Diving into the realm of retirement funds strategies, we uncover a world of financial planning and smart investment choices that pave the way to a secure future. From understanding the different types of retirement funds to exploring strategies for growth and withdrawal, this journey promises to be both enlightening and empowering.

Get ready to embark on a journey towards financial independence and a worry-free retirement as we delve into the intricate details of retirement funds strategies.

Understanding Retirement Funds

Starting a retirement fund early is crucial for securing your financial future. There are different types of retirement funds available, each with its own features and benefits. Let’s explore some of the common options:

401(k)

- A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their salary to a tax-advantaged investment account.

- Employers may match a percentage of the employee’s contributions, providing a valuable opportunity to grow retirement savings.

- Contributions to a traditional 401(k) are made with pre-tax dollars, reducing taxable income in the present.

IRA (Individual Retirement Account)

- An IRA is a personal retirement account that individuals can open independently, separate from an employer-sponsored plan.

- There are two main types of IRAs: traditional and Roth. In a traditional IRA, contributions may be tax-deductible, while a Roth IRA offers tax-free withdrawals in retirement.

- IRAs provide flexibility in investment choices, allowing individuals to select from a variety of options to build their retirement savings.

Roth IRA

- A Roth IRA is a retirement account where contributions are made with after-tax dollars, but withdrawals in retirement are typically tax-free.

- Roth IRAs offer the advantage of tax-free growth on investments, making them an attractive option for long-term savings.

- Individuals must meet certain income requirements to contribute to a Roth IRA, but it can be a valuable tool for building a tax-efficient retirement portfolio.

Strategies for Building Retirement Funds

Building a solid retirement fund requires careful planning and strategic decision-making. Here are some key strategies to help you maximize your retirement savings:

Maximizing Employer Contributions

- One of the most effective ways to boost your retirement fund is by taking full advantage of employer contributions to your retirement account.

- Many employers offer matching contributions up to a certain percentage of your salary. Make sure to contribute enough to receive the maximum match, as this essentially gives you free money towards your retirement.

- Consider increasing your contributions over time to maximize the benefits of employer matching.

Diversifying Retirement Fund Investments

- Diversification is key to reducing risk and maximizing returns in your retirement portfolio.

- By spreading your investments across different asset classes such as stocks, bonds, and real estate, you can protect your savings from market fluctuations.

- Consult with a financial advisor to create a well-balanced investment portfolio that aligns with your risk tolerance and retirement goals.

The Concept of Dollar-Cost Averaging

- Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions.

- This strategy helps reduce the impact of market volatility on your investments by spreading out your purchases over time.

- Over the long term, dollar-cost averaging can help you build a sizable retirement fund while minimizing the risk of making poor investment decisions based on short-term market fluctuations.

Retirement Fund Withdrawal Strategies

When it comes to retirement fund withdrawal strategies, it’s crucial to plan carefully to ensure financial stability during your golden years. Early withdrawals from retirement funds can have serious implications on your financial health, so it’s important to understand the risks involved. Additionally, being aware of the tax implications when withdrawing from retirement funds can help you make informed decisions about your finances.

Types of Retirement Fund Withdrawal Strategies

- Systematic Withdrawal Plan: A systematic withdrawal plan involves withdrawing a fixed amount regularly from your retirement account. This method provides a steady income stream but may not adjust for market fluctuations.

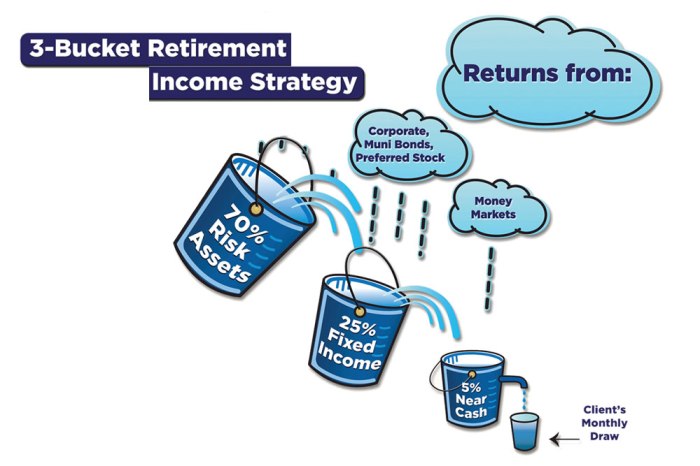

- Bucket Strategy: The bucket strategy involves dividing your retirement savings into different “buckets” based on time horizon and risk tolerance. This approach helps manage market volatility and ensures you have funds available for different needs.

- Required Minimum Distributions (RMDs): Once you reach a certain age, typically 72, you are required to take minimum withdrawals from your retirement accounts. Failure to do so can result in penalties, so it’s important to stay informed about RMD rules.

Implications of Early Withdrawals

Early withdrawals from retirement funds, before the age of 59 ½, may result in penalties and taxes. It’s important to consider the impact of these penalties on your overall savings and retirement income. Additionally, withdrawing early can significantly reduce the amount of funds available for your retirement years, potentially leaving you financially vulnerable.

Tax Implications of Retirement Fund Withdrawals

It’s essential to be aware of the tax implications when withdrawing from retirement funds. Depending on the type of account (Traditional IRA, Roth IRA, 401(k), etc.), withdrawals may be subject to income tax. Understanding how withdrawals are taxed can help you plan for the financial impact on your retirement income.

Planning for Retirement Fund Growth

When it comes to planning for retirement fund growth, there are key strategies and factors to consider to ensure a secure financial future. One of the most important elements in growing retirement funds is the power of compound interest, which can significantly boost your savings over time.

Role of Compound Interest

Compound interest is like a magic trick for your retirement funds. It’s the interest you earn on both the initial amount you invested and on the interest that has already been added to your account. Over time, this compounding effect can snowball your savings and accelerate your retirement fund growth. As the years go by, compound interest can turn a modest investment into a substantial nest egg, making it crucial to start saving early to maximize its impact.

Adjusting Investments by Age

As you progress through different stages of life, it’s essential to adjust your retirement fund investments accordingly. In your younger years, you may have a higher risk tolerance, allowing you to invest in more aggressive options like stocks that offer higher returns over the long term. As you approach retirement age, it’s wise to shift towards more conservative investments such as bonds to protect your savings from market fluctuations. By adapting your investment strategy based on your age, you can optimize your retirement fund growth while managing risk effectively.

Periodic Reviews and Adjustments

Regularly reviewing and adjusting your retirement fund plan is key to ensuring its growth aligns with your financial goals. Life circumstances, market conditions, and personal preferences can change over time, necessitating adjustments to your investment portfolio. By conducting periodic reviews, you can assess the performance of your retirement funds, rebalance your investments, and make necessary changes to stay on track towards a comfortable retirement. Remember, staying proactive and engaged with your retirement fund plan can make a significant difference in securing your financial future.