overall risk in your investment portfolio. Additionally, index funds typically have lower fees compared to actively managed funds, as they aim to replicate the performance of a specific index rather than trying to beat the market.

Examples of How Index Funds Provide Diversification for Investors

Index funds provide diversification by holding a wide range of securities within a particular index. For instance, an S&P 500 index fund would hold the 500 largest publicly traded companies in the U.S., representing various sectors of the economy. By investing in this index fund, an individual gains exposure to companies across different industries, reducing the impact of sector-specific risks. This diversification can help protect investors from significant losses if one sector experiences a downturn while other sectors perform well.

Types of Index Funds

When it comes to investing in index funds, there are various types available in the market, each with its own set of characteristics and advantages. Let’s take a closer look at some of the most common types of index funds you can consider adding to your investment portfolio.

ETFs (Exchange-Traded Funds)

ETFs are a type of index fund that can be bought and sold on stock exchanges, similar to individual stocks. They typically track a specific index and offer diversification at a low cost. Popular examples of ETFs include SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ).

Mutual Funds

Mutual funds are another type of index fund that pools money from multiple investors to invest in a diversified portfolio of assets. These funds are actively managed by fund managers who aim to replicate the performance of a particular index. Vanguard Total Stock Market Index Fund (VTSAX) and Fidelity 500 Index Fund (FXAIX) are well-known examples of mutual funds.

Sector-Specific Funds

Sector-specific index funds focus on a particular industry or sector of the economy, such as technology, healthcare, or energy. These funds allow investors to target specific areas of the market that they believe will outperform. Examples of sector-specific index funds include Technology Select Sector SPDR Fund (XLK) and Health Care Select Sector SPDR Fund (XLV).

Considerations Before Investing in Index Funds

Before diving into investing in index funds, there are several key considerations to keep in mind. Understanding the underlying index, fees associated with the funds, and aligning your investment goals are crucial steps in making informed decisions.

Researching the Underlying Index

When investing in index funds, it is essential to research and understand the underlying index that the fund tracks. The performance of the index directly impacts the returns of the fund. Take the time to analyze the components of the index, its historical performance, and how it aligns with your investment strategy.

Fees and Their Impact on Returns

One important factor to consider when choosing an index fund is the fees associated with it. These fees can vary between funds and can have a significant impact on your overall returns. Look out for expense ratios, management fees, and any other costs associated with the fund. Lower fees can lead to higher returns over time.

Choosing the Right Index Fund

When selecting an index fund, it is crucial to align it with your investment goals. Consider factors such as risk tolerance, investment time horizon, and overall financial objectives. Choose an index fund that matches your goals and objectives to ensure a successful investment journey.

Risks Associated with Index Fund Investments

When it comes to investing in index funds, there are certain risks that investors need to be aware of in order to make informed decisions. While index funds are generally considered to be less risky compared to actively managed funds, there are still potential downsides that investors should consider. Here, we will discuss the risks associated with index fund investments and provide strategies to mitigate these risks.

Market Volatility

One of the key risks of investing in index funds is market volatility. Since index funds are passively managed and track the performance of a specific index, they are directly affected by market fluctuations. If the overall market experiences a downturn, the value of the index fund will also decrease. This can result in temporary losses for investors, especially those with a short-term investment horizon.

Lack of Flexibility

Another risk of index fund investments is the lack of flexibility in adjusting the fund’s holdings. Unlike actively managed funds, index funds simply mirror the components of the underlying index without the ability to make strategic investment decisions based on market conditions. This can limit the fund’s ability to outperform the market during certain periods of time.

Tracking Error

Index funds are designed to closely track the performance of a specific index. However, there may be instances where the fund deviates slightly from the index due to factors like fees, trading costs, or timing differences. This discrepancy, known as tracking error, can impact the fund’s returns and potentially lead to underperformance compared to the index it is supposed to replicate.

Strategies to Mitigate Risks

- Diversification: Investing in a variety of index funds across different asset classes can help spread risk and minimize the impact of market volatility on a single fund.

- Regular Monitoring: Keeping track of the performance of index funds and rebalancing the portfolio when necessary can help mitigate risks associated with market fluctuations.

- Consider Time Horizon: Understanding your investment goals and time horizon can help determine the level of risk you are willing to take with index fund investments.

- Cost Considerations: Paying attention to fees and expenses associated with index funds can help maximize returns and reduce the impact of tracking error.